|

|

|

|

Home > Archive: October, 2021

|

|

Archive for October, 2021

October 29th, 2021 at 05:55 pm

Ahead of my usual month end post, I decided to go ahead and post a bit of a mish mosh of updates, so I don't make that post overly long. Of course, that means this one will be instead lol.

Today is payday, and so even though I am off, I am sitting at the work computer to get bills paid. I've been checking emails as they come in, just because the new message notification bugs me.

An email came in from the head of HR, stating that our wellness stipend for this year is being increased from $250 to $500. There was some other stuff about expanded guidelines for what is eligible, but those didn't impact me, so I didn't pay much attention haha. I already claimed the initial $250 back in February (I purchased a smartwatch), so I now have another $250 to play with. We have until November 15 to submit to receive reimbursement by the end of the year. Conveniently, this coming Monday, I am making a large wellness purchase - our new benefit for a fancy spin bike starting with a P begins, and I am ordering one. Our discounted price for the model I am ordering is $1145 plus tax (estimating around $1250 total). I have been saving my pennies for this, and have the full amount put aside, so no need for financing. Well, this bit of news reduces my effective price to $895 before tax. That's not so shabby at all. And since I have the money set aside already, when the reimbursement comes in, I can put it towards whatever I choose. It'll likely be put towards the big credit card that I'm trying to get paid down.

Next piece of good news, I checked the status of my STAR rebate while I was on this computer, and a check has been issued for me, so I should be receiving that next week, depending on how long the mail takes. Last year I received $2100-something. This year's is $1930 and change. That will be split between savings, the big credit card, and the remaining balance on the little credit card.

My mother and I went to get our COVID boosters last night. Other than getting tired very early, and going to sleep pretty early, I feel completely fine. My arm is a bit sore but that's to be expected. I pre-emptively took today off just in case I felt poorly, but I'm not mad about having a day off either way! While we were in CVS, I did a bit of shopping, and had a lot of deals stacked on my card. My subtotal came to $105, and after all of my deals were applied, I paid $21. That's pretty impressive, even for me. Out of that haul, I got a new heating pad that's very nice, a year's supply of allergy meds, and a few other things. I also got another $5 in ExtraBucks to spend, so I'll probably save that for when my CarePass is issued in November, and put it all together to stack some more deals.

School is going very well - I am coming up on about 6 weeks left in the semester. In the first half of the semester I was taking 2 classes for popular software programs, they have ended, and now I am taking another half semester class for another software program. These are programs I use daily at work and have for years, so I basically just need to do the assignments, and I will easily pass the course - actual grades are not given for these, they are either S (satisfactory) or U (unsatisfactory). For the 2 completed classes, I could have not submitted the 3 last assignments and stil passed haha. I still have As in my 3 major classes (anthropology, algebra and stats). The rest of the coursework is laid out for anthro and stats for the rest of the semester, so if I were feeling really ambitious, I could complete most of that work early and not have to worry about it. The work for algebra is released weekly, so I can't do this in advance, but overall, I'm feeling great about my progress.

In two weeks, I can start re-taking the 3 CLEP exams I did not pass over the summer. I am planning to use different study resources. The econmics exams were very close to passing scores, so hopefully this gets me close enough to pass this time. I was a bit lower on the accounting exam, so if I don't pass that one, I will just take the class in the next few semesters. Either way, I will be getting reimbursement of the $90 in test administration fees refunded as soon as I submit my scores.

I ultimately decided to extend my school roadmap out an additional semester. I am feeling very burnt out right about now - between taking 15 credits, having a very busy season at work, pushing hard on my weight loss journey, getting myself into a more optimal financial position.....I'm TIRED. If I extend another semester, that allows me to take a lighter load this spring, plus allows me to claim another semester's worth of tuition reimbursement. It means I'll obtain my degree in August or December 2023....which really does not matter, I am not looking at any deadlines to complete except those that are self imposed haha. I think this tweak to the plan is better for my overall mental health. I still do have timing for a semester off built in there, depending on when I am able to get in for plastics. If I don't need to take a major semester off, and instead can have surgery in the summer, then it may end up being faster anyway.

