|

|

|

|

Home > Archive: November, 2021

|

|

Archive for November, 2021

November 19th, 2021 at 03:28 pm

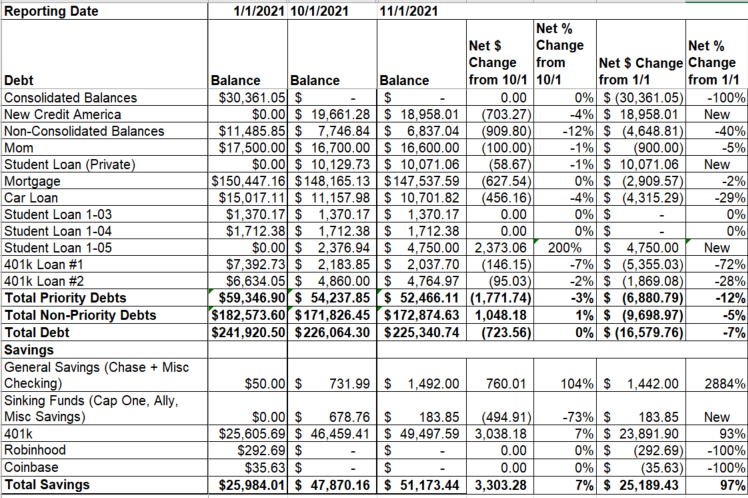

My contribution/loan payments from the 11/15 paycheck have posted, and I am happy to report that I have achieved a 102% increase in my 401k balance since 1/1. Wooooo! My overall savings increase from 1/1 (including general savings, sinking funds, and 401k) has increased 106% since 1/1. This is exactly the kind of thing I have been striving for - onward and upward! Can't wait to see what 2022 brings in this arena.

Posted in

Uncategorized

|

3 Comments »

November 16th, 2021 at 09:20 pm

A few months ago, upon the 2 year anniversary of initiating my internet service, I noticed that my bill had gone up, due to some of the discounts on the account falling off. I contacted them, and arranged for a new plan (that wasn't very different from my old plan). My new bill was supposed to be $64.99 a month after an autopay/paperless billing discount that I have always had.

Since I was changing my plan, they told me I was eligible for a trial of a service for 30 days. It is not a service I am interested in, so I told them to not even add the trial and I did not want it at all. They said that as long as I didn't activate the trial, then it would not convert to a paid selection. Well, clearly that was a lie.

I got the text this morning that my new bill was ready and it was for NINETY FIVE DOLLARS!!! A full $30 more than it should have been. When I logged in and looked at the bill detail, they had not only charged me for the service I said from the beginning I didn't want ($20) plus removed my autopay discount ($10).

It's usually easiest to chat with them via their app, but it was very glitchy today - I got kicked out of the chat twice, and had to start over, then I finally got mad and called them. I hate having to make phone calls, but in this case, it was the right thing. After about an hour, I was able to have credits applied for the service AND the missed discount, have the service removed from my account, and have the discount re-applied. The majority of the credits have been manually applied to the current bill, so now my autopay for this one will be $72, and then there will be another separate automatic credit on my December bill.

A good reminder to keep an eye on your automated bills and make sure you're not being charged for services you didn't sign up for!!!

Posted in

Uncategorized

|

1 Comments »

November 9th, 2021 at 04:59 pm

Since I spent some time yesterday with open enrollment, I decided to do a little take-home pay modeling for 2022 this morning. Mostly because I don't feel like doing the stuff on my actual work to do list, lol.

Some up front things of note - I built out a projected 2022 budget a few weeks/months ago. I increased my AutoSave, I increased the amount to "the Mom Loan", I added a few additional sinking funds on a monthly basis, and I adjusted the extra funds I am sending to the NCA loan (paying additional $$ every pay check). This assumes no revolving credit card debt, but since I am def not going to be paying my big card off before the end of the year, I need to make some adjustments there. It will likely be at the cost of the extra payments to the NCA loan but TBD. I had also originally modeled in $$ every pay check to fund a Roth IRA, but since I'm pretty sure I am going to be income limited out of that, and I still have space to max my 401k, I decided to put it there instead.

