This is going to be a whopper of an entry, please bear with me!!!! Trying to orgranize this into sections. First, December & Full Year 2021 Spending. Next, the usual December debt/savings summary, along with a full year snapshot of that. Then, full year 2021 goals summary!

First up - December Spending...my spending does not include bills, just "discretionary" spending. Some of my categories are a little wonky, but I am adjusting them in 2022 now that I have a full year's worth of spending to reference.

Category Name - December Spending/Full 2021 Spending: commentary

Alcohol - $44.15/$405.20: when my best friend was in town, we went to a winery about an hour away (fun fact, it is America's longest continuously operating winery!), did a private cellar tour, and did a little shopping in their store. Overall, I did not spend a ton on alcohol this year, and will not be carrying this as a separate category into 2022. If it's something I buy at the grocery store (hard seltzer, beer etc), it will go into grocery. If it's something I buy at a wine shop for a special occasion, it'll go into dining/entertainment.

Car/Gas - $87.44/$731.97: this was gas, a toll pass replenishment, and some miscellaneous parking. This year, I had planned to replace my tires, but just didn't get around to it. At this point, I will wait til spring, and it will come out of savings. Glancing at the monthly totals, I would say the majority of this total cost was gas. Not much maintenance this year, I have a newer car, and don't drive a ton. Other than the tires, this category should increase in 2022 due to a registration renewal (ours are every 2 years). Hopefully no other big maintenance items come up, but if they do, I will address them - my car will be paid off in 2023, and I need it to last until after I buy a new home in 2024 (trying to keep my DTI as low as possible since it'll be a tricky transaction....more on that in the future).

Clothing - $354.25/$1873.16: I am at the point in my weight loss where I definitely need to replace a lot of things, and it comes up seasonally. Thankfully, there haven't been a ton of events I needed something to wear for, but they still exist. I'm still trying to pace myself, since there's not a huge call for it urgently, and I expect my size to change again several more times in 2022. Right now I have a couple of large bags slated for good will, it's good energy to clear out as much of the "too big" stuff as I can.

Dining/Entertainment - $468.71/$2634.95: I knew this month would be higher than "normal" (what even is normal these days)...with my best friend in town, and being off from work for 2 weeks, I didn't quite have the enthusiasm for my usual meal prepping haha. Higher for the year than I would have liked, since I know a good chunk of it was takeout, rather than a nice meal out shared with friends, but it is what it is.

Education - $65.01/$1152.61: in December, this was another month of a study prep service for the credit by exams I was taking. This has been cancelled, since I am done with those exams and that part of my degree journey! Overall, the spending on this category was low (it does not include tuition or school fees that I did not pay directly, as those are covered by loans and are considered bills), and the return on the investment was fantastic. Since June 1, I earned 44 credits. I expect my out of pocket spending in 2022 for this category to be quite a bit lower, as I don't have to buy a computer, pay for any study resources, or pay any transcript/application/orientation fees. It'll mostly be books, and it seems a lot of my classes use freely available resources for that.

Gifts - $97.71/$941.12: December was obviously all holiday gifts. Overall I'm not upset with the year's total - hopefully I can get a sinking fund for this going in 2022, but if not, no pressure since this is an easily cash-flowable amount over the course of a year.

Grocery/Household/Toiletries - $537.22/$6538.45: I don't think there's anything out of the ordinary in this, my largest category. I budget $400 per month for this, and I've clearly overspent the yearly budget by about $1800...at some point in 2022, I'll hopefully increase it, but not too worried. This is also a fairly broad category, and some of the spending here will be shifted to other categories in 2022, including stuff purchased at CVS that can be counted under FSA spending.

Medical - $170.13/$1202.41 - in December, this was a few copays, a prescription, and a number of at home COVID tests. Looking at the year in totality, all but a few transactions here are FSA eligible, so while I will track to ensure I am pacing myself, I will not count it in spending since it will not be coming out of my net funds. I fully funded an FSA in 2022, and my net pay has already been estimated to account for that deduction. This category will be split for 2022 into 2 separate ones - Medical FSA and Medical non FSA.

Miscellaneous - -$147.61/$1705.74: this is negative in December because my second wellness stipend for the year was deposited, offsetting the purchase of the Peloton in November which also went into this category. I also bought some home decor items this month. Overall for the year, it's mostly health & wellness stuff, home decor stuff, and truly miscellaneous stuff that I don't need a distinct category for (post office, license renewal fee, etc). In 2022, I will be adding categories for Health/Wellness, and Home Decor/Furniture.

Office Supplies - $0/$106.92 - generally this category is printer stuff lol. Not gonna complain about the yearly total here!

