|

|

|

|

Home > Archive: March, 2021

|

|

Archive for March, 2021

March 31st, 2021 at 05:12 pm

Today is payday! I had a lot of money moves to make today, so I have been looking forward to today all week.

But before getting into the payday report, some new extra money came in...

On Monday, someone came to buy another set of my dumbbells. This was the set of 45 pounders....I had them listed for $180 ($2/pound, which seems to be about the going rate these days). He offered me $150 and I decided to take it, since it was close enough. I still have a pair of 35s and a pair of 55s. He gave me cash, and since I had to go to the bank today to make a deposit, I waited to do it in one transaction. I'm splitting this between savings, holding for groceries, and adding to a credit card payment.

As I mentioned in my previous entry, I opened a Chime account and received a $75 referral bonus for opening it. The person whose link I used should have also received $75. Since it was very easy and fast, and did not require any direct deposit, I had my mom and a friend sign up for the account using my referral link. They both completed their activity yesterday. My mom's transfer posted this morning and we both got $75. My friend's transfer should post tomorrow (she may have done it too late in the day for it to post next day), so hopefully another $75. Both of those will go into savings. If anyone wants to earn a quick and easy $75, feel free to use my referral link - happy to walk you through how to set it up to get your bonus: Text is https://www.chime.com/r/elizabethfaughnan and Link is https://www.chime.com/r/elizabethfaughnan

With my paycheck, I also got 2 extra payments. One was my wellness stipend - we are allotted $250 every year to purchase wellness items. I wanted a new fitness tracker this year, so I got one of those, an additonal band for it, and then since that didn't quite equal $250, I threw one of my protein powder purchases in as well. We got an email informing us the other day that these payments would be processed 4/15 instead of 3/31 as expected, so it was a pleasant surprise to see it in one of my account this morning. Additionally, I got some other wellness reward that I was not expecting - I honestly think it might be a mistake lol. But who am I to say no? It was $75 and change. The stipend went into savings, since I had paid for those items out of savings knowing it would be replaced. The $75 was split between funding for my next bank account bonus (more on that later), and an additional payment to the next credit card I'm working on.

Today's paycheck also marked meeting the requirements for one of the bank account bonuses I was working on. So I reduced the DD for this account (have to have something going in there to keep it fee free), and added DD for another bonus (lol - yes this is a LOT to keep track of), which should go into effect next paycheck. I only need one direct deposit to go into that account. The fee is 99 cents a month, so I will either just pay the fee for a few months, or I will do a transfer in/out. But I can live with ~$3 in total fees for $300

After my brain processed all of that lol - I paid my bills, including an extra $75 as mentioned above to the next credit card I am chipping away at. I'll talk more about that in tomorrow's entry which will be my March summary. I was able to put a small chunk of money back into savings. I funded the opening deposit for my newest bank account, and I was able to hold $95 for groceries. I'm waiting on some Amazon returns to process (going back to my Amazon account as credit), and then I will purchase an accessory for my stationary bike. I'll have to pay less than $4 out of pocket for this, the rest has been funded with Amazon credits. All in all, that's pretty good.

Before I got to all of that this morning, I did a whole lot of finagling. I opened a new bank account which will net me $250. There are a lot of DD changes, so I decided to map them out haha. I have 2 more accounts I am planning to open in the next few months. One does not require direct deposit, the other does. By mid August, I will have earned $1800 from bank account bonuses this year. That's not including any additional bonuses I get from Chime! Pretty good for just keeping track of stuff, which I'm really good at (it's also kinda my job to be suuuuuuper organized lol).

Once I updated all of my tracking in my massive spreadsheet, I now don't know what to do with myself for the rest of the day (I mean, I have to work, but it's quiet today). I'm just going to bask in sticking with my plan. My aggressive and complicated, but so far successful and effective plan

Tomorrow I'll post my March summary! Excited to see my progress.

Posted in

Uncategorized

|

2 Comments »

March 28th, 2021 at 11:00 pm

This will, unless something crazy happens, be the last accounting of grocery spending for this month. I have everything I need to get me through the week, and by the next time I need to go to the store, it'll be April

3/27 - Stop & Shop

7.49 - 2 lbs of strawberries (this annoys me. I've been getting the 2 lb package on sale for either 5 or 5.99 the past few weeks. They had the 1 lb packages on sale at 3/$10, but I didn't need 3 lbs, so I wrestled with it, and ultimately decided that paying 2.50 more to get the better deal wasn't worth it to me. It's some kind of win, anyway...)

3.80 - 4 apples (for green smoothies)

2.64 - 4 lemons (same as above)

2.99 - bagged spinach (same as above)

3.53 - 2 red peppers (for this week's dinner, egg white omelettes with sauteed onions & peppers, cheddar, and an English muffin. I already have the egg whites, cheese, and English muffins)

1.10 - 1 onion (same as above)

5.99 - 1/2 gallon of half & half (jeez I go through this fast lol)

8.99 - 24 pack of string cheese (this too!!!!)