The calculator I like to use is Paycheck City's....it gets pretty close, although never exact. I modeled a bunch of different steps:

First, change to my takehome pay accounting for the increase to current benefits along with fully funding FSA. This is a difference from current take home of about $40 less. That's ok, because the FSA will cover a $30 line item budgeted for in every pay period, so I am almost net neutral there.

Then, I calculated my take home pay once 401k loan 1 is paid off (which should be mid-January to end of January, exact timing TBD based on how quickly the tuition reimbursement from the fall semester is processed). This is a big jump....about $150 a check. Once that's paid off, I'll be increasing my 401k % to 15% of my salary. This takes me back to down to the same ballpark as what take home was prior to the loan being paid off, but is only a few thousand off from maxing 401k.

Next I modeled what things could look like after my COL increase (we generally get these in April/May, 2020/2021 notwithstanding, and traditionally, they are between 3-5%). I used 4%, and that was a surprisingly large jump, almost another $100 in take home.

Then (lol) I modeled what it could look like at the increased pay, 15% 401k contribution, and current 401k loan 2 paid off. This is slated to be paid off mid-June, again depending on how quickly tuition reimbursement is processed. Could be sooner depending on how stuff shakes out. At this point, take home should be around $200 higher than it currently is, but with no 401k loans, fully funding an FSA, and an increase in 401k contributions of 5%. That's kinda huge!

And then finally, I modeled what it would look like once I take the 401k loan I am planning for next year to pay for surgery...I don't really know what the interest rate would be (I am unable to model it directly with my 401k provider since I am not currently eligible for another loan), so I just used the interest rate from 401k loan 2, since it's the most recent. I chose a term of 4 years, but may shift that in either direction depending on where I'm at by then. This take home brought me down to about $160 less than my current take home is, but includes a lot more stuff, so I am feeling ok about that. There's enough flexibility in my budget to be able to accomodate this, plus since I am planning on refinancing my mortgage next year as well, that impacts some of the fixed outlays as well.

Overall I'm feeling really good about where things will stand for next year, financially. I'll finally be contributing 15% of my own money to retirement, will be on my way to debt free, and can accomodate all the things I want to do within my budget. If I get a promotion next year that puts me into the salary range I think it will....then I don't even need to adjust 401k up anymore, as that salary level at 15% maxes.

Posted in

Uncategorized

|

2 Comments »

November 8th, 2021 at 04:40 pm

This morning, I am going through the 2022 benefits guide put out by my company (I've become the de facto housekeeping/culture/HR person on my team haha, so I was adding some info to slides for our monthly meeting tomorrow).

I was surprised (in a good way) to realize that by the time I need to take short term disability for my surgery (or surgeries, which is yet TBD), I will be eligible for 26 weeks at full pay. It really doesn't make a difference, as I was already eligible for 20 weeks, and I wouldn't need nearly that much time (if I do one round, I will take 3 months. If I do two rounds, I will take 2 months for first, and 1 month for second). But it's nice to know!

Whenever someone asks me what my 401k match is, I can never remember. Documenting here....100% match on first 3% contributed, and 50% on next 2%. I started out contributing 8% (I think) when I joined 4.5 years ago, so I have always gotten max match. I am currently at 10%, but will be bumping up to 12-13% at the start of the new year. I'll update my election sometime in December, not sure how many pay periods it will take to kick in. They match on a per pay period basis, but they do an annual true up in the first quarter as long as you are employed on Dec 31, which answers some questions as I will be able to max in the next year or two, but it's challenging to get it right on the mark in 24 pay periods. Now I can rest assured that if the percentage I elect causes me to max early, I will still get my full match. It looks like, at my current salary, 18% brings me a few hundred over the 2022 max of $20,500 (I can only elect in whole percentages, not dollars). Have a little more digging to do but since I won't be maxing for a few years unless I get that next big promo and the salary is where I'm anticipating....I have time  I'm still not sure I understand true up provisions but that'll be a Google rabbit hole for another day. I'm still not sure I understand true up provisions but that'll be a Google rabbit hole for another day.