Personal Care - $123.86/$2627.57: December's spending was a tip at a laser appointment, a few makeup items I purchased, as a trip to the nail salon with my mama (we alternate paying/tipping. It was my month to pay, in January I will tip and she will pay). The yearly amount is a little high for something I have not yet managed to budget for, but with my current hair color regimen that has me in the salon every 6-8 weeks, I don't see it going down in 2022. Oh well lol. As a reminder, I am not striving to be the most frugal I can be.

Pet - $87.02/$1194.20: this is the typical stuff....food/litter. No toys lol. In 2022, this should be around the same - they didn't come to live with me until the end of April, but I did have some start up costs that i will not have again going forward.

Subscriptions - $28.99/$457.30: December was monthly iCloud and monthly Peloton (which will go into Health/Wellness for 2022). The yearly total includes a bunch of streaming subscriptions (I tend to pay for these annually), and Prime.

Travel - $0/$2206.69: this is a category that will likely increase next year - I am not planning on a lot of trips, due to having some major surgeries, but I am going to New Orleans for my birthday, Portland for Thanksgiving, and hopefully a few smaller weekend trips here and there. Another one that I would like to start putting money into a sinking fund for, but I'll get there.

Total - $1916.88/$23778.29: December was a middle of the road month for spending when compared to the other months of the year. I would never have predicted that total, though....that's where tracking every penny comes in handy, so I can continue to be realistic with myself!

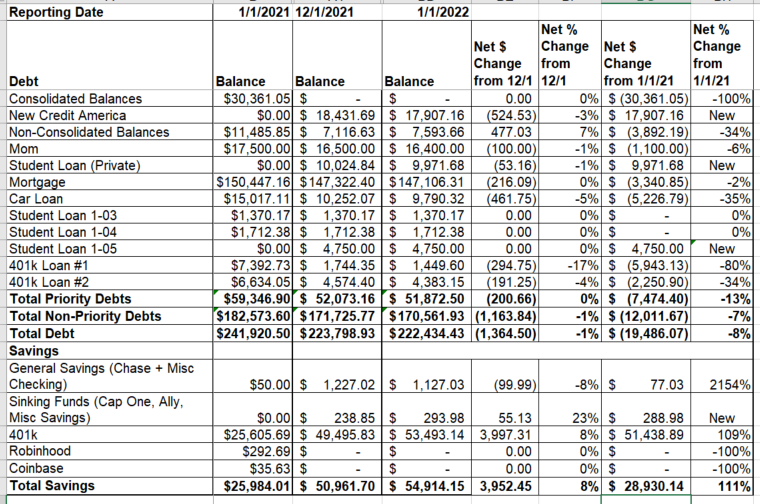

Next Up - the December Month over Month Summary....as always, this does not include my 401k contributions/loan payments from my last check of the year, as those have not yet been reflected. This screenshot shows change from 12/1 as well as change from 1/1/21.

I started the year with a total of $241920.50 in debt. I ended it with $223798.93 in debt, for a reduction of 8%. What that number does not reflect is that there were a few new debts added throughout the year (the new personal loan for my consolidated credit card accounts that were settled, and 2 new student loans), of which I have paid down approximately $2900 total. It's not a big enough difference to make myself crazy with the math, but will sort itself out next year. I'm pretty happy with an 8% reduction, knowing that it's actually slightly higher.

I started the year with $50 in cash savings, and just over $25k in my 401k. I am ending the year with just over $1500 in cash savings, and just over $53k in my 401k. That's quite a respectable increase. My overall savings category has increased by 111% this year.

I don't much focus on net worth, but do track it for my own amusement. My net worth (using an estimated value for my home and my car) has increased from $15k at the start of the year to $67k at the end of the year, for a percentage increase of 348%.

Since this is Year 2 of this detailed tracking, I can start a Year over Year tracker now....this is very high level as the exact line items are definitely going to change year to year. (I am not sharing an image as it doesn't contain anything different numbers wise as the one above).

2021 Goals Wrap-Up

Consolidated Balances: At the start of the year, the consolidated accounts left to be settled were 9 of the original 12, with a total balance left to settle of just over $30k. The goal was to stay the course and hope that the balance was around to around $20k by the end of the year. At the end of last quarter, this was down to zero, as I was able to obtain a personal loan to pay off the remaining amounts, the starting balance of the loan was just around $20k. This loan is now just under $18k, and I am hoping to do a cash out refinance in a few months and knock this out. My interest rate on this loan is very high. Since I bought my home before interest rates dropped so dramatically, I can definitely lower the rate quite a bit. Based on some calculations I've run, it looks like my mortgage payment after taking cash out will either be lower than it is right now or the same. While this does reset my loan back to 30 years, I'm not bothered by that as I'm planning to sell in a few years and buy a new home, which means my mortgage is resetting back to 30 anyway. The spirit of the goal is completed, in my opinion.

