|

|

|

|

Home > Archive: April, 2021

|

|

Archive for April, 2021

April 27th, 2021 at 06:29 pm

Can't remember if I mentioned this a few weeks ago or not, but I requested registration for some classes for this summer's term. Since I am not yet officially enrolled, I had to wait for current students to register, then they processed non-enrolled requests on a first come first serve basis. I made my request on the first day it opened so I would be as close to the front of the line as possible.

I requested 4 classes, for a total of 16 credits (go big or go home, right?). Not sure if it's because I am a non matriculated student or just a general summer session limit, but I received a message back when they were processing my registration request that I was limited to 8 credits, or 2 classes. Probably not the worst thing in the world to happen, haha.

I then went ahead and applied for the private loan (only need private for this one semester, will be able to use federal from here on out), and am just waiting for the school to certify/generate my invoice. Once I have the bill, I can submit for approval for tuition reimbursement (I'll then have to submit for payment once I get my grades back).

I also purchased the CLEP exam review books for two of the exams I want to take (I believe I am planning to take a total of 7 exams). I decided to take the practice test in the back of the book for a baseline of where my knowledge is. I got 29% correct lol. Not sure what constitutes a passing score, but pretty confident that it's a lot higher than 29%. Guess I should read the book before scheduling lol.

It's all starting to move and I'm pretty excited! I may have to push my estimated graduation date out by a semester, based on how they applied my transfer credits, but I decided to just wait to speak with my academic advisor once I am matriculated to figure all of that out. No sense in making myself crazy yet.

Posted in

Uncategorized

|

1 Comments »

April 26th, 2021 at 04:49 pm

When I wrote last, I was waiting to see if I would get a call from the market research team conducting the in-home study or if I was not going to get called and get paid either way. Well, they did end up calling me around 1pm, and said they would arrive around 2:30. That worked out ok with the list of errands I had set up for the afternoon. They were on time, I let them in, we went over everything, and I skedaddled. They kept me updated on their progress throughout the day, and let me know they were done & gone around 10:15pm. I received an email with the link to my $595 virtual rewards card on Monday. Setting up access was easy, and I was able to use it in full. I used it for a mix of wants and needs. It's now got a zero balance. I was able to pay this month's electric bill and the majority of this month's cell phone bill (freeing up paycheck money to increase payment to the credit card I'm working on now), plus I ordered a few things from eBay, Amazon and a clothing store to round out the rest.

In other snowflake news, I joined a site called Drop last month. They've been a bit annoying to work with, but I am waiting on some pending points to post. Once they do, I'll have enough redeem $100 worth of Amazon gift cards from completing a few offers. I'll combine that with the $10 in gift cards I'll get for this month's receipts in Amazon Shopper Panel. No immediate plans for those gift cards, but Amazon never goes bad lol.

I also got another Chime referral bonus! That brings me to a total of $300 earned via Chime for very little work. One was the bonus I got for signing up, and I've gotten 3 bonuses from people using my referral link.

Since my last post, I did some test drives that are gonna end up costing me money haha. The day I had to be out of the house for the in-home stufy, I went over to a friend's place to hang out. She has a Peloton, and I wanted to try it out to see how it compared to my off brand bike. Holy crap. They're not even in the same universe. Now I want a Peloton and have to figure out how to save for it amidst all of my other goals. Sigh. I'll probably buy a used one and save up for it in cash, rather than buying new and financing. That could change depending on if I get promoted in July/what the pay increase would be. I don't think I would pull the trigger until next year at the earliest, which gives me plenty of time to figure it out. Paying off debt, getting my savings up to at least baby EF level and funding surgery are still higher priorities. The second expensive test drive was our rental car in Vegas. Our original flight had gotten changed, and I forgot to adjust the car rental reservation. The only cars available when we arrived were luxury cars, so we ended up choosing a BMW X3, which just so happens to be what I want as my next car (when current loan is paid off in Aug 2023). I was glad to have a week to drive it. Unfortunately, it's just as nice as I expected it to be, lol.

Vegas was pretty low spend as expected. I think I spent less than $100 out of pocket for the entire week. Not gambling helped haha. I'll be interested to see how it impacted my spending for the month when I do my April summary on Saturday.