I'm electing into an FSA for the first time. I'm going to max it, as I do have a lot of eligible expenses thrughout the year. I'll have to keep an eye on it, to make sure I don't end up with a lot left in December, because that would be a waste. But I did see that massage is eligible as long as you have a prescription, so that's helpful haha. I'm not worried about spending it all, though.

Pre-pandemic, I was also contributing $270 a month to my transit spending account. My monthly train ticket was $246, plus I paid $2.75 each way for the subway once I got off my commuter train. I don't believe I ever had to pay out of pocket for transit, but I moved to my suburb about 5 months prior to everything shutting down, so don't have long term data. Once we got sent home, I reduced my contribution to $5 a paycheck, just to keep the account active. I don't think we actually need to make a contribution to stay active at this point, but I don't notice $5 a check. At current time, my account has almost $600 in it....I have gone to my local office 3 times, and our Philadelphia office once. I used to drive to Philly, but took the train when I went since I could just buy the train ticket from this account. I can go to the NYC office 33 more times with the current balance in the account haha. We are not discussing returning to the office until January, and even at that, I don't think I will be in more than once every two weeks at a maximum. I'm likely to be in Philly more often based on who I work with. As time moves on, I will revisit upping this back to where it was, but for now, it covers my needs. I think I forfeit any remaining balance if I leave my company, so don't want to build it up to a level where I can't reasonably spend it.

There will be a slight increase to medical and dental options in 2022. On our enrollment site, I'm not sure if the cost per pay period (medical, dental, FSA and transit) reflects the increase, but as of right now, it's showing $232.11 per pay period (semi-monthly, 24 pay periods per year).

There will be a lot of changes to my net pay in January, so I'll just add this to the list.

Posted in

Uncategorized

|

0 Comments »

November 2nd, 2021 at 04:32 pm

Spending:

Category - Oct Spending/YTD Spending: Context. I do not include any bills in my spending, as I do not have the ability to adjust them in the short term, this is all discretionary spending.

Alcohol - 0/$279.80: I don't think I am going to keep this as a separate category for next year - I clearly don't spend a lot of money here, on a regular basis. I'm ok with it skewing my grocery category in the instances that I do buy something.

Car/Gas - $2.15/$474.04: just some parking meters this month. I do need to get gas this weekend though, I am down just under a quarter of a tank.

Clothing - $86.92/$1518.91: I'm still pretty pleased with where this category is, even though I've loosened the rules I placed on myself at the start of the year. As I continue losing wieight, I need to replace clothing. As long as I do so in an economical way, and not at the expense of paying bills or making progress on debt, then I am fine with it. I am not willing to live below my standards to pay my debt.

Dining/Entertainment - $190.66/$1979.13: this, however, is a category that needs to calm down lol. This is sadly only on meal out, plus a Kindle book (entertainment)....the rest is delivery which is always overpriced and not nearly worth it. I meal prep like a champ, and so when I am giving myself a break of a meal, sometimes it goes too far. Need to find a happy medium here.

Education - 0/$1022.59: I'll never be mad at this category! This accounts for any out of pocket costs I incur in the pursuit of my degree, that are not covered by student loans. Not so bad for the progress I've made so far this year. I expect next year and 2023 to be far less, since I won't be paying for the credit by exam study resources, and most of my classes seem to be using free resources as texts. 65% of the YTD amount also includes a laptop and associated software that will not need replacing through the course of my degree.

