I keep thinking to myself that I should write an entry, then I decide I don't have anything interesting to write about. But then I go to do one of these entries and realize I have too many topics haha. Oh well, I'm wordy sometimes.

August Spending:

Hopefully this month is the last month that spending is this high (she says naively....). Actually I know that's false, I am going to be ordering an expensive piece of workout equipment this month, just waiting for some checks with extra funds to arrive to cover it. But hopefully that's the only out of the ordinary spending.

Rather than going category by category...my total spending for the month was $3,074.36, and my YTD spending is $15,323.63. I do not include bills in my spending, I have minimal control over these in the short term so they're pretty static. My categories are Alcohol, Car/Gas, Clothing, Dining/Entertainment, Education, Gifts, Grocery/Household/Toiletries, Medical, Miscellaneous, Office Supplies, Personal Care, Pet, Subscriptions, and Travel.

My highest category is usually grocery, and this month was no different. Personal care was also pretty high, as I had a pricey hair appointment, and also stocked up on some of my expensive hair products while I was at the salon. Dining/entertainment was also pretty high, but that included a few different outings. I was on vacation at the start of the month, and had a friend come to town, so we were out and about. Looking forward to September being a boring, quiet month.

August Summary:

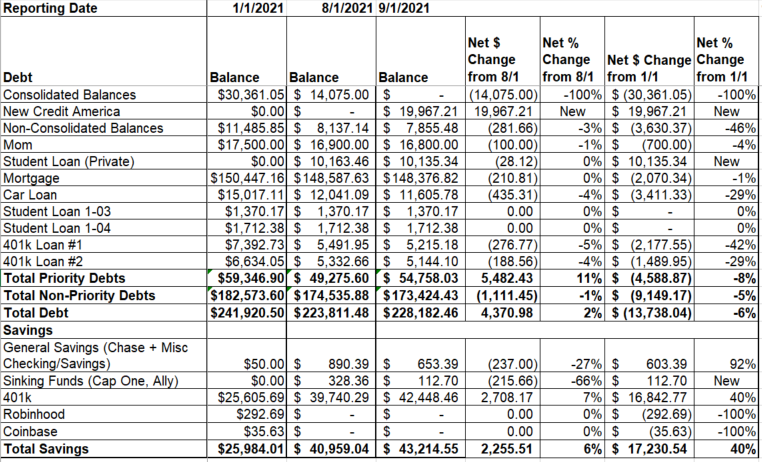

There was lots of action this month, what with transferrring the consolidated balances to a new personal loan. I went back and looked at July's summary entry, and not sure what happened with the screenshot in that one, but oh well.

Everything is still going in the right direction, and should continue to do so for the rest of the year.

I have some big chunks of money coming in September that will (mostly) go directly to debt. I received my first tuition reimbursement check yesterday, and although it was incorrect and needs to be fixed (it was taxed and should not have been), once that is resolved, it will be sent in full to 401k loan 1. Still waiting on a rebate check from the state for what every other state calls a homestead exemption, my state calls it the STAR rebate. That should have been received already, so I am going to have to call them next week if it doesn't come this week. That's going to be split between savings and non consolidated credit cards. There are a few more things coming, but not sure when. Everything has been asigned a purpose!

I'm really looking forward to seeing where I'm at in 2022 and beyond. 2022 is going to be very focused on continuing to pay down this new personal loan, my private student loan, and the remaining 401k loan (in prep for taking another to fund surgery midyear). I would also like to see about refinancing my mortgage, but I need my liquid savings to increase before then, and my credit score to go up. 2023 will depend on what happens in 2022, haha, but should be more of the same, with contuining to attack the non-mortgage debt. My car also gets paid off that year, and I will hopefully be able to start throwing a lot of money into a new down payment fund (fingers crossed for another promotion that comes with a sizeable raise by then!)

My goal is to, by the end of 2024, be in a position to buy a new home. To do that, I will need my debt to be as low as it can be considering that I will still have a mortgage and student loans....I need to have saved $50k or so.....and my credit score needs to have returned back to at least good lol. Not sure if I will be trying to do a bridge loan for the remaining down payment or what. I'm looking in the $500-$550 range. Once I sell my current home, any net proceeds I receive will be likely sent as a lump sum to the new mortgage, and I'll either recast it or refinance, depending on the numbers.