1.25 + .11 tax - Reese's (no comment lol)

37.89 total

3/28 - Target....offered to pick up an order for a friend since it was at the location in my mom's neighborhood. While I was there, I wanted to see if they had the flavor of ready to drink protein shake that I like to keep handy for days where I'm on the go. They did

7.99 - 4 pack of RTD protein shakes

7.59 total (I had a 5% birthday offer in the Target Circle app. I also had some money on my Target Circle account but I hadn't toggled it on to be used before I got into thei store and their service is always awful. I'll use it next time.)

That brings my total spending for March on strictly groceries to 375.16. That's a bit higher than I expected, but it is what it is - it does include $52 for an annual CarePass membership that I prepaid. It's not crazy, but I'd like to try to keep it a bit lower. I did stock up on some non-perishables, so I think that skewed it higher. As the overall grocery category, which includes toiletries and household expenses, should be done as well, and is currently sitting at 531.44. That means I had $156 in other expenses that go in this category. Those are made up of drugstore level toiletries, cleaning products, and laundry card refills mostly.

Posted in

Uncategorized

|

2 Comments »

March 26th, 2021 at 03:26 pm

I feel like most of my entries this month have been about the grocery challenge, so I wanted to write one on a day that I did not have grocery spending to report to try to capture my other finance related updates!

Stimulus & 2021 Goals: Last week, I did indeed get my $1400 stimulus payment, and directed it as planned. I have not yet paid off the smaller card account, as I'm managing some cash flow, but I will by next Monday (expecting a transfer from somewhere else to come through). I will not incur any additional interest by waiting to pay it off, though, as it'll still be before the due date/cycle closing. Once that payment posts, I will officially have met my "pay off in full" goal for the year, which is exciting. With my budgeted payments for the next card (based on minimum payment when it's maxed), I will achieve the next goal for the year, which is to have that card paid down to 75% utilization. I do have a few snowflakes coming later in the year that are bigger that will also get partially directed there, so I will be ahead of that goal.

School: I believe the last time I posted about it, I had decided not to take classes this summer, due to it just being complicated. I changed my mind. Again.  My issue was that I cannot use federal loans for these classes, since I will not yet be a matriculated student. I have to use private, and with my current situation, I cannot get approved without a cosigner. I decided to ask my mom if she would cosign, and she said yes. I decided to take the classes for a few reasons - 1. the way the tuition reimbursement benefit is structured, I will maximize my payout from the company by doing it this way (it's boring to go into but it basically gets me more money back) and 2. next summer, I will be recovering from at least one major plastic surgery procedure (more on that later), so if I can load this summer up and make next summer easier, it'll be better. I'm still waiting on my transfer credit evaluation to figure out what classes I need to take for my program overall, and then registration for summer classes begins mid-April, so I'll see how it all shakes out. Either way, this will be the only semester for which I need to take a private loan, and I have to see what the repayment terms are, but because it will be cosigned, it will become a priority to be taken care of in the next few years. My issue was that I cannot use federal loans for these classes, since I will not yet be a matriculated student. I have to use private, and with my current situation, I cannot get approved without a cosigner. I decided to ask my mom if she would cosign, and she said yes. I decided to take the classes for a few reasons - 1. the way the tuition reimbursement benefit is structured, I will maximize my payout from the company by doing it this way (it's boring to go into but it basically gets me more money back) and 2. next summer, I will be recovering from at least one major plastic surgery procedure (more on that later), so if I can load this summer up and make next summer easier, it'll be better. I'm still waiting on my transfer credit evaluation to figure out what classes I need to take for my program overall, and then registration for summer classes begins mid-April, so I'll see how it all shakes out. Either way, this will be the only semester for which I need to take a private loan, and I have to see what the repayment terms are, but because it will be cosigned, it will become a priority to be taken care of in the next few years.

Dumbbells: I have had several sets of dumbbells listed on FB marketplace, LetGo and Craisglist for quite a while now. Lots of questions and nibbles but no bites. I wasn't dying to sell them, but left the listings up. I did reduce price a few times as I saw that the market was shifting. I got a message on Wednesday night about my heaviest pair, which is the one I was most hoping to get out of my living room haha. It's a pair of 65 pounds dumbbells, and someone offered me $200 for them. I accepted, and he came by last night to pick them up and gave me cash. This money will help make up a budget shortfall for next week's paycheck, fund a little bit of an Amazon purchase I want to make but am not letting myself use "real" money for, and I haven't decided what the rest will be. I still have listings up for my 35, 45 and 55 pound pairs. I don't plan to use those weights at home anytime soon....I am not currently lifting weights because it just makes me too hungry which is counterproductive to when I am trying to lose weight. I'll revisit lifting after I reach goal weight depending on when plastic surgery is. There's a lifting gym nearby that I am interested in, and it's very affordable. Just not sure what my fitness goals are past weight loss yet.

