This will likely be a long post, but I don't have the brain space to separate. I'll be looking at my March spending, my 3/31-4/1 summary, and check in to see where I am with regards to my 2021 goals.

March Spending:

Reminder, my spending does not include bills, those are fixed and I cannot adjust them as easily in the short run. This is anything variable or discretionary. I track every penny I spend, for better or worse, and use this data to try to make decisions. My goal is not to be as frugal as possible, but it is to know where my money is going. I am not looking for advice on how to cut spending by sharing this, sharing mostly for myself and to provide a full picture of my financial life.

Key: Category - March spend/YTD spend: context

Car/Gas - $68.90/$146.28: this was one gas fill-up, a toll pass refill, and parking. If I use change to pay for a parking meter, I don't count that, but if it's via an app that is paid for with a card, I do include. The gas fill was about 2 weeks ago, and I still have 3/4 of a tank.

Clothing/Accessories - $26.53/$608.07: I had birthday rewards from two stores I frequent, so the $26.53 was my OOP portion from what I ordered. I was able to get 2 bras for this amount, which is crazy. A single one of my bras runs $50-$60.

Dining/Entertainment - $280.54/$944.66: this amount is crazy to me, and I am clearly getting out of hand with this spending category. To be fair though, $60 of this is an annual payment for one of my streaming services. Better but meh. I categorize this in entertainment rather than subscriptions because it's something I can cancel if I can't afford it.

Gifts - $81.85/$81.85: Mama's birthday was in March, and this is the only occasion I have bought gifts for thus far. I pretty much buy gifts for her birthday, Mother's Day, my sister's birthday and Christmas gifts for my mother, brother and sister (he and I do not exchange birthday gifts). This is never a category I worry about.

Grocery/Household - $269.77/$1012.88: taken by itself, this category looks great (I budget $400 a month for groceries), but clearly it's only low because I was ordering too much damn takeout.

Health/Welless - $26/$563.97: the only spending here was my monthly Peloton membership.

Home Decor/Furniture - $0/$387.70: no spend here! Not anticipating much in this category for the rest of the year honestly.

Medical (non-FSA) - $0/($110.78): all of my medical spending this month was done via my FSA which I track separately. This category is still net negative YTD due to a large refund I recieved in January.

Miscellaneous - $0/$115.16: another no spend! My goal is to have as little in this category as possible so I can accurately group spending.

Office Supplies - $0/$126.21 - on a roll  This one is generally used for printer ink and paper. I should be good on ink for a while, although I will need paper soon.

This one is generally used for printer ink and paper. I should be good on ink for a while, although I will need paper soon.

Personal Care - $320/$994.71: March was a hair appointment month, as well as my month to pay the tip for my monthly mani/pedi date with Mama.

Pet - $15.41/$167.37: just some litter deodorizing crystals. I do have to buy some food and litter this week, which will hopefully stock me up for another month or two.

Subscriptions - $2.99/$137.94: monthly iCloud. I have started trying to track subscription costs in the category that they truly live in, although I go back and forth on it.

Travel - $979.35/$1689.37: my trip to New Orleans is basically all that is captured in this category. Not expecting much else here this year due to other stuff going on.

Total excluding FSA - $2071.34/$6865.39 - I'm averaging about $2300 a month in discretionary/variable spend. This is about 24% of my gross income.

Medical (FSA) - $251.98/$576.83: this month's FSA spending included co-pays, prescriptions, my responsibility for a visit earlier in the year that was billed, and the new cost for my therapist since she has gone out of network.

