|

|

|

March 4th, 2021 at 02:01 pm

Had to pick up a few things from the grocery store yesterday. As mentioned in my previous entry, I have found that going for multiple smaller trips helps me stay a little more focused with what I purchase. It's not uncommon for me to go 2-3 times a week. This started when I lived in the city, and was walking with my groceries. I didn't want to carry lots of heavy bags so I would pick things up as I needed them. I kept it going when I moved into the suburbs, and now prefer it with staying home all the time. Going to the grocery store is my main "going out" haha.

5.99 - Half & Half - I drink a giant cup of tea every day, and use half & half. This is non negotiable lol. I purchase the half gallon container, and will usually buy a new one as soon as I open the old one so I have the backup ready to go.

3.85 - 4 Granny Smith apples - for green smoothies

2.50 - bagged spinach - same as above

2.64 - 4 lemons - same as above

.88 plus tax - a pack of Reese's - while waiting in the checkout line, I decided that my green smoothie had lost appeal for the day and since I had the room in my calorie budget, I could make the swap. Bonus, it was on sale!!!

15.94/37.97 MTD (not including $20 for laundry card refill)

This morning, I was very grateful to receive my first dose of the COVID vaccine. In my state, I am eligible due to an underlying condition - specifically obesity. I am close to not being obese anymore, but still counts! I went to a site about 15 minutes away from my house, and was back home an hour and 15 minutes after leaving. Easy peasy. I go back in 3 weeks for my second dose. It made me feel hope. There is light at the end of this dark tunnel. It's not as close as some people/states think it is, but it's there.

Posted in

Uncategorized

|

3 Comments »

March 3rd, 2021 at 05:51 pm

Joing in LAL's March 2021 Food Challenge! I am single, and generally prep food only for myself (although sometimes I buy food for my mom/sister, for which they reimburse me). I am still working out what my monthly food budget is....right now, based on Jan/Feb data, it looks like I spend about $360 a month on groceries/household/toiletries. That includes laundry card refills, any household supplies and drugstore level toiletries (I also have some higher end stuff but that's pulled out into a separate category so it doesn't skew my grocery category too badly). So maybe $300 on groceries alone? I tend to do most of my grocery shopping at Stop & Shop, but depending on what I need, also make trips to other stores as well as online grocery stores & warehouse club. I tend to shop multiple times a week. Doing it this way ensures that I am only buying what I need for the next few days, rather than stocking up on random stuff and making a plan from what I have - that method always leads to me buying stuff I don't need/use.

Some more context. I work from home. I meal prep everything I consume between Monday morning and Friday afternoon, eating the same thing every day. I don't eat a ton at one time because I have a gastric sleeve which limits my stomach capacity, and I am still actively trying to lose weight (down 85 pounds in 3 years, 15 left to go). Friday/Saturday nights, I either eat a frozen meal, get takeout, or have dinner plans with a friend. Sundays are my free day, I have dinner at my mom's house.

So, 3/1's trip to Stop & Shop:

4.49 - Fairlife milk (I go through a lot of milk, between my breakfast protein smoothie and my nighttime oatmeal)

3.89x2 - 2 frozen Healthy Choice meals. I like to have a couple of frozen dinners on hand for Friday/Saturday nights if I am not getting takeout/don't have dinner plans.

1.44 Red onion for dinner meal prep

3.32 - 2 red peppers for dinner meal prep (this week's dinners are egg white omelettes with sauteed onions & pepper and cheddar, with an English muffin on the side. I eat this fairly often, and purchased a bulk package of carton egg whites last month. After what I used this week, I have enough egg whites for 2 more weeks of this meal prep. I bought the English muffins last week, they were on sale for buy 1 get 2 free. When this happens, I get 3 packs and stash them in the freezer. Cheese is purchased from warehouse club when needed, I still have 2 lbs in the fridge lol.)

5.00 - 2lbs of strawberries (I eat 2 lbs of strawberries every 8 days, so I pretty much always buy strawberries lol)

Total - 22.03 (grocery category technically at 42.03 due to laundry card refill on Monday as well)

A typical weekday looks like this for me: large cup of tea with Splenda, half & half, and fiber supplement...chocolate chia oat protein smoothie...strawberries...string cheese...green smoothie...whatever I've meal prepped for dinners for the week...and DIY instant oatmeal made with milk before bed. A typical weekend day is the tea, two eggs, toast, strawberries, some kind of protein drink, and dinner is planned but random lol.