Surgery: Speaking of goal weight and plastic surgery.....yesterday, after my second vaccine dose (yay!), I drove about 45 minutes away to my first in person consult with a plastic surgeon. I've done a few virtual, phone and email consults, but this was the first in person. I liked him very much, and I like his plan for me. He wants to do two rounds of surgery, each consisting of a few procedures. I will need 3-4 months in between the first and second round. For the first round, he believes that my insurance will provide quite a bit of coverage based on my history etc. But even without that, the ballpark prices he quoted before insurance were very much within the range I had determined I can live with for this surgery. Because of my medical history, he would like me to get down a little bit lower than my goal weight was. I am currently 12-14 pounds from my goal weight, depending on the day. I am 27-29 pounds from his goal weight. That's going to be a challenge but I can do it! He would like to see me again in 3 months to see where we are at, and then we discuss. I was not planning to have surgery before this December at the absolute earliest, so I have some time. And apparently a new goal since I didn't have enough of those already....lol. I do have a few more consults scheduled, and I may or may not keep them. Right now, I am leaning toward going with this surgeon, but I do not have to decide yet.

Chime/Bank Bonuses: I recently saw a quick & easy bank bonus for Chime, which is becoming a very popular online only bank that is known for no fees and posting transactions quickly. The bonus I saw was to sign up using a referral link, set up an external deposit for $200 (they say DD but the blog said that any external ACH worked), and you'd receive $75. Well, I didn't mind moving $200 from savings for a few days to try it out, if it could net me a very easy $75. Opened the account Tuesday, set up the external account in my primary bank same day. The account was verified Wednesday, I transferred $200, and yesterday, the transfer posted and they added $75 to my account. Easy peasy. Just waiting for the $275 to be transferred back to my primary bank now  I have my own referral link, and if anyone is interested, it is at the end of this paragraph. We will both get $75 if you open an account and transfer $200 from an external source within 45 days of account opening. In other bank bonus news, I opened my next bonus account since the current one I am working on will be complete with Wednesday's paycheck. I like opening them a few days in advance of when I am planning to switch the DD to them so I have time to get everything set up. This is another easy one - $250 upon receipt of one single DD. So this one will be completed with my 4/15 paycheck. I already have the next 2 on deck! I have my own referral link, and if anyone is interested, it is at the end of this paragraph. We will both get $75 if you open an account and transfer $200 from an external source within 45 days of account opening. In other bank bonus news, I opened my next bonus account since the current one I am working on will be complete with Wednesday's paycheck. I like opening them a few days in advance of when I am planning to switch the DD to them so I have time to get everything set up. This is another easy one - $250 upon receipt of one single DD. So this one will be completed with my 4/15 paycheck. I already have the next 2 on deck!

Chime Referral Link: Text is https://chime.com/r/elizabethfaughnan and Link is https://chime.com/r/elizabethfaughnan

Pets: An interesting development came about at dinner with my mother and sister the other night. My mom has 5 cats. One of them is "mine" (I was her person when I lived at home while she was young, I moved out for the last time in 2016 and she has gradually become less interested in me lol). She is an absolute terror and my sister often jokes that she is going to hide her in my purse when I am leaving so that she doesn't have to deal with her anymore. What started as a joke conversation about me taking her and one of the other cats (a very handsome fluffy boy), somehow turned serious into an actual conversation about me taking my cat (Mischa) and the other girl (Misty). I went home and thought about it, and the next day proposed to my mother that we do a 2-3 month trial. If either the cats or I am unhappy with the arrangement at the end of that time, they go back to my mother's house, no harm no foul. But the companionship will be nice for me. This will represent a need for a new category in my spending, but other than a moderate up front cost of buying some supplies, shouldn't be a large increase based on what they eat. I do need to establish a vet fund, but I can add to it gradually, and my mother said if there are any vet bills this year she will help me since she was expecting to pay for them anyway. They will come live with me the day after my mother and I return from Las Vegas next month, so we don't have to disrupt them multiple times. I'm very excited!

Misc Spending/Not Spending: spending has been pretty low the last few days. I did not need groceries for this week after my Fresh Direct delivery on Sunday. I'll need to go over the weekend to prep for next week. But it should be a small trip, under $35-$40. I refilled my laundry card for $20. I ordered something on Amazon for the cats for $5.95. Yesterday, I overestimated the time it would take me to get from my second vaccine appt to the plastic surgeon's office, and I was an hour early! So while I was waiting, I saw that there was a BJs store with gas about 2 miles down the road. I didn't really need gas yet, but I had time to kill and it's cheaper there, so I got half a tank for $23 and change. I was expecting a co-pay at the octor's office, but since we were not sure what my co-pay actually is (not printed on my card and I couldn't remeber if it's $30 or $35 for a specialist lol), they said they would just bill me for it. On my way home, I stopped at a Starbucks, used a $4 coupon I'd gotten months ago, and a little bit off of my pre-loaded Starbucks balance, so there was nothing out of pocket there. I'm pretty sure my grocery trip and another cat purchase over the weekend may be the only spending left for this month - unless I decide to treat myself to takeout or something this weekend, which is still TBD depending on what my plans end up being. Basically, it would have to be under $10 to fit my budgetary goals, and also be able to fit within my calorie goals. So we'll see what kind of offers I get and where my adventures take me lol.

This has turned into a long enough entry for now! Hope everyone is enjoying early spring!