Gifts - $27.36/$574.50: split a condolence/housewarming plant with my best friend for my other best friend, when she had to put her cat to sleep as she was moving back into her newly renovated apartment. I'm expecting this category to jump a bit as I do holiday shopping, I only buy for my mom and brother/sister.

Grocery/Household/Toiletries - $614.16/$5391.52: always a big one. Still a little higher than I would like, but there are also a lot of sub-categories wrapped into here. I either need to adjust my expectations for 2022 or start getting more granular.

Medical - $343.78/$965.23: this includes a few co-pays, a few prescription refills, and the bulk of it is a consult fee I needed to pre-pay for a plastic surgeon I am hoping to work with. If I decide to go with him (won't know til next year), the $200 gets credited towards my procedures. If I decide to cancel before the consult (currently scheduled for July, but seriously hoping that gets moved up to February!), then the fee will be refunded.

Miscellaneous - $31.72/$585.65: this was a table top Christmas tree from Traget and an electronic greeting card for one of my direct reports on her birthday.

Office Supplies - 0/$106.92: still holding strong on ink and such. I think this is pretty good considering I work from home, am a full time student, and print a lot of stuff.

Personal Care - $567.52/$2005.21: this was a bigger month - hair appointment for color which is pricey, a mani/pedi with Mama and it was my turn to pay, and I had another pre-piad appointment for which I gave a cash tip. On top of that, I got a piercing, and bought some jewelry for other piercings at the same time, and didn't feel like separating that out.

Pet - $101.42/$1036.39: same ole same ole. Food, litter, toys. I haven't started dipping into the pet sinking fund for anything yet, I am hoping to be able to cash flow their daily needs, and keep the sinking fund set aside for vet bills as they come up.

Subscriptions - $12.98/$339.32: easy month here. Just my monthly iCloud, and a DashPass, which saves me money, a fairly significant amount, on DoorDash orders. I need to cut those down and then I will re-evaluate if I want to keep this.

Travel - ($95.68)/$2206.69: back in July when I went to Chicago for a long weekend, I got an offer to upgrade on one of my flights to first class for $95.68. I said yes, I paid for it, and the charge never posted. While I am completely willing to pay for it should they come looking, I've done my part here haha. So I reversed the charge from my spending, since at this point, I have not incurred it.

Grand Total - $1882.99/$18485.90: this month was a middle of the road month as far as totals go. This is the first year I've ever tracked spending like this, and I find it so helpful. I'll be interested to see where I finish the year out.

Summary:

As per usual, this does not include the 401k contribution/loan payments from my last paycheck of the month. Since I am a day behind in writing this post, was hoping they'd have posted by now, but no luck.

Debt continues to go down. Savings continue to go up. I've re-grouped my savings accounts (again), as I consolidated down to far fewer accounts now that I am done with bank account bonuses for the year. The sinking funds are lower than last month, because I made a large purchase yesterday that I've been saving up for. But in the same breath, I received the check for my school tax rebate, and was able to send a good chunk of it to savings. I'll likely need to dip into that before the end of the year to get new tires, but I've known about that for a while now, so it's not a surprise. I'm getting really close to the 401k hitting 100% growth this year (in fact, should happen whenever the stuff from Friday's check posts!) 401k loan #1 should be paid off right after the start of the new year (depending on how quickly I get my tuition reimbursement for the fall semester), and that'll also be a good start on loan #2. I plan to start trying to refnance my mortgage in March or so, taking enough out to pay off the New Credit America loan. I am not planning on having this mortgage for more than another 2 years so I am comfortable with that. This will free up a lot of cash flow every month to deal with plastics, tackling the rest of my debt, and starting to save for my next down payment. Everything really feels like it's come together from where I started the year, and I couldn't be more pleased.

Posted in

Uncategorized

|

0 Comments »

|

I'm still not sure I understand true up provisions but that'll be a Google rabbit hole for another day.

I'm still not sure I understand true up provisions but that'll be a Google rabbit hole for another day.