Posted in

Uncategorized

|

0 Comments »

March 1st, 2021 at 03:13 pm

Wow, it's hard to believe that February is over and that we are now in March, marking a full year of the pandemic here in the States. Wooooof. There's light at the end of the tunnel, but it is still so very far away. If you had asked me a year ago what the next 12 months would be like, I don't think I would have gotten any facet of it correctly. I'm so happy to be out of February though. It's my least favorite month for a lot of reasons, and I am so tired of the winter - come on spring! We are ready for you!

February spending: spendy month (I do not include bills or debt payments in this tracking, this is all the stuff I gotta spend money on on top of those expenses). Across 9 categories, I spent juuuust under $1100.

Car/Gas - $113.57 - this was an oil change and replacement of my wiper blades. I had a coupon from the dealer for a $30 oil change, for the wiper blades, they just charged me for parts and did not charge to install. This ended up cheaper than if I had not gone to the dealer. They did forget to install the rear wiper blade (grrrr), but I will go back next Saturday and they will put it on. They'll give me my next oil change for free for the inconvenience. I only drive about 4k miles per year so this is less attractive of an incentive than it would be for some people, but whatever. They also told me that my tires need to be replaced soon (like, by the summer). While this isn't what I want to hear, but my tires are the originals from the factory, and my car has 60k miles on it (2015 model year, I purchased in 2017 with about 44k miles on it). They quoted $1150 for that, but I can definitely do better elsewhere so I am going to get a few quotes. I do not yet have any money in the auto maintenance fund, so both of these expenditures will need to come out of savings. I'm not thrilled about dipping into my newly replenished savings, but it's better than putting it on a credit card. I have owned this car since July 2017, and in that time, have only done oil changes, replaced wiper blades, rear brake pads and one trip to the body shop (covered by insurance, I just had to pay deductible). I'd say maintenance on this car has cost me maaaaaybe $1200 total since owning it, so I can live with the tires. I will sell the car long before they need to be replaced again.

Clothing - $43.87 This was my online shopping trip earlier in the month. I allotted myself $30 to spend, ordered $52 worth of items but one of them went out of stock before it could be shipped (my dress!!!!! sad face lol). I rarely buy new clothes, and this was funded out of a snowflake as per the rules of 2021's frivolous spending.

Education - $95.40 I wasn't expecting to add this as a category but here we are haha. No complaints about this - it's worth finding extra money in the budget for this, as it will return the investment in spades.

Grocery/Household/Toiletries - $377.43 A touch higher than January, but averaging at $368 for the 2 complete months of the year. This includes toiletries and anything for my household, like refilling my laundry card. Right now I don't see a need to further break it out. It's higher than I thought it would be but maybe if I just counted groceries it would be more in line. Since I eat 99% of my meals at home, I don't have an issue with this.

Miscellaneous - $248.27 this one is a little deceptive. These are the items I purchased to count towards my annual wellness stipend, for which I will be reimbursed at the end of March. March should show a credit in an equal amount for this category.

Office Supplies - $55.42 I wasn't expecting this category to have an amount in it....but I needed to purchase more printer ink last week, and impulsively bought a new roll of shipping tape with a dispenser. March will show a small credit, Staples lost the first shipment of my ink, and in addition to re-shipping it, refunded me $10 of the cost. That has not yet posted, so it'll reflect this month.

Personal Care - $159 I went back and forth on this one. I had set aside this amount (almost to the dollar) for a haircut and pedicure out of my federal refund. But then I ran out of an eyelash serum I really like. Yes, frivolous, but there's so little frivolity in my day today life that I deserve a little bit, especially if it's funded. I decided to push the haircut and pedi off for a few months, and buy the serum. If I hadn't had the funds allocated for it out of the federal refund I would have sucked it up and not purchased. But since I did, I am ok with it going to something else in that category. I've found some extra funds in April for a haircut.

Subscriptions - $2.99 this is my monthly iCloud storage.

Takeout/Entertainment - $2.06 This one is great! I expect March to be higher here as I have dinner plans with a friend in 2 weeks.