I think that's enough babbling for now....I'll be back on Monday with my October summary!

Posted in

Uncategorized

|

0 Comments »

October 14th, 2021 at 03:25 pm

At this point, I do not have any IRAs. Whenever I have left jobs in the past, I took the distribution from my 401k (unfortunate but needed). Now that I am in a much better position, I am able to start contributing to an IRA in 2022. My income is above the level for tax deductability for traditional, and within a few years, above the level to be eligible to contribute directly to Roth. My salary is $115k, and my next promotion (expected sometime next year hopefully), should put me around $140k. My MAGI will still be under at that level, but don't think it'll be for more than a few years.

What I was planning to do: starting in 2022, contribute directly to a Roth. I believe I will be able to max it out or close. Once my income went over the limit, contribute to a traditional and convert via backdoor to Roth. Since all of my current projected retirement income is taxable, I liked the idea of diversifying a little bit. At current, I am projecting to have 401k, Social Security, and eventually taxable investments. Adding the Roth at this age won't make a huge difference, and I have zero idea what my tax bracket will be in retirement.

Now that there's a proposal to eliminate the ability to back door Roth, I'm wondering if there's even a point to opening one if I can only contribute for a few years. I could instead increase my 401k contribution to max (currently at 10%, maxing at my current salary would be 17%, which I can probably get close to). Once that is maxed, I could/would direct any additional retirement savings to a traditional. Once I receive my next promotion, I should be able to max both 401k and an IRA. Not sure if since I am over the income limit to deduct my IRA contributions, they are therefore not taxable in retirement, but I need to do more reading on that.

So, that's where I am confused - what say ye, good friends of Saving Advice? Should I just skip the Roth and focus on maxing 401k then spill excess into Traditional?

Posted in

Uncategorized

|

7 Comments »

October 11th, 2021 at 04:36 pm

I received my final bank account bonus of the year over the weekend, and it was a whopper. $750 from a local credit union for opening an account, having $2,000 of direct deposits in the first 60 days, and having $2,000 of debit card spend in that same time period. Easy peasy.

This makes a total of $3,000 for the year in bank account bonuses! Crazy. They were incredibly helpful to me at the start of the year as I really tried to cut spending to essentials only. There are a few more that I am eligible for, but I don't feel like doing any more right now. Trying to simplify down for a few months. My credit score has improved more rapidly than I expected (yay!), so I think I'll likely try for a mortgage refinance around March or so. It'll be easier if I have a few full months of streamlined bank statements showing paycheck deposits. I may dabble a little bit next year after completing the refinance but it's not a huge priority.

If you're at all interested in how I managed to get this many bank account bonuses, happy to share my techniques. Basically you need the ability to manage your own direct deposit (and have it split into multiple accounts), and have the ability to stay hyper organized with dates and requirements. Spreadsheets help (of course, I am always going to say that lol)!!!!

