|

|

|

|

Home > Archive: February, 2022

|

|

Archive for February, 2022

February 18th, 2022 at 03:57 pm

I have officially started the refinance process. My current mortgage is a 30 year fixed, at 5%, with a balance of just under $147k. I am about 2.5 years into the loan, and my current payment is $830 a month. When I purchased my apartment in 2019, it appraised for $199k, but afterwards, I did a fairly extensive renovation, including completely gutting the kitchen. I am hoping for an appraisal of $220-225k. I would like to take $25k out to pay off a few much higher interest debts, and free up a large amount of cashflow every month.

I submitted an application with a bank nearby yesterday, and had a call this morning with the assistant on their team to discuss. Based on the soft pull, they're offering me a 30 year fixed at 3.875%, no points, and if the new mortgage is $180k (which would require an appraisal of $225k), my closing costs would be $3500-$4000, my monthly payment would be $846, and the cash received upon closing would be $28k. I am completely fine with resetting the term back to 30, as I don't plan to be here for longer than another few years, so paying it down completely is not on my list of goals.

I own a co-op which is a complicated kind of ownership structure, so I can only work with certain banks, it's a different type of mortgage as well. This bank is well versed in them, so I am hopeful that it moves along smoothly. She said their typical time to close is 45-60 days, which I am fine with. Fingers crossed!!!!

Posted in

Uncategorized

|

1 Comments »

February 15th, 2022 at 04:00 pm

Today is payday, and I was pleased to see that the loan I paid off last month has stopped being deducted from my check. I went ahead and increased my 401k contribution from 10% to 15%. Felt pretty momentous, and I'm not gonna lie, scary haha. While this is not quite maxing, it is not far off. To max, I would need to contribute 18% (technically 17.8 lol). I'll obviously get closer after my merit increase in a few months, and then will see how far from maxing I actually am. My next promotion should net quite a large raise, at which time I'd need to actually lower my contribution to keep it stable through the year (I prefer consistency over getting the money into the market a little earlier).

I'm currently trying to balance 3 objectives from a financial standpoint - 1. set aside as much money as I can for taxes blah. 2. pay down the balances I ran up in December/January on the credit cards I had paid off last year. 3. Cash flow a short trip away with a friend - the flight and hotel are already paid for, which are obviously the biggest costs. Now I need to put together spending money. This trip is in 3 weeks, so not a ton of time to do so, but it should be ok. I have a lot of non-budgeted needs for money over the next few months, but I also have a lot of extra money coming in as well.

Next on my list for today: make a few phone calls about refinancing! I am somehow almost caught up on work tasks, and schoolwork is in a good spot. I am in a state of tenuous peace lol.

Posted in

Uncategorized

|

0 Comments »

February 14th, 2022 at 06:36 pm

My therapist let me know at our last session that she is leaving the current practice, and starting her own, and that she will be out of network for all insurance. Sigh. I've had it very good - mental health is exempt from the deductible, and my co-pay was $30. My FSA modeling was all based on this obviously. In the new world, I will be subject to a $1400 deductible, then after that, they will cover 60% of the allowable amount. What's the allowable amount, you ask? Good question, one which my health insurance company cannot answer. It's apparently a proprietary number that the phone reps don't have access to. So the only way I can find out is to file a claim, and see if it comes back on the EOB. Not sure if that detail will be on there before I meet the deductible though.

She will be charging $150 a session. I obviously don't have this built into my budget to pay for up front, so I will be using the FSA to pay for it. By the time I start getting reimbursements, I have a feeling that they'll be somewhere around $20-$30 a session (ouch). My plan was to use as much of the FSA as possible to cover off on extra medical appointments this year related to surgeries (clearances, lots of extra bloodwork, etc)....but I guess that's scuttled. I was also hoping to be able to incorporate medical massage. Oh well. I am glad I have this option.....pre-FSA, I likely would have had to try to find another therapist in-network, and from all I'm hearing that's not an easy proposition these days. I will likely have to change the cadence of my sessions to monthly, rather than bi-weekly. Assuming that I go down to monthly, it looks like I will have about $1000 in the FSA to play with.