Other than that, everything is just moving along as planned. Debt going down. Savings going up. Lifestyle staying fairly status quo. I have a few updates on other topics, but will do separate posts for them.

Posted in

Uncategorized

|

0 Comments »

April 16th, 2021 at 02:22 pm

Not much big news to report from me. Everything is humming along as per the plan, and while I wish some of it was moving faster, I really can't complain about the progress I've made on all fronts since embarking on this big ambitious 4 year goal plan.

Yesterday was payday. I had a large amount going into one of the bank bonus accounts, so I went over to one of their branches to withdraw that money. Conveniently, my main bank was right across the street, so I was able to deposit into my main checking in the same trip. Nothing unusual about this payday. Got home, made all of the planned payments for the day and that was about it.

The direct deposit into the bonus account yesterday was a one and done - meaning that it's the only direct deposit needed to earn that bonus. So when I got home, I updated my direct deposit info to switch over to the next bonus account. I also received an offer for a bonus that doesn't need direct deposit, just having to keep a minimum average daily balance for two months. Since I had more than this amount in savings, I went ahead and opened the account and made the transfer. Not planning to use for any transactions, so it's no different than sitting in my savings, except in 2 months it'll have earned me $250 lol. That's a nice return! This slows down the bonus activity for the year.....after the current bonus I just set up direct deposit for, I just have one more planned out for the year, and I'll start working on that in June. I am thinking I can probably only get 1-2 more for the year, I'll have exhausted the list of banks that are physically close enough to me to be able to take advantage of the bonuses. So I'll have to wait at least 6 months, more like 12-24, to be able to take advantage of those bonuses again. I'll see what comes up over the summer.

Hopefully by summer, I'll have gotten promoted (this is currently top of mind as I am reviewing job descriptions for my team. I am currently performing somewhere in between the level above mine, and the one above that. Always fun to realize.) But I am hopeful that with all of the high level work I am putting it, I will be recognized. Obviously, this brings personal and professional satisfaction, but the truth is, I really need a raise to move my plan along. It's built out based on my current salary, but I am not able to make optimizations that have been identified as a need until I can increase the amount of money coming in. For the past few months, I've been managing it thanks to snowflakes and such, but I'd really like to move to the next step where all of my expenses are covered by pay, and extra money is literally only used for extra things - such as accelerating debt & savings goals, and fun stuff! We'll get there.

Speaking of snowflakes, today is the market research in home study for which I'll be paid $595. The good news is that I am actually a backup for the study, which means they may not call me to even come. But I'll get paid anyway (best case scenario). The maybe not good news is that as a backup, I am not committed to a specific time slot for them to call, and they can call anywhere between 5am and 10pm. If I am not available/turn them down, I do not get paid. If they call me before 2:30pm, I can make it work. When I thought I had to be out of the house for 9 hours, I made a lot of plans for this afternoon, which aren't all that flexible. So if they call me after that, it'll be harder for me to let them in. But! The study is supposed to take 8 hours (plus an hour to let air particles settle after they leave). So I have my fingers crossed that they wouldn't call after 2 since there would not be enough time to complete the study in the timeframe they're working with....so far so good, but it's only 9:15am here. It'll be a bummer if they do call and I am unable to accomodate them, but this was all kind of sudden anyway. I do have tentative plans for spending the incentive but nothing is finalized yet. If I don't get it, I'll be disappointed but I will live.

Tomorrow I am traveling for the first time in about a year and a half. I am going with my mom to clean out my grandfather's apartment, in Las Vegas (a 5 hour flight from where we are in NY). We are meeting her sister there. I am not super nervous to travel, as I am fully vaccinated. It'll be nice to have a change of scenery for a week, even if it won't be a truly fun time. Hopefully it'll be a low spend week. Not usually the case with traveling since you're out of your routine etc but I am not anticipating a lot of out of pocket costs for myself.

Posted in

Uncategorized

|

2 Comments »

April 8th, 2021 at 06:32 pm

Popping in to say hello and share a few updates.