Posted in

Uncategorized

|

3 Comments »

March 20th, 2021 at 02:22 pm

3/19 - Stop & Shop

4.49 - milk

4.89 - string cheese

5.99 - 2 lb of strawberries

3.00 plus tax - 2 king size Reese's (oy. It was my birthday!!!!!)

Total - 20.63

3/19 - GNC

A friend posted about some flavors of ready to drink protein shake that I wanted to try out. Since I was literally going to be walking past a GNC, I ducked in to see if they had them available as singles. I include this in the grocery category, since it's a meal replacement for me.

3.19 x 2 plus tax - the flavors I got were Cookie Butter and Chocolate Peanut Butter.....we shall see if they're any good. Probably not lol.

Total - 6.38

3/21 - FreshDirect

I placed this order Thursday, it was charged today and will be delivered tomorrow. Below totals are if nothing is out of stock, etc. There were definitely a few things on this list that I didn't need yet, so it'll drive my March costs a little higher, but it's fine. I really wanted their stupid chicken, and I had a $10 off a $75 coupon.

23.63 - 6 pack of 16 oz cartons of egg whites

4.99 x3 - milk

2.99 x2 - frozen green beans

7.99 - chia seeds

3.99 - microwave popcorn

5.99 - oats

3.99 - little potatoes

4.99x2 - 6oz of grilled chicken

Total - 74.09 after fees less coupon. Probably not worth it but I really wanted that chicken lol. Once the weather gets warmer, I will start grilling chicken at my mom's on weekends for my meal prep and things get a lot cheaper.

I also picked up a 12 pack of Snapple for my mom at Stop & Shop, it was on sale for a good price and she hasn't had it for a while. I do not include this in my spending, as I'll transfer the money from her bank account next time I log in.

Groceries alone month to date are at 329.68. Category is at 460.67....I joined CarePass, and had to replace a couple of different vitamins this month, as well as a few laundry card refills. I will only need to purchase groceries once more this month, next weekend. And it shouldn't be a pricey trip, maybe less than $15.

Yesterday was my birthday, I am 42 now. I stopped at a Starbucks and used my free birthday drink....I used to drink so much Starbucks, and while my drink was never one of the horrific ones calorie wise that you see.....I didn't really miss it. Definitely not worth $6. It was a quiet day, hopefully I will not have another pandemic birthday. I've now had 2 and they are not that fun, especially when you're single with no kids. I also ordered UberEats last night, as I refused to cook for myself or eat a frozen meal on my birthday. Dining/Entertainment category will be on the high side this month but that's ok, it's been very low this year otherwise.

Since my driver's license was expiring on my birthday, I went on Thursday to the DMV to renew it, and upgrade it to the REAL ID (so I can use it to board domestic flights and enter federal buildings). This upgrade needed to be done in person, because of the extra documents I had to bring to prove my identity. I had the choice between a REAL ID or an Enhanced ID (which I could use to enter Mexico, Canada and countries in the Caribbean by air). The REAL IS is free, but the Enhanced is $30 extra. I already have a passport, so why on earth would I pay extra for something I can do already?? The clerk at the DMV mistakenly put me in for the Enhanced, and when I saw the cost on the card machine, I made him go back in and change it. However, they don't tell you at all along the way how much it is, so I wonder how many people have that happen to them and just pay it. Not this girl  My license is now good for another 8 years, and will need to be renewed again on my 50th (!!!!!!!!!) birthday. $80.50 to the Misc category and $2 for parking. My license is now good for another 8 years, and will need to be renewed again on my 50th (!!!!!!!!!) birthday. $80.50 to the Misc category and $2 for parking.

Posted in

Uncategorized

|

2 Comments »

March 16th, 2021 at 03:13 pm

3/15 - Stop & Shop

As noted yesterday, I went to the grocery store later in the day to get some things I needed for this week's dinners and green smoothies.

4.29 - bread (had a coupon for $1 off, this bread is pricey but I really like it and I don't go through it that quickly so I am ok with the cost. The loaf lasts me around 2 months.)

2.99 - 18 eggs (this will also probably last me 2 months)

3.89 x 3 - frozen dinners (I like to keep these in the freezer for weekends and such where I don't feel like cooking)

3.99 x 2 - more frozen dinners. (These 5 should keep me stocked for a few weeks)

2.64 - 4 lemons (for green smoothies)

2.86 - 4 granny smith apples (smoothies)

2.99 - bagged spinach (smoothies)

1.10 - red onion (for dinner prep - this week's dinner is egg white omelettes with sauteed onions/peppers & cheddar, and a toasted english muffin. I already had the cheese, egg whites, and english muffins.)

2.86 - 2 red peppers

Total - $39.38

3/16 - Amazon

When checking my account this morning, I saw that my next Subscribe & Save order was charged - this is an 8 pack of Carnation Breakfast Essentials (64 packets total). I use 4 packets a week in making my breakfast smoothie, so this will last me til mid/late May. The price is deceptive....they used my gift card balance for part of it (which I'm annoyed about, I thought I had unchecked that box, so I can save gift card balances for silly things but oh well. It was only $8.) Regular price is $43 and change. I paid $27.47 (also a discount for the first S&S order I think).