Posted in

Uncategorized

|

1 Comments »

October 2nd, 2021 at 03:28 pm

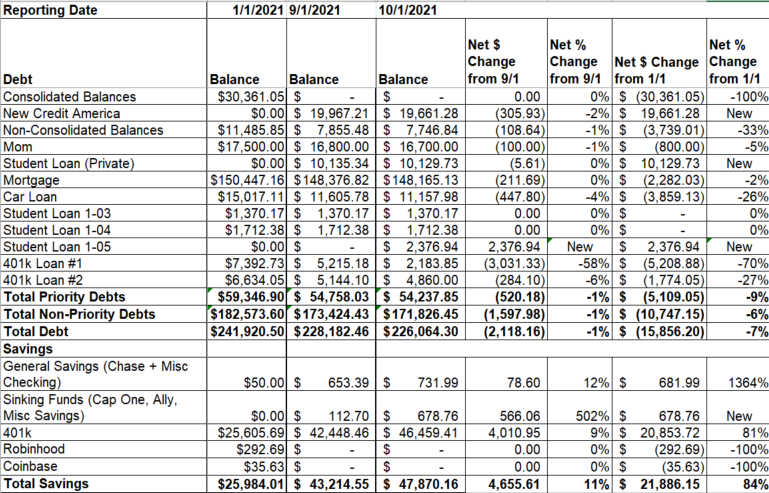

Below is the screenshot of where my finances stand as of yesterday, 10/1. This table compares 10/1 numbers to both 9/1 and to 1/1, I like to look at both to see what progress I've made over the past month, as as well as over the year so far.

Usually, this summary does not yet reflect my end of month 401k contribution/loan payments, but they seem to have processed those faster than usual this month, so they're reflected. It does not reflect an additional payment I made to the new personal loan (New Credit America). I made a payment of $200 yesterday and it's not showing on their site yet, nor has it been deducted from my bank account.

Everything is still chugging along nicely, while I wish I could say that some of those debt numbers were going down faster month over month, I've still made remarkable progress in so many areas, especially those that I deemed priorities. I was a bit pensive when thinking about the debt I had added this year, but when I look at this sheet, I see that in actuality, I moved one debt to a new account, which is not new debt even though it looks like it is.....and then I added some student loan debt, which I don't consider bad debt at all. Student loan 1-05, the federal loan to cover the Fall semester, will have the second half of the semester's disbursement added to it sometime in the next month or two, so that will go up, but other than that, debt should continue to go down. I'm thrilled with this.

And then savings. Woweeeee look at savings! Yes, I still have far too little savings, but looking at where I started the year, this is impressive. I'm hoping to get that 401k increase to 100% by the end of the year....based on just contributions and loan repyaments alone, I will exceed that, but obviously changes in the market can impact as well. While I don't track my net worth here monthly, I do track it elsewhere in my massive budget file. Making some conservative assumptions about the value of my home and my car, it appears that my net worth has increased 257% this year.

So, now that we are stepping our toes into Q4, it's time for another check-in on where I am tracking vs the goals I set for myself in January.

Consolidated Balances: At the start of the year, the consolidated accounts left to be settled were 9 of the original 12, with a total balance left to settle of just over $30k. The goal was to stay the course and hope that the balance was around to around $20k by the end of the year. At the end of last quarter, I was down to 3 accounts left to be settled with a total balance of just over $14k. This was not the total amount left to pay, but when I began tracking it, I didn't set it up that way, and mentioned something about having to switch. Well, this goal is technically met. All of my accounts have officially been settled, and the balances remaining have been transferred to a new personal loan with a total balance of just under $20k. This forced the transition in tracking, and this has become #1 on the priority list. My hope for next year is to be able to do a cash out refinance to pay this loan off....while it's still just moving money around for the time being, it'll make the interest rate so much lower than this loan happens to be. Either way, hoping to not have this loan for too long.

Non-Consolidated Balances: These are credit cards that did not go into the debt settlement program. At the start of the year, I had 5 accounts with balances, with a total of around $11k. The goal was to pay 3 off by the end of the year, with a total balance remaining of around $5k. A sub-goal of this was to bring my main card down to 75% utilization. At mid-year, I had paid off 1 account completely, with a total balance of $9.4k. As of today, 3 accounts have balances (total of $7.7k) and two are paid off. The one with the smallest balance will be paid off within a few weeks once my last bank account bonuses for the year come in, and I am hoping my property tax rebate gets processed soon as well, as I am planning on sending a big chunk of that to the big card. Right now, I am projecting to be at 2 accounts with balances (total of $2.7k), main card down to 22% utilization, at the end of the year. The other card is a furniture store on a fixed rate promo, and I don't see any reason to speed this one up while I have bigger fish to fry. I pay more than the minimum, and it will be paid off before the promo rate expires, so no need to worry about retro interest hitting me. I'm going to consider this one still way ahead of track!