I received word from my debt consolidation company that they were able to negotiate settlements on two more of my accounts in the past few days. This takes me down to 3 that are left to be settled, and a total unsettled balance of just over $14k. Already way past where I thought the year would end up, and it's only April. I guess later in the year I'm going to have to switch my tracking mechanism to how much is left to pay vs how much is left to be settled. I'll probably make that switch at the end of the year because it sounds too annoying to do right now haha. It's very good news, though.

Yesterday, I glommed on to my mom's tax appointment to see if her tax preparer could help me with my amendment to my 2019 state taxes. Basically....I moved out of a city that has a city income tax in Sept of that year, to one with no tax. I changed my withholdings appropriately, so the city tax stopped coming out, but didn't realize I had to file a form with my state taxes that year to reflect the part year resident tax. Plus, my tax software is a bit too simple for that - so my tax return was prepared as if I had been a resident of the tax free city all year, when in reality, it was only 4 months. Big refund, yay - or so I thought lol. Refund never came, and the status on our state tax site just kept saying pending. Finally I got a notice in the mail that they had recalculated my taxes, and that I owed them a few hundred dollars instead of getting my big refund (booooooo). I realized then that my taxes didn't inform them that I had moved, and they recalculated based on me living in the city with the tax full year. Since I stopped having that tax witheld from my paycheck, obviously they thought I owed. So the truth was somewhere in the middle. I didn't have enough time to figure out how to fix it, so I paid the few hundred bucks to not incur penalties, figuring it would all factor in at the end. I eventually downloaded the forms, and spoke to someone at the state tax dept to confirm what I needed to do. But I was unsure if I was going in the right direction. Welp, my mom's tax guy pretty much ignored all of the nuance I was trying to explain to him, and left out several critical numbers in the return and on the additional form. So I got home and realized that he had done them both wrong. Which is very annoying since I sat there for 3 hours. But, at least I was able to tackle them myself today, and am 99% confident that I am due an additonal $693. Which is very nice - it's mostly going to go to savings and education expenses. Hopefully they agree with my amendment, and the refund is proccessed in a decent timeframe.

I also got a call the other day to screen me into an in home market research study I had signed up for. Basically, they come into your home and take pics or videos. The payment is $595 via virtual Visa. I've done surveys with this company before so I know they're on the up and up. Since that's very unexpected and out of the blue, that money is being spent on some more fun things (not all of it). I'm going to hopefully upgrade my cheap spin bike pedals to clip in pedals, and also buy cycling shoes. It'll also go towards some education expenses, and my cell phone bill that month (to relieve what's assigned to that paycheck), and help fund a purchase I want to make on Groupon. Any leftover will be used to purchase an Amazon gift card, since I can always find uses for those.

Finally (for today), I received my latest bank bonus. It was $200, and I immediately moved it into my education account. So much funding is going into this account to cover some exams for credit I need to take to supplement my degree. I'm sure there will be more costs due to the school itself that will not be covered by loans, so just trying to build that buffer for now. If I end up not needing as much as I am setting aside, then of course finding another use for it won't be an issue

Posted in

Uncategorized

|

1 Comments »

April 1st, 2021 at 02:19 pm

I can't believe it's April already! Bear with me, this is a long one.

March spending was a touch lower than Feb...by ~$100....still would like to get this down, but also happy that I am finding balance, and a way to live life in a satisfying way without derailing my debt pay down efforts. This spending does not include housing or debt pay down (basically any of my bills) - this is all "discretionary" spending....quotes because buying groceries isn't exactly discretionary lol. But it's something I have control over rather than my mortgage, etc.

Alcohol - 0

Car/Gas - $60.20 (got gas twice this month. Once because I needed it, and once because I was killing time and was near the cheaper gas station. Might be able to get through April without getting it again but not sure if I have any plans that include longer drives than usual.)

Clothing - $45.30 (this was in conjunction with a $20 birthday reward I received from a store I used to shop at a lot. I don't remember which of my snowflakes was used to fund the out of pocket spending, but thems be my rules.)

Dining/Entertainment - $125.59 (this was extraordinarily high for me lately. I don't really order takeout or go out to dinner, but there were a few things lumped pretty close together. Big contrast from last month's $2.06 haha.)

Education - $50 (enrollment fee for school. It's getting real!)