Non-Consolidated Balances: These are credit cards that did not go into the debt settlement program. At the start of the year, I had 5 accounts with balances, with a total of around $11k. The goal was to pay 3 off by the end of the year, with a total balance remaining of around $5k. A sub-goal of this was to bring my main card down to 75% utilization. At the end of the third quarter, 3 accounts had balances (total of $7.7k) and two were paid off. As of the end of the year, two remain paid off (although it was three paid off for most of the quarter, I decided to do a little shopping the other day that I will pay off in 1Q220. Of the 3 cards with balances, the total debt is just about $7.5k. While I did not get my main card's utilization quite as low as I had hoped, I am still quite pleased with this progress. Once my mortgage has been refinanced, paying off some of the higher interest loans, the cash flow that is freed up from this will go a long way to helping this balance.

Mom Debt: The goal was just to begin repayment on this. I made 11 payments to her in 2021, it is a part of my budget, and will remain so. This year, I will increase the amount I repay, and then again in 2023. This one is good!

Non-Priority Debts: These include my mortgage, car loan, 401k loans, and federal student loans. The goal here was to just continue servicing as scheduled, without accelerating any of the payoffs. Throughout the year, I added 2 new student loans (1 federal, 1 private), and shifted 401k loans to priority status, using the tuition reimbursement payments I receive from work to tackle those. Of the student loans, the private loan was actually moved to priority status, and will be paid off using equity taken out from the refinance if possible (again a higher interest rate). If I am not able to pay it off via the refinance, then the goal is to have this one paid off before I graduate, and my federal loans come out of deferment. Completed!

Grow savings: I started the year with just $50 in cash savings, and the goal was to finish the year with around $2k in cash savings. At the end of the third quarter, I was at around $1400, not including the extra buffer in the checking account I use to pay my mortgage (which was about $600 - deciding how I want to calculate this reserve for 2022). I am ending the year with just around there in cash savings, as I had to dip into it a little bit for a few things. Not quite as far as I had hoped to get, but still such great progress from where I started. 2022 will bring a new level of aggressiveness in this arena. Not quite completed but still outstanding progress.

Bump retirement savings: I started the year contributing 10% (not including match), and was hoping to bump this to 12% by the end of the year. My promotion midyear did increase the $ amount going into my 401k, even if I did not bump the %. I did not end up increasing the % in 2021, although as soon as my next tuition reimbursement payment comes, and I am able to pay off 401k loan #1, I will be increasing this to 15%. Maxing at my current salary is 17%, so I don't think I will be actively increasing this again, honestly. Any raises at 15% will get me closer and closer to maxing. As my salary increases, I will likely have to reduce this percentage which is funny to me lol. The spirit of the goal is completed.

Investments - no change from Q3: The initial goal was to increase my small balances in robo-investing accounts as able, without any set $ amounts. Ultimately, back in February, I decided that I am not in a position to start investing in taxable space yet, and need to focus on debt, cash savings and retirement first. I cleared these accounts out, and have no plans to begin this type of investing again for a few years. Goal removed.

Get promoted (financial goal as well as personal goal) - no change from Q3: BOOM. Got my promotion effective July 1, with a huge salary increase as well. Definitely had a little too much fun celebrating, but now back to being focused. Starting to work towards the next one, which is truthfully the level I have been working at. I'm hoping for next summer for that one. GOAL COMPLETED.

Other non-financial goals: Stay focused on weight loss journey - no measurable goal set, but I show a net loss of about 17 pounds for the year. This leaves me 1 pound from my goal weight, which is 100 pounds down from my highest weight. This also does not reflect the ~15 pounds I put on mid year during a thyroid freakout, which I also had to take back off. Definitely considered this one completed in an excellent way.

Start taking steps for plastic surgery post weight loss - After a lot of consults, I chose a surgeon, and have a plan for timing/funding/school break, etc in place. It is looking like my first round will be early July, and then my second round will be mid December. I'll go into more detail on this in a separate post for 2022 goals. Completed!

One goal that was not on the plan at the start of the year - go back to school. It was something I always wanted to do, but since my company did not at the time offer tuition reimbursement, it wasn't something I wanted badly enough to actually pay for it myself lol. They announced the benefit on Feb 1, and by Feb 18, I was enrolled in an online degree program. I officially started June 1, and by the end of the year, have earned 44 credits since June. This might be the thing I'm most proud of accomplishing this year, and what makes that funny is that it wasn't even on my radar when I set my 2021 goals!

Overall, I think I had an amazing year, and I'm thrilled. I'm still refining my 2022 goals, and frankly this entry is long enough lol.....so I will post about that separately.

I definitely think I need to start budgeting money for clothing though, I am at the point where I need to replace a lot of things, and it is becoming more difficult to cashflow it, so into the budget it has to go!

I definitely think I need to start budgeting money for clothing though, I am at the point where I need to replace a lot of things, and it is becoming more difficult to cashflow it, so into the budget it has to go!