Mom Debt: The goal was just to begin repayment on this. I have made 8 payments to her thus far, it is a part of my budget, and will remain so. Next year, I will increase the amount I repay, and then again in 2023. This one is good!

Non-Priority Debts: These include my mortgage, car loan, 401k loans, and federal student loans. The goal here was to just continue servicing as scheduled, without accelerating any of the payoffs. Since the start of the year, I've added 2 new student loans, and shifted 401k loans to priority status, using the tuition reimbursement payments I receive from work to tackle those. Next year, I will move my chart around to reflect their change in priority status. I didn't really go into much detail at midyear, since the plan hadn't shifted then yet, but this was on track then, and I would say way ahead of the original goal at this point, since one of the 401k loans is going to be paid off in January (over a year earlier than originally planned), and the other will be paid off around June (about a year and a half earlier than originally planned).

Grow savings: I started the year with just $50 in cash savings, and the goal was to finish the year with around $2k in cash savings. At midyear, I apparently had around $2200 in cash savings. As of today, I am at around $1400, not including the extra buffer in the checking account I use to pay my mortgage (which is about $600). I'm going to start including this next year! So as of today, I am on track, with some larger payments hopefully coming in through the next few months in addition to regular additions to this. There are probably a few large purchases that will be coming out of savings as well, but that's what it's there for, and I've been planning for them, bumping savings up. Still work to do here, but technically on track with the goal. Next year's savings goals will be a bit more aggressive.

Bump retirement savings: I started the year contributing 10% (not including match), and was hoping to bump this to 12% by the end of the year. My promotion midyear did increase the $ amount going into my 401k, even if I did not bump the %. I ultimately decided to shift strategies a little bit, and fully fund a Roth IRA before increasing 401k, to try to diversify my accounts in retirement. I built out a plan, based on current salary/take home to fund a Roth about 75% next year, and 100% in 2023. Obviously, if I am able to pay debt down faster, freeing that money up AND/OR my take home changes, I can also add to that. BUT, the new wrinkle is that the legislature currently being debated removes the loophole for back door Roth, you may not contribute after-tax dollars to a Roth if you exceed income limits. While I don't exceed them just yet, my next promotion will bump me out of eligibility. So since I am not contributing yet, I am taking a wait and see attitude. I'm not sure if there's a benefit to contributing to a tIRA before maxing my 401k since they have the same tax treatment (except 401k reduces taxable income, and I am not eligible to deduct my tIRA contribution). Extra money for retirement is scheduled in the budget either way starting next year, I just haven't decided yet what kind of account it will go into. This goal is on track, even if it's just the spirit of the goal.

Investments: The initial goal was to increase my small balances in robo-investing accounts as able, without any set $ amounts. Ultimately, back in February, I decided that I am not in a position to start investing in taxable space yet, and need to focus on debt, cash savings and retirement first. I cleared these accounts out, and have no plans to begin this type of investing again for a few years. Goal removed.

Get promoted (financial goal as well as personal goal): BOOM. Got my promotion effective July 1, with a huge salary increase as well. Definitely had a little too much fun celebrating, but now back to being focused. Starting to work towards the next one, which is truthfully the level I have been working at. I'm hoping for next summer for that one. GOAL COMPLETED.

Other non-financial goals: Stay focused on weight loss journey - no measurable goal set, but after a big curveball thrown my way in the spring with a thyroid freakout, I am back on track and hooooope to meet this goal by the end of the year? But weight loss is never linear, o if the scale doesn't not give me that good news, but I have been putting in the effort, then I will consider this one achieved. Start taking steps for plastic surgery post weight loss - I definitely achieved the "starting" aspect of this goal, I met with several surgeons, thought I had selected one, but now am reconsidering since I really want to try to go with the surgeon whose work I have been admiring for years. A plan for funding is in place, timing is TBD (I have to get on this magic surgeon's consult schedule before I can figure out timing), a plan to rearrange classes/semesters if I need to based on his surgery schedule is in place. Now I just need his patient coordinator to call me back haha.