In other not-so-fun news, I have kept cracking away at my taxes. I'm still waiting on some forms that could be coming, but as we approach later in Feb, I will probably start to mentally strike them off the list as likely to show up. So these numbers could obviously still change (although it woud be nice if they didn't).....as of right now, it's looking like I owe about $3k. OUCH. I'll be able to pay the state taxes in full, and will have to do a payment plan for federal. The bonus I mentioned in my last entry will come in May. That will all be directed towards this. I also may be receiving a referral bonus if a friend I referred is hired.....this is usually a few thousand dollars. I have no idea what the amount is these days as it keeps changing lol. If she's hired this month, it would come sometime in June (90 days after the new hire starts). So, it should all be fine, but not what I was hoping for the year.

Posted in

Uncategorized

|

0 Comments »

February 4th, 2022 at 06:38 pm

My company has been in the industry news for the past few days. Apparently we blew past our 2021 financial goals, and all of our employees (about 80k worldwide!) are getting a bonus. I don't normally get bonuses, and actually don't think I have ever gotten one, so this is exciting. Upon digging into it, and finally watching the video our CEO sent out the other day, it appears we are each getting a week's salary as a bonus. That's slightly less exciting lol....for me, it's about $2200 after taxes, so not terribly much. However, it is still extra money, that I can definitely use right now.

I got an email from my 401k provider yesterday, stating that they were sending a refund for the overpayment on the loan I just paid off, sent via ACH to my bank account on file. It didn't have an amount specified, but I got a text from my bank this morning that a direct deposit of $148.98 had posted. That's the amount that was deducted from my last paycheck for that loan, so I think I am probably ok to go ahead and increase my 401k contribution percentage......but I'm still gonna wait til the 15th to make sure. I can certainly manage it if there's an overlap but I'd rather not.

Taxes are still chugging along. I have gotten more than half of the documents needed now....sadly, the only ones outstanding are going to send my numbers in the wrong direction. At this point, I will owe both state and federal, thanks to the combination of a lot of debt being cancelled last year as well as earning a few thousand in bank bonuses. Hoping for my total tax bill to be under $2k (guess that bonus will come in handy lol). I obviously won't file/pay until the deadline if I owe, but my taxes should be done long before that so I will have about 2 months to put together the money. Thankfully, it'll be a one time aberration - I am used to receiving a refund and prefer it that way. My paychecks withhold more than enough tax to cover them, it's just these outside of normal pay events that got me. Even though I'm feeling the squeeze right now, having settled the debt saved me far more money than I have to pay in extra taxes, which helps to put in perspective. I'd rather be able to use the bonus and all of the other little dribs and drabs coming in over the next few months to be able to pay down more debt, but I guess I'll hold in favor of the tax payment. All in all, if this tax bill had come last year, I would not have been in such a position, and it would have been a real hardship to pay the bill. So for that I'm grateful. My choices this year are to raid savings or forego debt payoff acceleration. Last year, I would have had to go into more debt to handle it. Progress is always good, and recognizing it is even better.

Posted in

Uncategorized

|

1 Comments »

February 1st, 2022 at 09:55 pm

Hello my SA friends! Hope everyone is surviving January lol. I will say that for the past few years, January has been soooo incredibly stressful and felt about 20 years long....and this year was far less stressful (although I could have done without the blizzard the Northeast got last weekend...). I'm not the biggest fan of February either, but at least it's a short month!

Let's get the painful stuff out of the way - January was a spennnndy month, and I only have myself to blame. As I mentioned in my last entry, I've been going a little nutty buying clothes. Sounds super frivolous, and some of it definitely is, but a lot of it was legitimiate, I refuse to continuing wearing clothing that is not reflective of my hard work, even if most of the time, I am home in workout clothes (my typical work uniform these days),

Key: Category: Jan Spending - context

Car/Gas: $35.78 - this was one gas fill-up, and probably some miscellaneous parking here and there. Most of the towns near me have apps for the meters, so it's easy to track. I would not include this if it were throwing a quarter in the meter. I never have quarters for the meter lol.

Clothing/Accessories: $584.02 - welp. Knew that one was going to be ugly. There will be some returns in Feb to offset this but not enough to make it hurt significantly less lol.