These two expenditures bring my MTD grocery spend to $228.58 (overall category is at $285.48). I tried to place my order for BJs (the warehouse store) this morning via Instacart, but the email coupon they had sent me was no longer valid, as it had exceeded the maximum redemptions. Oh well. I was only ordering this week because of the coupon. Nothing I was getting was essential, so it will wait. Annoyed about the coupon but it's probably better off. This is shaping up to be a pricey grocery month already without adding a non-essential shop to the mix. Still going to place a FreshDirect order for delivery Sunday or Monday - that will have the ingredients I need for next week's dinner meal prep (yes, I do plan it out that far in advance haha). Hopefully the coupon I have for them will not run into the same issue - but if it does, I will just take some stuff out of the cart that I don't really need yet, but added to hit a minimum spend for coupon.

Later this week, probably Friday, I'll definitely need to get milk (if I had thought of it, would have gotten it yesterday but didn't realize). I don't think I will need anything else til mid/late next week.

Posted in

Uncategorized

|

2 Comments »

March 15th, 2021 at 02:26 pm

As expected, I needed to go to the grocery store by the end of last week to pick up a few things to round out my stocks.

Friday, 3/12 - Stop & Shop

4.49 - milk

5.99 - half & half

4.99 - chicken meatballs (didn't NEED these per se, but they were on sale for a good price, and I use them for dinner meal prep reasonably often so I grabbed a package)

5.99 - 2 lbs of strawberries

3.01 - a spaghetti squash

1.25 + tax - 2 pack of peanut butter cups lol

Total: $25.83

Saturday, 3/13 - CVS

I woke up on Saturday and realized that I should join CVS CarePass after all. I started using a powdered fiber supplement, and have been buying either the Target brand or CVS brand. CVS is way more expensive than Target, but also way more convenient. I can get the price down to a crazy number by stacking coupon deals, though. So I joined CarePass for the year, paid upfront, which was $52.02. I will get a $10 reward every month in this program, which I will use to reduce the price of the fiber supplement, since that's about how often I need to re-stock. Since I am only going to use the $10 reward (same as Extra Bucks) towards the fiber, I felt this belonged in the grocery category, since it's effectively reducing my grocery costs for the next year.

Total $52.02

Later on, I went to CVS, and bought the following -

6.42 - fiber supplement (I think this is what the final cost was...they way they display the different savings on the receipt for this deal made it confusing. Original price was 22.49, less $10 CarePass, less another CVS coupon I must have had loaded onto my card, less 20% health card discount)

1.22 peanut butter cups lolol (it was the weekend!!!!!)

Total: 7.74 after tax (I know the pb cups are taxable, not sure about the fiber, so I don't know which item to assign it to).

Sunday, March 14 - CVS

2.39 + tax - you guessed it. Some more PB cups! I am done til next weekend haha. I had some extra room in my calories and since I pass by CVS on the way home from my mom's house........................

Total: 2.59

Those 4 transactions came to $88.18, and bring my MTD grocery spending to $161.73 (overall category which includes household and toiletries is at $216.83). Because of the CarePass subscription, my grocery spending will skew a little higher this month. I do need to go to the store today to get some stuff for this week's dinners and this week's batch of green smoothies, plus I am placing an Instacart order from BJs (warehouse store) and a FreshDirect order later this week. That may actually hold me into mid next week.

Today is payday. It's not really an exciting one.....it's all going to scheduled debt payments and bills. I'm ok with it, as there are other money advancements happening this week that I am excited about. With my next paycheck (on 3/31), I will have met the 3 months of direct deposit needed for the bank bonus I'm currently working on (HSBC - $200), so I am going to open my next account today (Citizen's - $300, with potential for more based on debit card purchases). That way the account is up and running by the 31st, and I can go ahead and schedule the direct deposit to fulfill that bonus. This one is easy. Requires one single DD of $500. You can keep the account free with a single deposit every month (does not have to be DD, can just be a deposit or transfer), otherwise the fee is 99 cents. I may decide to just pay the fee, depending on what things look like afterward. I will need to keep a small DD going to the HSBC account to keep that account free as well.

I am expecting the 3rd stimulus to be available in my bank account on Wednesday. I am eligible for the full amount of $1400, my AGI just barely snuck in under the $75k cutoff based on 2020 taxes. Originally, this was going to be split across paying off a portion of a credit card balance, and two savings accounts. I decided to rearrange it. $315 of it is going to pay a credit card in full (been chipping away at this one all month), and the rest is going to pay another credit card in full as well. That means that the three credit cards that I wanted to have paid off this year will be done so by mid-March. Pretty good stuff. This not only makes my debt balance lower, and frees up utilization hopefully helping my poor abused credit score....but it also frees up cash flow from not having to make those monthly payments anymore. Good stuff. The savings contributions that I had been planning to make from this have been shifted to some other snowflakes coming in at a later time. They'll still get there, but not as quickly. But since the interest amount of my savings account is so close to zero that it may as well be....and the interest amount on these credit cards is quite high, I think it was the right choice!