Total - $1098.01

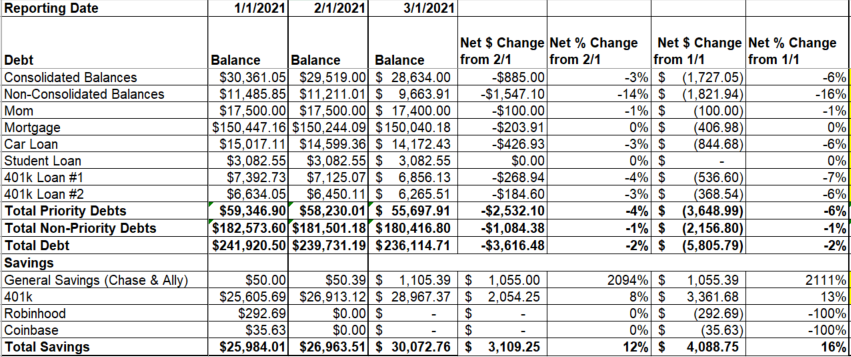

I also completed my February account summary. Pretty happy with my progress in just 2 months so far.

Good progress made on all of my priorities. Between the pending 3rd stimulus, a very small disbursement from my grandfather's estate and a few other snowflakes, I am expecting March to be another good progress month. I'll definitely have to dip into savings to cover a few things (the oil change/wiper blades bill, my mom's birthday, and a few things yet to be identified).....but again, spending from savings is better than putting onto the credit card. This year is going to be the learning/transition year, so I think my savings will not be as healthy at the end of the year as I had hoped it would be. But my debt will continue to go down, and I'll know what I need to budget for next year.

Posted in

Uncategorized

|

3 Comments »

February 26th, 2021 at 05:00 pm

What seemed like it was going to be a relatively quiet week on the financial front ended up turning out to be pretty busy.

Between my bank account bonus and federal refund, I got some "snowflakes" earlier than expected. That combined with payday meant a good deal of progress on debt and savings goals. I'm looking forward to my monthly summary on Monday.

Over the weekend, I will likely have to take a little bit of money out of savings for some auto maintenance....I don't yet have an auto sinking fund set up, but am getting started on that soon. While I don't relish the thought of taking it out of savings, it's certainly better than putting it on a credit card. I need to get my oil changed, and my wiper blades (front and rear) replaced. I'm going to the dealer, merely because I have a good coupon for the oil change. Hoping it all costs less than $100, but we shall see. I don't spend a lot on auto maintenance, I think it was less than $400 for all of 2020. I'm starting to funnel money into the sinking fund for that in a few months.

Once the low hanging fruit of credit cards has been paid off (the smaller balances that I am able to knock out with snowflakes), I am planning to increase my 401k contribution. I am currently at 10% (I forget what the terms of my match are exactly, but I know I am contributing more than enough to max the match). I'd like to bump this to 14% by the end of the year. In order to max at my current salary, I need to be at 23% - ideally I can get close to there by the time I'm 45. As time goes on in my massive debt paydown, I should be able to keep increasing this contribution. I think 23% by 45 is very doable.

I also spoke with HR this morning to iron out my questions about the tuition reimbursement program and was pleased with the answers I got. I'm still waiting on my transfer credit evaluation, and then I will update my roadmap of courses, and speak to the financial aid office to find out if I am eligible for loans for any courses taken prior to matriculation. That's the big outstanding question right now.

I've been helping my mother and aunt this week in settling my grandfather's estate. It's a little frustrating because no one seems to move as quickly as I do. But I'm glad I have the skillset to be able to push through the inefficiencies for them to lift that burden. It's also highlighted areas where I would like to conduct pre-planning for my mother's affairs (I will likely be her executor because I'm best suited for it out of my siblings). We decided that she will sign POAs now, so that it's taken care of long before needed. My sister and I are already on her bank accounts as joint holders, I can get into most if not all of her credit card accounts, and we are listed as beneficiaries on everything. Should be pretty straightforward. I am going to curate a list of all financial info, and just keep it updated as her situation changes. Right now the only outstanding things are the house and her car, and hopefully those will no longer be an issue by the time we have to deal with any of this.

Posted in

Uncategorized

|

3 Comments »

February 24th, 2021 at 03:53 pm

My federal refund hit my account this morning, a full week earlier than expected. I immediately began distributing it as planned - a small amount to pay my mom back for some money I owed her (outside of the Big Mom Loan lol), a big chunk into savings, paying one credit card off in full, paying about 40% of another....I'm left with about 6% of the refund lol. That money was originally going to be allocated towards a haircut and pedicure. I ultimately decided to use part of the remainder towards a fee for school, and hold the rest in escrow for some future indulgence, whatever it may be. Feels good to be making progress. Since the beginning of the year, when I started getting really serious about fixing my mess and tracking everything granularly....I have reduced my priority debt by 6%, and my non-priority debt by 1%, for an overall debt reduction of 1% (lol....math). I've increased my general savings by more than 2000% (no, not a typo hahaha), my 401k by 17%, and my overall savings by 20%. I am on track to be pretty far ahead of my goals for the year.