Grand Total including FSA - $2323.32/$7442.22

March Summary

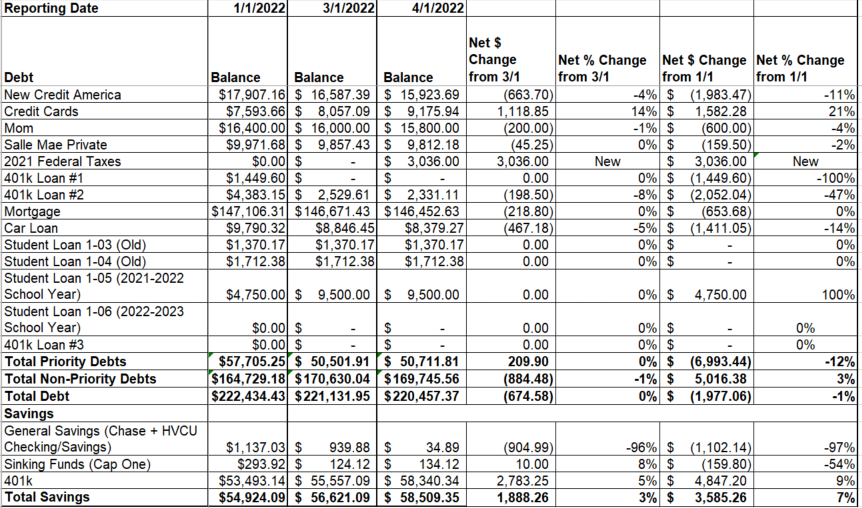

Below is the image of my chart where I keep track of my monthly summary, in a month over month view. As always, this does not yet include my 401k contribution/401k loan payment from my most recent paycheck, it hasn't posted to the account yet.

Not thrilled with this month's snapshot, although as usual not surprised. I added debt in the form of an installment agreement for my federal taxes, so it looks like it's wiped out all of the progress I have made YTD (which before that wasn't as much as I would have liked to see). The federal taxes should be paid off by the summer, the terms of my installment agreement are that they must be paid in full by 10/1. I also had to raid savings to pay the state portion of my tax bill in full. Not happy about that but better than adding another installment agreement/more debt.

Goals Check-In end of Q1

Financial Goals (in order of priority):

1. Pay off 401k Loan #1 - done!

2. Increase 401k contribution to 15% - done!

3. Refinance mortgage - goal removed, this is not the right environment for my financial situation, so I will revisit this next year, maybe. Or not bother, depending on how things are going.

4. Pay off NCA loan - goal removed. This was contingent on the refinance, but I will just continue to make my scheduled payments (which includes an additonal $300 per month to principal).

5. Pay off 401k Loan #2 - end of May? this is on track. Balance is currently around $2300, before the latest payment which has not yet posted. It should be around $1800 by the time I receive my tuition reimbursement from this semester, and will be paid in full.

6. Pay main credit card down to 50% utilization - EOY. I will likely need to revisit this goal since the refinance didn't happen, but am still hopeful.

7. Pay off private student loan - goal removed. With the refinance off the table, I will just continue paying the regularly scheduled payment and re-assess later in the year/next year. I did want to have this loan paid off before I graduate, but that might not be in the cards.

8. Pay main credit card down completely - stretch goal, EOY. this is likely off the table as well, but leaving it here in case I can make some magic happen.

No priority assigned - these "goals" have either been completed already, or are guaranteed to be completed when the time comes so they do not have a priority. I still think there is power in putting them down on paper so I can take stock in goals I have accomplished, even if it was easy!

a. increase autosave - the day after every pay day, my bank automatically transfers $$ to the savings account I have with them. I ended 2021 with it being $50 per check, and have increased this to $100 per check.

b. increase payment to Mom loan - throughout 2021, I paid her $100 per month. I have budgeted in for $200 a month this year. This will get me down to $14k by the end of the year, so I have a lot of work to do on this one, as I would like it paid off before I buy a new home.

c. Fund two rounds of major plastic surgery - estimating my OOP cost will be around $30k. This will be funded from 401k loans. I'm not thrilled that this is how I am going to do it but it's the best option based on other factors. Sincerely hoping this is the last time I need to take one of these guys. I'll need to wait and see what the terms will be based on how much I take, do I split it into two loans, etc. But either way, the money is there, and I cannot wait any longer to save the money up in another fashion.

Non-Financial Goals:

1. Get to goal weight - done!

2. Complete two rounds of plastic surgery - first round early July, second round mid-December. on track, I have received approval from insurance for their part of Round 1, and have a follow-up appointment scheduled for the end of this month to talk next steps.

3. Stay the course with school - ongoing. on track, I am a few weeks away from the end of the spring semester, and have registered for my fall classes. 5 classes remain to register for.

4. Work towards my next promotion - ongoing. on track, based on recent conversations with my boss it seems that October is on the table for this.

This one is generally used for printer ink and paper. I should be good on ink for a while, although I will need paper soon.

This one is generally used for printer ink and paper. I should be good on ink for a while, although I will need paper soon.