Posted in

Uncategorized

|

3 Comments »

March 10th, 2021 at 05:08 pm

Snowflakes:

As stated previously, I consider any money that is not part of my regular income a snowflake. A broad interpretation lol, but working for me so far. My state refund came this morning. It was $89. About half was used on a purchase from a clothing store I frequent (more details on that in the next section), and the other half was sent to the credit card I'm currently working on paying down. The balance remaining on that card is $315. Between some other snowflakes I am expecting in the next few weeks (reimbursement for my wellness stipend, pending 3rd stimulus, and a small disbursement from my grandfather's estate), that card will be paid off by the end of the month. Out of those upcoming infusions, I'll also be paying off another credit card (the 3rd and final one planned to be paid off this year!), adding to savings, and setting aside funds for educational expenses. With my 2020 state taxes processed and completed, I can also file an amended state return for 2019, which I am hoping/expecting nets me an additional $400 or so. That is all going to savings. That should be it in extra money for a few months, but cumulatively since the beginning of the year, these have helped me make really great progress on my goals.

Spending:

At the beginning of the year, I decided that any frivolous spending had to be funded from snowflakes. I can't stop paying bills or buying groceries....but I really don't need much in the way of clothes and home decor lol. I've done very well with that so far. I received a $20 reward from a clothing store I shop at for my birthday (which is next week). They also had a promo that if you spent $100, you got $40 off. So I figured I could find room in the allocations for snowflakes to come up with about $45 out of pocket. I ended up ordering a nightshirt, a sleep bra, and a few pairs of underwear. I can't justify ordering cute clothes right now, but loungewear is something that is definitely in heavy rotation so I feel like it was money well spent. I also cashed out a $25 Amazon gift card from Receipt Pal. This, combined with some gift credit I had left over from Christmas & some credit card rewards, went towards a new jewelry box, a decorative bottle, and a set of fancy bands for my new fitness watch. I paid nothing out of pocket for these. I still have $5 in Amazon credit left, to be saved for the next frivolous purchase. Overall this month's spending is sitting around $165 after some credits I have coming in. I do not include items I buy using gift cards in my spending. I didn't pay for them, after all

Social Security:

My mother is talking about retiring, and is trying to decide if she is going to do so at the end of this school year, or if she's going to work one more year. In 2 months, she has reached FRA. It got me thinking that it's been a while since I checked what my anticipated SS payment would be assuming no more changes to the system. I am looking at getting about $2500 a month at age 67. I then went and checked the NerdWallet retirement calculator, and by using my current 401k balance/contribution rate, salary and estimated SS....it looks like I am in good shape for retirement. If it gives me that result when I'm at a low point for savings, I am feeling hopeful. My salary will only continue to increase for the next few years, and my savings will also increase expoentially. My hope is that my expenses in retirement are lower than they are now as well. So all good things. I'm turning 42 next week, so 25 years to go lol.

Posted in

Uncategorized

|

2 Comments »

March 8th, 2021 at 03:50 pm

As expected, I did a touch more grocery shopping yesterday, this time at the market by my mother's house. I should be good now until the end of the week, when I'll need to grab a few things quickly.

2.39 (x2) - whipped butter

4.99 - crackers

3.69 (x2) - butter cooking spray

17.15, 73.55 MTD on groceries alone (overall category is at 118.09 including household and toiletries).

Posted in

Uncategorized

|

0 Comments »

March 6th, 2021 at 05:35 pm

This morning, I had a bunch of errands to run. Six separate stops, and home by 11:45. Two of my trips fell into the grocery category.

Stop & Shop:

8.99 - 24 pack of string cheese. This seemed expensive to me, and I almost bought the 12 pack which was on sale for 4.89....but then I realized that this was ever so slightly cheaper and will last me a little longer

4.49 - milk

3.34 - salad kit, part of this week's dinner meal prep

16.82 total

CVS:

1.49 plus tax - 2 pack of Reese's PB cups lol - clearly I have a weakness for these! Not on sale today, boo

1.61 total

Today's grocery spend - 18.43/56.40 MTD (category which includes household and toiletries is currently at 82.09).

While I was out, I got a donut at Dunkin (lol I have been planning for that since Thursday and have zero regrets about the $/calories it cost), dropped off an Amazon return & the fitness tracker at UPS (I decided I didn't like the color so reordered it for a nicer one that I like much more....had to return the original), went back to the dealership for them to actually change my rear wiper blade this time (they did not do it last week, so I called, and they asked me to come back today). They also gave me a cabin air filter and engine oil filter for my next service....which will be my free oil change in a few months. I went to the grocery store, got gas at the warehouse club, and then went to CVS for candy & shave gel, plus a birthday card, wrapping paper and more candy for my mom's birthday tomorrow.

On my way to my mom's house tomorrow, I need to stop at the grocery store near her for a few more things. Toldya I like to make a lot of smaller trips! The split between today's trip and tomorrow's is due to sales & various store brands I prefer. Neither store was out of the way in my list of errands, so there's not even a time/gas opportunity cost.

Now that I've gotten all of today's "outside" to do items handled, I can kick back and relax. A few more to do's on the list, but those don't require putting my coat on! Hoping everyone has a nice weekend!