Gifts - $117.05 (Mom birthday gift)

Grocery/Household/Toiletries - $529.71 (by far my biggest category. It was a slightly spendy month on groceries alone, then I had a few other things that get categorized in here as well. I would like this to be under $500 or better for April.)

Medical - 0 (although I am expecting a bill for the copay for my appt last week with the plastic surgeon - this will be captured whenever they send it/I pay it.)

Miscellaneous - ($98.14) (this is negative because it's offset by payment of my wellness stipend. Can't remember what else ended up in here.)

Office Supplies - ($10.84) (also negative, got a credit from Staples for them losing the delivery of my ink at the end of Feb.....credit posted in March.)

Personal Care - 0

Pet - $116.34 (this should cover the majority of my "start up" costs for taking my cats, I still need carriers. I'll have to start buying food & litter end of May/early June, Mom is providing the first month's supply.)

Grand Total - $978.14 (overall ok. I did have to dip into savings for a few things, but I'd rather do that then put anything on a credit card.)

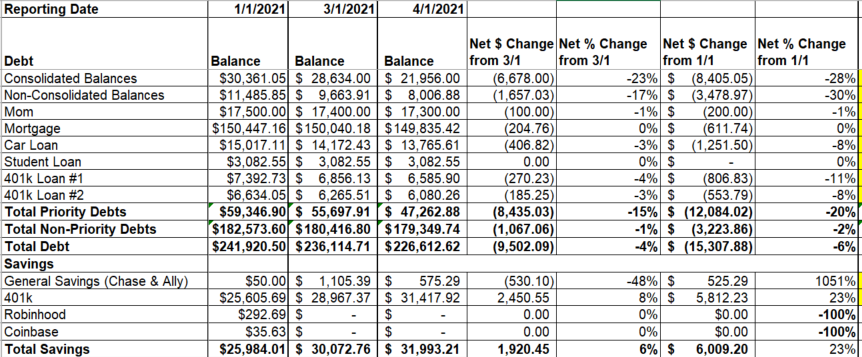

Month End Summary - below's pic is a screenshot from my tracker on where things stand, measured in both the change from 1/1 and the change from 3/1. Note, 401k loans and balance do not include the payments/contributions from my 3/31 paycheck, they take a few days to post to the account.

Overall everything is going in the right direction! Debt is going down, especially the priority debts. Savings is still going up, even if there was a downturn along the way. Very pleased with my progress.

Since today marks the start of the second quarter, I wanted to do a check in on my goals for the year and how I am tracking against them so far. I went back to my post from the beginning of the year to see what I said...

Consolidated Balances: In early January, the consolidated balances left to be tackled were 9 of the original 12 (3 having reached payment agreements and in active repayment). As of today, there are 5 left to be tackled. Of the 7 that an agreement was made, 6 are currently in active repyament and 1 has been paid. The goal was: stay the course and hope that the balance was down to around $20k by end of year. As of today, it is just under $22k. I would estimate that 2 more of the accounts will reach payment agreements this year, leaving me with 3 to go and a balance of about $16k if my estimates on what will be handled next are correct - if I'm wrong, it'll be even better. Ahead of goal there for sure.

Non-Consolidated Balances: these are my credit cards that did not go into the program. There are 6 of them, 5 of which had balances as of Jan 1. My goal was to pay off 3 of them by the end of the year, and bring my starting balance of ~$11k to ~$5k. As of today, I have paid off the 3 I wanted to have handled by end of year. Current balance remaining is just at $8k. Based on planned regular payments alone, I'll be just about there. That doesn't include some larger irregular payments I have coming in throughout the year that will be directed here, and whatever extra I am able to scrape up to chip away at that. I didn't state this goal here, but I also said elsewhere that I wanted my main credit card (the one with the highest balance) to be at or under 75% utilization by the end of the year - based on planned payments alone, it's projecting to be around 50% by EOY, with potential to be under 25% if certain events that trigger a snowflake come into play. Ahead of goal there as well!

Mom debt: my goal here was just to start paying this back. As of this writing, I have made 2 payments, and incorporated it into my monthly budget. I will not make much progress this year, but it was more about the intention than the measurable progress. I will increase this next year as other debt is paid off/my salary increases. On track.