One goal that was not on the plan at the start of the year - go back to school. It was something I always wanted to do, but since my company did not at the time offer tuition reimbursement, it wasn't something I wanted badly enough to actually pay for it myself lol. They announced the benefit on Feb 1, and by Feb 18, I was enrolled in an online degree program. I officially started June 1, and by the end of the year, will have earned 44 credits since June (assuming I don't bomb my classes this semester, which I don't think we are in any danger of lol). I have a 4.0 average, on top of a very demanding job which is currently in its busiest season. I guess you could say I'm doing okay at this goal.

My overall assessment of how I am tracking against my goals.....(recycling mid-year's rating here): KILLIN' IT.

Posted in

Uncategorized

|

2 Comments »

October 1st, 2021 at 05:48 pm

This month, I am splitting my spending summary and the month end "where am I" summary into two separate post - mostly because some payments weren't made until today and won't post til tomorrow, but they're technically part of September, so I wanna count them. Plus, since as we flip to the next quarter, I wanted to take stock of where I am tracking against my goals for the year, and that always turns into a longer entry!

Last month I was lazy, and didn't detail out my spending by category for the month. It was a combination of lazy and also horrified at how high some of them were....silly, I know. This month we are back in a "normal" range after the crazy of the summer, so I'll go back to detailing.

As always, spending does not include my bills - this is discretionary spending. I have less control over bills than I do the categories covered here.

Category: September Spending/YTD Spending - context

Alcohol: $0/$279.80 - another month without anything in this category. My previous wine collecting self giggles everytime I see this. Guess it's another good example of how we are constantly evoloving. For a few years, I was an avid wine collector, now I have no interest lol.

Car/Gas: $64.24/$471.89 - got gas, my toll tag did an automatic refill after I picked my mother up from the airport, and a few credit card enabled parking meters.

Clothing: $219.10/$1431.99 - creeping up but still not awful.

Dining/Entertainment: $147.83/$1788.47 - much lower than it was the past few months. I'm confortable with this level, this was all takeout, no actual meals out here.

Education: ($150)/$1022.59 - I received reimbursement for a bunch of test fees this month. Considering how much progress I've made this year toward my degree, I am not mad at $1k out of pocket! This obviously doesn't include any tuition/loans etc. Tuition is completely covered by loans so I don't pay for it upfront out of pocket. Loans are considered part of bills, which are not captured in my spending.

Gifts: $0/$547.14 - nothing this month.

Grocery/Household/Toiletries: $468.24/$4777.36 - way better this month. I budget $400 a month for this category, so glad to see I am closer to that. Next year, I will probably bump it to $450. This includes any groceries, drugstore level toiletries, laundry card refills or cleaning supplies. This year I have also been including home decor and furniture, next year there will be a separate category for that.

Medical: $84.99/$621.45 - two appointment co-pays and a prescription refill. I'm thankful to have very good medical coverage, I see a lot of specialists, so it comes in handy!

Miscellaneous: $197.49/$553.93 - this includes a bunch of new travel mugs that were ridiculously priced but that I wanted anyway (I guess I should have included this in grocery/household to be consistent but it doesn't really matter lol) and a trip to the post office.

Office Supplies: $0/$106.92 - this is a tiny bit misleading, I did buy printer ink this month but it was covered by an Amazon gift card so I don't count that as spending.

Personal Care: $128.45/$1437.69 - treated my mama to a mani/pedi day (she had treated last time, we generally go once a month), and a cash tip for another prepaid service.

Pet: $115.95/$934.97 - the usual....food, litter and whatever toys mysteriously make it into my cart lol.

Subscriptions: $2.99/$326.34 - monthly iCloud.

Travel: $0/$2302.37 - no travel this month, it's been a very busy month between work and school. I was hoping to maybe go somewhere in October but that looks unlikely as well.

Grand Total: $1279.28/$16602.91 - much better than the past few months, if I could keep my spending in this area I would be in great shape hahaha.

Posted in

Uncategorized

|

0 Comments »

|