Dining/Entertainment: $344.60 - This is actually better than it looks! There was one pricey dinner out with a friend for her birthday, which is about half. The rest is takeout/delivery, so that's actually a lot lower than usual.

Grocery/Household: $$489.87 - A little over budget here, but I stocked up on some pricey items which made up a good chunk. I won't have to buy my breakfast protein shakes for a few months  Hopefully I can keep it down for Feb. Hopefully I can keep it down for Feb.

Health/Wellness: $64.55 - some vitamins, my monthly Peloton membership, and some new resistance bands. Not bad at all.

Home Decor/Furniture: $387.70 - Some of this was needs - new sheets, etc (and I refuse to buy crappy sheets). The rest was not, lol. Some random decor pieces, an ornament, some candles.

Medical (non-FSA): ($200) - a refund for a consult fee from a plastic surgeon I cancelled my appt with was finally credited.

Miscellaneous: $115.16 - I paid for a credit report and score to see how close I think I am to my goal of initiating the refinance process in March. Score looks good, but I'd like to handle some of the credit card balance that's run up before having them take a look. I can absolutely support the refinance on my DTI, just trying to make everything as attractive as possible. I also donated to a charity for a friend's birthday.

Office Supplies: $126.21 - had to buy printer ink. I had been buying off brand ink from Amazon, but my printer did a firmware update and the cartridges no longer worked. I figured I would try to replace them with the OEM cartridges to see if that did the trick before replacing the whole thing (I would have replaced with the exact same model so the ink would not have been a waste). Thankfully it worked but that was unexpected and annoying.

Personal Care: $526.68 - yowza. Hair appointment was a pricey one this month. Plus there was the tip for the nail salon with Mama. This month should only be the nail salon, I won't be getting my hair done again til March.

Subscriptions: $131.96 - Prime (annual) and iCloud (monthly)

Grand Total: $2606.53

I do not include my FSA spending in this total, since it is not money coming directly out of my pocket, but I am tracking it just to make sure I stay on pace and to identify what the expenditures in this category are. In January, I spent $350.91 in this category. Co-pays for appts and prescriptions, some drugstore purchases, and a purchase for a back wheel set. This was denied, so I returned part of the order, and will reimburse the account for whatever the amount left is once the return finishes processing. It will be offset in Feb, and will come out of the health/wellness category instead. The total including FSA spending is $2957.44. High!

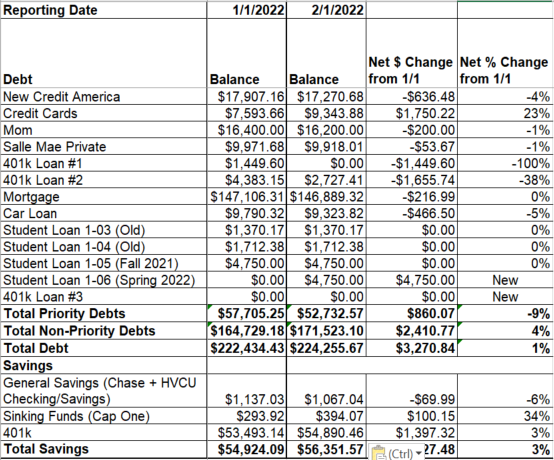

The month end summary of where everything stands is doing ok.

As an overall, debt is up, even with some large pay-downs. That's due to this semester's student loan being added, and not helped by an increase in credit card balances. General savings is down very slightly, sinking funds are up, and so is 401k. This does not include the payment for 401k loan #2 and the contribution from my last paycheck, as it has not yet reflected. It's rthe right direction even if it needs work.

I think my check on Friday had the last payment from 401k loan #1, so once I confirm that on 2/15, I'll increase my 401k contribution to 15%.

I'm still waiting on a bunch more tax documents to finish those, but as of right now, it looks like I owe money, due to the cancellation of debt from the settled accounts last year. Bummer but it's not a huge amount, and could still turn around as some of the deductions have not yet been inputted, waiting on that info from my building's accountant. Still holding out hope for a refund. I'd love to get back on the downward trend debt wise by the end of this quarter.

Posted in

Uncategorized

|

0 Comments »

|

Hopefully I can keep it down for Feb.

Hopefully I can keep it down for Feb.