Non-priority debt: goal was to continue to service on normal schedule. Not much to say here, as I've continued making regular payments to these - mortgage, car loan, 401k loans. Student loans will remain in deferment until after I graduate....even if the federal deferment is not extended again, which I think it will be, by that time I will be a full time student which automatically puts them in deferment. I will be adding to my student loan balances, but this is good debt so I am ok with it. For now, these are all "make the payment on time." On track.

A secondary goal under this heading was to potentially refinance my mortgage at the end of this year or beginning of next, but I've changed my mind on that. I was hoping to pull out some equity to cover my plastic surgery, but I can't be sure of how much I actually have without paying for an appraisal. Based on my purchase price, I have $50k of equity, or 25%. To fund surgery, I would need that to be $80k of equity (not impossible, my apartment was very underpriced in my opinion because it needed a gut renovation which I did), plus pay closing costs etc. I have since decided that I'm going to take another 401k loan (have to pay off one of the existing ones first, but I have a plan because I always have a plan). This also makes the debt shorter term, it would be paid off in 5 years or less. Plus, I have decided I'm going to move in a few years so it doesn't seem worth it to refinance just to go on and sell in 3-4 years. All works in progress. I'll talk about them in another post when I get closer to pulling the trigger.

Grow savings: I started the year with $50 in cash savings. No, that's not a typo. It was a scary place to be. The goal was to be somewhere around $2k in cash savings by end of year. I managed to get up as high as $1100 at one point, had to pull some out, and am currently sitting at just under $600 not including some snowflake money that is in transit. This goal is on track.

Bump retirement savings: I started the year contributing 10% to my 401k, and the goal was to increase that to 12% by midyear. Not sure if I will be able to do this by midyear, but it will definitely happen sometime this year. This does not include my company match, in which I will be fully vested next month. I currently have 2 401k loans, which are paid via auto deductions from my paycheck. As mentioned above, I am planning to pay one of these off by end of year, and take out another loan to fund surgery. I don't want to remain in the habit of borrowing from my future to pay for things, but I am hopeful that by the next time something of this importance comes up, I will be in a different financial position and have more options. On track based on planning but we will see.

Investments: I started the year with small balances at Coinbase (~$30) and Robinhood (~$300). The goal was to throw extra money at them as able, without any sort of measurable amount stated. I ultimately decided that in my situation, that money would be better used elsewhere, so I cleared those accounts out. I guess technically this goal will not be met, but in a conscious way haha.

Get promoted (financial and non-financial): Has not happened yet but I have a good feeling for either July or October! When this happens, once I know what my salary increase will be, the first thing I will do is fund a grocery budget in paychecks lol. The second thing will be to increase 401k contribution, and the third will be to start moderately funding sinking funds. After that, I will likely focus any extra money on debt.

Other non-financial goals: there were 2 goals here. One was to continue to stay focused on my weight loss journey. No measurable goal here at that point, but I have since confirmed my goal weight - well, my plastic surgeon set it for me haha. He wanted me to lose 20-25 pounds from where I was as of last week in order to proceed with surgery. I am hoping as a strech goal to start surgeries (need two rounds) in December, so would need to achieve this before then. I set an interim goal of losing ~10-15 pounds from where I was last week by my next appointment with him at the end of June, which is not only a big milestone for me (2 milestones actually), but is halfway to where he wants me to be. As of today, I am 8-13 pounds from the interim goal with just under 3 months to go. I'm feeling hopeful. The second goal here was to start taking steps for plastics. Clearly that's happening haha. I've met with 4 surgeons to date, and am undecided if I will meet with more, or if I have my guy. I've also come up with a pretty detailed plan to pay for it. Both of these goals are on track, if not ahead of schedule.

Overall, I think I'm killin' it and could not be more pleased with my progress. I don't feel deprived in any way, and having to be creative to fund wants from extra money has made me think a little more deeply about whether or not something is worth the effort to get it (I used to just buy and think about it later). I appreciate the things I do end up buying more now.

This year is really all about laying the foundation for a very ambitious 3 year plan. I'm confident that I will achieve this plan based on my mindset thus far. None of this feels difficult or a slog. And in the end, the position I will be in will be amazing.

Posted in

Uncategorized

|

2 Comments »

|