Posted in

Uncategorized

|

0 Comments »

March 4th, 2021 at 02:01 pm

Had to pick up a few things from the grocery store yesterday. As mentioned in my previous entry, I have found that going for multiple smaller trips helps me stay a little more focused with what I purchase. It's not uncommon for me to go 2-3 times a week. This started when I lived in the city, and was walking with my groceries. I didn't want to carry lots of heavy bags so I would pick things up as I needed them. I kept it going when I moved into the suburbs, and now prefer it with staying home all the time. Going to the grocery store is my main "going out" haha.

5.99 - Half & Half - I drink a giant cup of tea every day, and use half & half. This is non negotiable lol. I purchase the half gallon container, and will usually buy a new one as soon as I open the old one so I have the backup ready to go.

3.85 - 4 Granny Smith apples - for green smoothies

2.50 - bagged spinach - same as above

2.64 - 4 lemons - same as above

.88 plus tax - a pack of Reese's - while waiting in the checkout line, I decided that my green smoothie had lost appeal for the day and since I had the room in my calorie budget, I could make the swap. Bonus, it was on sale!!!

15.94/37.97 MTD (not including $20 for laundry card refill)

This morning, I was very grateful to receive my first dose of the COVID vaccine. In my state, I am eligible due to an underlying condition - specifically obesity. I am close to not being obese anymore, but still counts! I went to a site about 15 minutes away from my house, and was back home an hour and 15 minutes after leaving. Easy peasy. I go back in 3 weeks for my second dose. It made me feel hope. There is light at the end of this dark tunnel. It's not as close as some people/states think it is, but it's there.

Posted in

Uncategorized

|

3 Comments »

March 3rd, 2021 at 05:51 pm

Joing in LAL's March 2021 Food Challenge! I am single, and generally prep food only for myself (although sometimes I buy food for my mom/sister, for which they reimburse me). I am still working out what my monthly food budget is....right now, based on Jan/Feb data, it looks like I spend about $360 a month on groceries/household/toiletries. That includes laundry card refills, any household supplies and drugstore level toiletries (I also have some higher end stuff but that's pulled out into a separate category so it doesn't skew my grocery category too badly). So maybe $300 on groceries alone? I tend to do most of my grocery shopping at Stop & Shop, but depending on what I need, also make trips to other stores as well as online grocery stores & warehouse club. I tend to shop multiple times a week. Doing it this way ensures that I am only buying what I need for the next few days, rather than stocking up on random stuff and making a plan from what I have - that method always leads to me buying stuff I don't need/use.

Some more context. I work from home. I meal prep everything I consume between Monday morning and Friday afternoon, eating the same thing every day. I don't eat a ton at one time because I have a gastric sleeve which limits my stomach capacity, and I am still actively trying to lose weight (down 85 pounds in 3 years, 15 left to go). Friday/Saturday nights, I either eat a frozen meal, get takeout, or have dinner plans with a friend. Sundays are my free day, I have dinner at my mom's house.

So, 3/1's trip to Stop & Shop:

4.49 - Fairlife milk (I go through a lot of milk, between my breakfast protein smoothie and my nighttime oatmeal)

3.89x2 - 2 frozen Healthy Choice meals. I like to have a couple of frozen dinners on hand for Friday/Saturday nights if I am not getting takeout/don't have dinner plans.

1.44 Red onion for dinner meal prep

3.32 - 2 red peppers for dinner meal prep (this week's dinners are egg white omelettes with sauteed onions & pepper and cheddar, with an English muffin on the side. I eat this fairly often, and purchased a bulk package of carton egg whites last month. After what I used this week, I have enough egg whites for 2 more weeks of this meal prep. I bought the English muffins last week, they were on sale for buy 1 get 2 free. When this happens, I get 3 packs and stash them in the freezer. Cheese is purchased from warehouse club when needed, I still have 2 lbs in the fridge lol.)

5.00 - 2lbs of strawberries (I eat 2 lbs of strawberries every 8 days, so I pretty much always buy strawberries lol)

Total - 22.03 (grocery category technically at 42.03 due to laundry card refill on Monday as well)

A typical weekday looks like this for me: large cup of tea with Splenda, half & half, and fiber supplement...chocolate chia oat protein smoothie...strawberries...string cheese...green smoothie...whatever I've meal prepped for dinners for the week...and DIY instant oatmeal made with milk before bed. A typical weekend day is the tea, two eggs, toast, strawberries, some kind of protein drink, and dinner is planned but random lol.

Posted in

Uncategorized

|

0 Comments »

March 1st, 2021 at 03:13 pm

Wow, it's hard to believe that February is over and that we are now in March, marking a full year of the pandemic here in the States. Wooooof. There's light at the end of the tunnel, but it is still so very far away. If you had asked me a year ago what the next 12 months would be like, I don't think I would have gotten any facet of it correctly. I'm so happy to be out of February though. It's my least favorite month for a lot of reasons, and I am so tired of the winter - come on spring! We are ready for you!

February spending: spendy month (I do not include bills or debt payments in this tracking, this is all the stuff I gotta spend money on on top of those expenses). Across 9 categories, I spent juuuust under $1100.