I can't remember if I posted about this yet or not, but in my state they opened up vaccine eligibility to folks with underlying conditions. One of them is obesity. My BMI is still technically obese by a few points, although I don't look it. I've never been so grateful to not yet be at my goal weight haha. I was able to initially make an appointment for a vaccine site about an hour away for early April. But this morning, they opened up appointments for a new site about 4 miles away, and they are only taking residents of a few zip codes right now. Mine is one of the zip codes, so I went in and was able to get an appt for next week! Very happy about this. It means I will be fully vaccinated by the end of March, and the vaccine will be fully active by mid April, when my mom and I go to Vegas to close up her dad's apartment. (Of course I cancelled the original appointment to open it back up for someone who was hoping to get one). My mom's second dose is this weekend, so she will be good to go as well. Her sister is meeting us there, and she got her first dose last week. Happy on all accounts here.

I've started making consult appointments with some plastic surgeons. i was hoping to do all of the procedures I need in one surgery, but am willing to separate them if insurance is covering the main one I need. If I have to pay anything out of pocket, I am not prepared to do that this year, but I do want to start getting real prices so I can come up with my plan to fund it. I was estimating $40k, but it now seems like it will be a LOT less (maybe $20k total? Big difference). I have a very generous STD plan at work, that with my tenure at the company, allows me to take 3 months of fully paid leave per year (I believe per 12 month period, so if the surgeries are 6 months apart, then 3 months total). All things to think about.

Other than that....I had a bit of spending yesterday. My printer ran out of ink in January. I replaced the black cartridge, figuring I could print everything I needed in black & white. Well, the other day it started refusing to do even that, although the black cartridge is full. I now have too many things I need to print to hold off any longer, and well, I had the extra money, so I went ahead and ordered the color cartridges. $42.26. Hopefully I don't need to buy ink again for a few months. My February spending is currently sitting at just under $500. There will definitely be a few more purchases over the next few days though, so I am not ready to close the books on it yet. Depending on how I choose to reflect some of it, I think I'll still end up coming in lower than January after it all nets out, although some of that will carry over into March. I have 2 more grocery trips to make for the month as well, but they will both be small.

Posted in

Uncategorized

|

1 Comments »

February 23rd, 2021 at 04:57 pm

While doing my daily roundup of checking all of my financial apps, I was very pleased to see that my $400 bonus for opening a Cap One checking account was received yesterday! I wasn't expecting this until the end of April.

Originally, when I thought this was coming a little later, I was going to send the entire bonus to one of the credit cards I am working to pay off. Since it came earlier, I decided to mix it up a little bit. Every year, I am eligible for a $250 wellness reimbursement from my company. This year, I decided to purchase a new fitness tracker, and a strap for it. That only gets me to $247 and change lol, so thankfully I have a standalone receipt for protein powder I can use to make up the difference. As long as my receipts are submitted by somewhere around 3/20, I will receive this in my 3/31 paycheck (it's processed quarterly) - I will likely submit the receipts Friday, so wellllll within the timeframe needed.

I was originally going to purchase these items out of my federal tax refund money. I decided to pay for these items out of the bonus, since that's here first. I rearranged the amounts going to this credit card based on the "snowflake". It's all coming out the same in the end, just adjusting the individual snowflake allocations. Because I'm a bit of a lunatic. I'm still on track to pay off all but 2 credit cards by April/May, mostly using snowflake money. Of the 2 remaining, one is a store card on a fixed interest promo (it was for my bed), and so I'll likely just continue making the payment as scheduled. The other is a MasterCard that I would actively like to get the balance/utilization down on. Looking good!

