February is my least favorite month, so I am not sad it's over. The good news is that it's a short month, and it appears to have been a less spendy one, that's something anyway...

Off we go! As always, this captures just my "discretionary" spending, not my bills. I do not consider bills to be spending as I have less control over them in the short term.

The convention here is Category - Feb Spending/YTD Spending: context

Car/Gas - $41.60/$77.38: this was a tank of gas and some parking. I have definitely noticed gas prices going up, but since I don't get gas often, I haven't started to "feel" it yet. I average once a month or so.

Clothing/Accessories - ($2.48)/$581.54: after a lot of shopping in January, I had a bunch of returns that ended up leaving me with negative spending for Feb. I've talked about this before, but a lot of the time clothes shopping for me is necessary since my body has changed so much. Anytime things start to ease up and there is an opportunity for socializing, I realize how many holes there are in my wardrobe now!

Dining/Entertainment - $319.52/$664.12: this month included a birthday dinner that I covered for one of my best friends, as well as my share of drinks and dinner out with a friend I haven't seen for a long time. The rest was takeout and delivery. Blah, higher than I'd like, but my grocery category was fairly low, so I guessss it balances? Sorta?

Grocery/Household - $253.24/$743.11: as mentioned above, pretty low this month. I guess I just didn't need much. The amount I budget for groceries is $400 a month. If I can keep it on the lower side in March, that would also be helpful.

Health/Wellness - $473.42/$537.97: this number is misleading, as I purchased something that will be covered mostly by a wellness stipend from work, which I will receive reimbursement for in March, so there will be an offset. Otherwise, this includes something I moved from the FSA category as it was denied so I had to reimburse the account and my monthly Peloton membership.

Home Decor/Furniture - $0/$387.70: a no spend category!

Medical (non FSA) - $89.22/($110.78): this category is still negative YTD due to a refund I got in January. This month was some delayed medical bills from last year, so I could not pay for them using my FSA.

Miscellaneous - $0/$115.16: another no spend category!

Office Supplies - $0/$126.26: another one! This category should remain low this year, it pretty much gets used for printer ink, which I just bought in January.

Personal Care - $148.03/$674.71: it was my month to pay for mani/pedi with mama.

Pet - $151.96/$151.96: the usual. Cat food and litter. Got a good deal at Target so I stocked up, so I shouldn't have much if any spending here in March. Looks like I hadn't bought anything yet this year so that works for me.

Subscriptions - $2.99/$134.95: just my monthly iCloud this month. In March, I have a streaming service renewal coming (I prefer to pay annually rather than monthly).

Travel - $710.02/$710.02: this is the cost for the flight and my share of the hotel for my upcoming trip to New Orleans. The hotel actually didn't technically charge me yet, but my friend already paid me back for her half, so I figured it was easier to just leave it in February. With two major surgeries this year, I don't foresee much traveling this year, so while I would have liked to pre-fund a travel category to cover, it is what it is.

Total excluding FSA - $2187.52/$4794.05: not a very spendy month, even with the large travel expense. I'll take it

Medical (FSA) - ($146.06)/$204.85: I don't include this in my spending, since it is not money directly out of my pocket. I am aware that it's my money funding the account, but I don't have to directly budget for it  This month ended up being net negative, since I made a return/reimbursed the account for a purchase I had made with it in January that was subsequently denied. Otherwise, it was used for the usual - co-pays, prescriptions, etc.

This month ended up being net negative, since I made a return/reimbursed the account for a purchase I had made with it in January that was subsequently denied. Otherwise, it was used for the usual - co-pays, prescriptions, etc.

Grand Total including FSA - $2041.46/$4998.90: Funny how it goes down when I include another category!

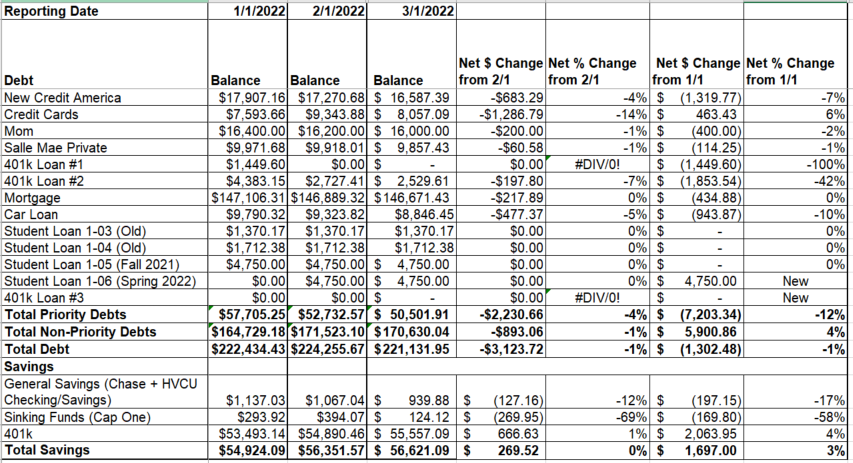

Below is this month's summary:

Debt still continuing to go down, still struggling to get those credit cards back down to where they were at the start of the year and beyond, but working on it. Cash savings took a hit this month to pay for upcoming travel, but at least it didn't go on a credit card. As always, this does not include the 401k contribution/loan payment from my end of month paycheck. Doesn't feel like a ton of progress was made, but I know I'm chugging along.