Car/Gas - $113.57 - this was an oil change and replacement of my wiper blades. I had a coupon from the dealer for a $30 oil change, for the wiper blades, they just charged me for parts and did not charge to install. This ended up cheaper than if I had not gone to the dealer. They did forget to install the rear wiper blade (grrrr), but I will go back next Saturday and they will put it on. They'll give me my next oil change for free for the inconvenience. I only drive about 4k miles per year so this is less attractive of an incentive than it would be for some people, but whatever. They also told me that my tires need to be replaced soon (like, by the summer). While this isn't what I want to hear, but my tires are the originals from the factory, and my car has 60k miles on it (2015 model year, I purchased in 2017 with about 44k miles on it). They quoted $1150 for that, but I can definitely do better elsewhere so I am going to get a few quotes. I do not yet have any money in the auto maintenance fund, so both of these expenditures will need to come out of savings. I'm not thrilled about dipping into my newly replenished savings, but it's better than putting it on a credit card. I have owned this car since July 2017, and in that time, have only done oil changes, replaced wiper blades, rear brake pads and one trip to the body shop (covered by insurance, I just had to pay deductible). I'd say maintenance on this car has cost me maaaaaybe $1200 total since owning it, so I can live with the tires. I will sell the car long before they need to be replaced again.

Clothing - $43.87 This was my online shopping trip earlier in the month. I allotted myself $30 to spend, ordered $52 worth of items but one of them went out of stock before it could be shipped (my dress!!!!! sad face lol). I rarely buy new clothes, and this was funded out of a snowflake as per the rules of 2021's frivolous spending.

Education - $95.40 I wasn't expecting to add this as a category but here we are haha. No complaints about this - it's worth finding extra money in the budget for this, as it will return the investment in spades.

Grocery/Household/Toiletries - $377.43 A touch higher than January, but averaging at $368 for the 2 complete months of the year. This includes toiletries and anything for my household, like refilling my laundry card. Right now I don't see a need to further break it out. It's higher than I thought it would be but maybe if I just counted groceries it would be more in line. Since I eat 99% of my meals at home, I don't have an issue with this.

Miscellaneous - $248.27 this one is a little deceptive. These are the items I purchased to count towards my annual wellness stipend, for which I will be reimbursed at the end of March. March should show a credit in an equal amount for this category.

Office Supplies - $55.42 I wasn't expecting this category to have an amount in it....but I needed to purchase more printer ink last week, and impulsively bought a new roll of shipping tape with a dispenser. March will show a small credit, Staples lost the first shipment of my ink, and in addition to re-shipping it, refunded me $10 of the cost. That has not yet posted, so it'll reflect this month.

Personal Care - $159 I went back and forth on this one. I had set aside this amount (almost to the dollar) for a haircut and pedicure out of my federal refund. But then I ran out of an eyelash serum I really like. Yes, frivolous, but there's so little frivolity in my day today life that I deserve a little bit, especially if it's funded. I decided to push the haircut and pedi off for a few months, and buy the serum. If I hadn't had the funds allocated for it out of the federal refund I would have sucked it up and not purchased. But since I did, I am ok with it going to something else in that category. I've found some extra funds in April for a haircut.

Subscriptions - $2.99 this is my monthly iCloud storage.

Takeout/Entertainment - $2.06 This one is great! I expect March to be higher here as I have dinner plans with a friend in 2 weeks.

Total - $1098.01

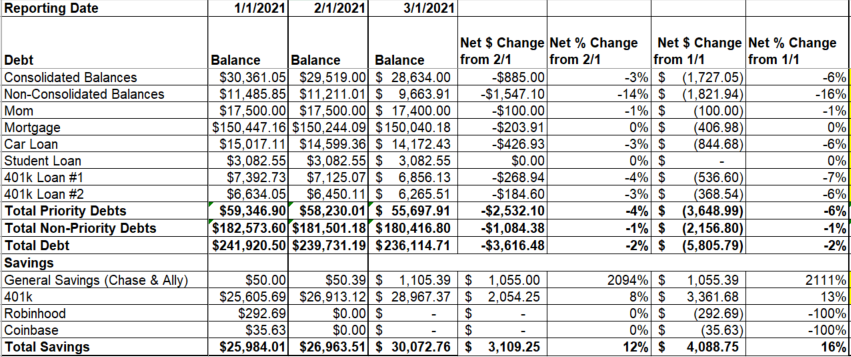

I also completed my February account summary. Pretty happy with my progress in just 2 months so far.

Good progress made on all of my priorities. Between the pending 3rd stimulus, a very small disbursement from my grandfather's estate and a few other snowflakes, I am expecting March to be another good progress month. I'll definitely have to dip into savings to cover a few things (the oil change/wiper blades bill, my mom's birthday, and a few things yet to be identified).....but again, spending from savings is better than putting onto the credit card. This year is going to be the learning/transition year, so I think my savings will not be as healthy at the end of the year as I had hoped it would be. But my debt will continue to go down, and I'll know what I need to budget for next year.

Posted in

Uncategorized

|

3 Comments »

|