As I work through my planning, I realized I am ready to start using buckets for my savings - for whatever sinking funds I identify, and some upcoming expenses that I am saving for in the short term. Long term general savings will probably just stay in my attached savings for now, but this will help me organize these things. I opened a savings account online with Ally Bank, and created 3 buckets. Homeowners Insurance (this will be a sinking fund I will start funding in August, after I pay this year's premium in full out of general savings), Plastics (this won't get used just yet, but extra money coming in later this year that will be used to directly or indirectly fund plastic surgery), & Education (any money I allocate for anything having to do with my degree program. Lots of individual fees coming up that I want to make sure I know how much I have funded). I'm sure this will continue evolving. I'd like to be able to fund my car insurance in advance to pay the premium in full twice a year, instead of monthly like I currently do. It won't save much, but even the $30 it'll save helps. Not sure what else may make sense in the near term, but I'm sure I'll come up with a way to make it more complicated than it needs to be

Posted in

Uncategorized

|

0 Comments »

February 22nd, 2021 at 05:48 pm

My mother's father passed away on Saturday, after a long battle with cancer. He was 91 years old, lived a full life, and was ready to go. My grandmother is still alive, but has advanced Alzheimer's. I would be very surprised if she lived through the end of this year. I did/do not have a very close relationship with them, but am hurting for my mother. They retired to Las Vegas 25 years ago, and as they aged/became ill, my mother was going out to visit them 3-4 times per year. Unfortunately, with the pandemic hitting, she has not been able to visit since February of 2020. Thankfully, she was able to speak to him one last time on Friday to say goodbye.

We had already been planning to make a trip to Vegas in April to clean out his apartment (my mother's second vaccine dose is this weekend, so she will be fully vaccinated mid-March). I am also elgiible based on the underlying conditions in our state, and as of right now my first dose is the week before we are booked to go. A new vaccine site is opening in the next city over though, and so I am hoping I can reschedule for an earlier date so I will also be fully vaccinated by the time we have to travel. I'm very much not thrilled about this trip overall, but it's unfortunately necessary.

The mess part is that neither of my grandparents were at all technologically savvy, did not use the internet at all, and so none of their accounts etc are managed online. My mother and her sister also do not seem to have the necessary documents to settle their estate, so I am getting thrown in to handle all of this. We have a POA for my grandfather, but for my grandmother, we only seem to have a healthcare POA. 75% of the papers are still at the nursing home that my grandfather has lived in for the past few weeks (my grandmother has been there for 4.5 years), so we need the manager of the home to send them to us this week to sort through. My mother's sister is who is technically named on the POA, but she is very emotional and disorganized in the best of times. So I told my mother to have the docs sent to us, and I will sort them out and figure out what they need to do.

All of this renewed my determination to not go through when my mother passes. She's much more technologically savvy, and I have all of her passwords to everything/am already a signer on her bank account. I mentioned to her this morning that I think we should get POAs in place now that way they're handled long before they're needed. In our state, an attorney does not need to draw them up, they just need to be notarized. She agreed, and will name my sister and I POA. I'm then going to start a list of all of her financial info in a Google doc to share with my brother and sister, and will update as she makes changes. That way we don't have to go looking all over the place for the info. I'd rather create the list while she can still give us info.

Anything left over after my grandfather's estate has been settled will go into my grandmother's account (after being married for 70+ years, they still had separate bank accounts ha). My mother and her sisters all have bonds that my grandfather purchased for them, which should be around $20k. He also purchased bonds for my brother in the amount of about $1k. My mother has said that she will give my sister and I $1k each from her bonds to make it equal. I am not expecting anything more from his estate. I've made a tentative plan for the $1k (it'll be split between savings, some upcoming educational expenses, and some debt payoff).

Posted in

Uncategorized

|

0 Comments »

February 18th, 2021 at 04:04 pm

My planned weekend spending went ok. I spent more on clothing than planned but not by a lot. I made the mistake of going into the clearance section of the website and a holiday sweater (that I hope I can still wear by then) and a dress (same - I haven't worn a dress in over a year lol) called my name and needed to be mine. Between the 2 of them, they were $22 more than budgeted so it's ok. I just adjusted how much of the Rakuten payout was allocated. Target ended up being way less than planned, Wendy's and CVS as expected. Staying on track, and I feel like I got a little extra retail therapy to boot.

I got an email on Sunday that my federal return had been accepted, so now I am tracking the status of my refund. Still showing as received in the IRS2GO app. I'm really looking forward to that refund, as it makes some major inroads in savings goals and pays off an entire credit card balance. I knew I was going to start getting crazy with projecting progress out once I set up my balance on everything in the format that I did. But it looks like if all stays on track, by the end of the year I will have paid off 75% of my non-consolidated balances, and put $4k into my general savings. That doesn't include any progress on installment debt! Pretty cool what you can accomplish once you put your mind to it.

I was notified yesterday of my acceptance into the degree program I applied for! Very exciting stuff. I just need to wat on the transfer credit evaluation to be completed (3-4 weeks, I believe), to see what they take and what courses I still need and then I can refine the degree roadmap I created a few weeks ago. I was considering the idea of taking classes this summer, and may still take 1 or 2, but most likely will start with fall. I don't believe I can use student loans for non-credit bearing classes. And since you can only matriculate in the fall or spring, I would have to take the classes as a non-matriculated student, then I can have them converted to credit bearing. I am also trying to find out if they would be eligible for tuition reimbursement since at the time of taking them, they would not be for credit. Seems annoying and complicated, so I may just skip it. I'll need to take classes in 1-2 winter/summer sessions if I want to get the majority of my classes completed in 4 fall/spring semesters.

Things are otherwise quiet. I am self-quarantining. I was with my mother and sister on Sunday. My sister let me know on Tuesday that a guy she worked with on Friday lives with his aunt who tested positive. Unfortunately, this guy seems flaky and has not gotten tested, to our knowledge. Mom and sister were tested Tuesday, both negative. They will get tested again tomorrow. I am going to wait until Saturday, and go get tested myself. I am fairly confident I will be negative as well, and a week since my tertiary exposure feels like enough time to trust the test. I am probably being overly cautious, but I would rather do that, especially since it's really no hardship to quarantine. Mildly inconvenient....I put off doing my laundry, ordered groceries for delivery instead of going to the store, cancelled my appointment to get my license renewed at the DMV, and cancelled an oil change appointment for my car. Nothing major, and ends up keeping my February spending lower than it would have been (except the DMV and oil change will just get moved to March instead ha).

Posted in

Uncategorized

|

1 Comments »

February 12th, 2021 at 05:27 pm

It's payday, which feels like I have tangible action on some of my goals, instead of just planning out actions and waiting for the calendar to tick over.

I now have a more accurate picture of what my new take home pay is at the lower withholding rate, and while for some pay periods it's not quite enough, it's close enough that I am just going to make it work. Once some of the "snowflakes" I am expecting come in, and I am able to eliminate some monthly debt payments, this will get better, so I don't see the value in continuing to fiddle with it.

I paid about $400 towards debt today, sent $25 to savings, and once I transfer from one of the other checking accounts I have my direct deposit split into, will pay another $450 towards debt, and pay the rest of my bills. Sometime next week, my mortgage will be auto-deducted from the separate account I keep for housing costs, so another $415 towards debt. I don't have a huge buffer left over when that's all done, but I'm going to try to stay within it for grocery spending over the next 2 weeks til my next paycheck.

Looking forward to a few months from now when I have a larger checking buffer to cover that kind of stuff. How do you figure out what your checking buffer should be? Is it a set dollar amount, or is it a certain % of expenses etc? I know both methods are valid, just curious why you chose to go the way you did. I think what I would ultimately like to have in my checking account is a month of expenses, and then tiered savings (3 months in my attached savings account, an additional x amount of months in a separate higher yield savings, etc....) I'm still at the baby steps portion of this all. I'm going to start with $250 as a goal, then gradually increase until I get to a month's worth of expenses. Do you consider your checking buffer as part of savings?

Today, the IRS opened up acceptance of federal tax returns for 2020. I have not yet gotten notification that mine was accepted.....fingers crossed that comes in a few days so I can get a better idea of when I will receive my refund and put it to good use. I was able to complete my state taxes yesterday, and am getting back a whopping $89 lol. Oh well, it's better than owing, and it will go directly to debt. Once I receive that refund, I can then work on amending my 2019 state return, and should get some money back from that too.

My quarterly Rakuten payment is scheduled to come Monday. I am expecting around $115. Some of that will be used for spending this weekend (~$30), and I had not decided where the rest was going to be allocated (~$85), as I wanted to see what the situation was with my new take home before overcommitting. I think what I am leaning towards now is just leaving in checking as the start to my buffer.

Spending on tap for this weekend:

*$30 at a clothing store I like - will be combined with a $20 birthday reward for a total budget of $50 (out of Rakuten). This is definitely not a need, but I could use some new leggings and I like theirs. And it's funded out of extra money, so fits the parameters I've set for fun spending.

*Target - will buy the few groceries I need for next week (using existing cash buffer), and also want to pick up a jar for my newest bedtime snack obsession (DIY Instant Oatmeal lol). I've been using a jar I had but it is not the right shape, I need something with a much wider opening. Target looks like they have several options that will work well, all for under $10. I'll be using the merch credit I got from Target a few weeks ago to cover this ($19.80). I will also be using the merch credit to cover ingredients for Rice Krispy Treats that I am making for a friend later next week.

*Wendy's - this is a treat for both my diet and my budget  I'll probably only spend a few dollars here, which can come out of existing cash buffer. I haven't purchased takeout for about a month, and this will be a very economical way to feel like I am treating myself, while still staying within my calories for the day and my financial goals. I'll probably only spend a few dollars here, which can come out of existing cash buffer. I haven't purchased takeout for about a month, and this will be a very economical way to feel like I am treating myself, while still staying within my calories for the day and my financial goals.

*CVS - will probably stop at one at some point tomorrow and pick up some candy. I have $1 in ExtraBucks so whatever the balance is (maybe a few cents?) will come out of cash buffer. I let myself have candy once a week. Same concept as above!

That's a long enough entry for now hahaha. I'll leave on this note. I know a lot of people here are fans of Dave Ramsey, and I have mentioned in the past that I am not a fan of his. He just rubs me the wrong way. Well, I saw this article yesterday, and if his quote in here is accurate, it just proves further that he's a jerk. How judgemental can you be?!?! Ugh. This is why I will not ever follow his program, even if some of the advice is sound. He's a <insert many curse words here>, kicking people while they're down. Text is https://thehill.com/homenews/news/538549-dave-ramsey-on-stimulus-checks-if-600-or-1400-changes-your-life-you-were-pretty?rl=1 and Link is https://thehill.com/homenews/news/538549-dave-ramsey-on-stim...

Posted in

Uncategorized

|

3 Comments »

February 10th, 2021 at 04:20 pm

Since my last entry, I am still doing a lot of sitting around waiting. Harrumph

I did receive word from the debt consolidation company that another balance will be paid off. That lowers the remaining balance there, and takes me to 5 paid, 7 to go. Based on amounts, I think 2 more will be paid this year, and then the remaining 5 will be spread over the year and a half left in the program (runs through Aug 2023).

Otherwise...

Taxes - still waiting for the IRS to open up (Friday! Come on!) and waiting for my state to be available via Credit Karma so I can file those. Once this year's state taxes have been accepted and whatever refund (fingers crossed) has been received, I'll readdress amending my 2019 state taxes to properly reflect my move out of NYC.

School - all transcripts are still making their way to the school. There's a helpful portal that shows me the status, none have been received yet. I only requested them last week, so I need to calm myself haha. I've done about as much mapping out of courses as I can do until I find out what they will accept as transfer credits.

Upcoming Snowflakes - as I've mentioned, I count anything that isn't paycheck income as a snowflake, even if that isn't the technical definition. Quite a few coming up....federal tax refund, (hopefully) state tax refund, 2019 state tax refund, Q1 Rakuten payout, annual wellness stipend from my company, a few bank bonuses and (very hopefully) a third stimulus payment. Where those will go has been sketched out....mostly being split between savings and debt, which gives me a leg up on those, with small portions being held for educational expenses and some "fun spending" (a haircut, a pedicure, etc).

Overall Finances - with the help of those snowflakes, I'll be over $2k ahead on the debt payoff goals for the year, and almost $2k ahead on savings goals. Not having to make monthly payments on those debts (all credit cards right now) frees up room in my semi-monthly pay. Eventually I hope to use that room to increase debt payments to other bigger accounts, but right now it'll help solve the current shortfall.

I was talking to a friend the other day, and I said you know, I just realized that between the ages of 40 and 45, if all goes to plan, I will have bought and extensively renovated my first home, paid off $50k+ worth of debt, completed my degree, accomplished a 100 pound weight loss, cash flowed expensive plastic surgery, and excelled in my career. And that makes me frightened for what I come up with for 46-50 lol. Her response was well whatever it is, I bet you'll make it look easy. That made me smile

Posted in

Uncategorized

|

1 Comments »

February 5th, 2021 at 06:36 pm

No real updates, but I'm so into all of my tracking that I find lack of updates has me antsy lol.

It's been a few low spend days, as expected. The only spending so far this month is for groceries/household, and educational expenses (transcript & application fees). Last night I went to CVS to purchase a money order for my high school transcript (they don't seem to realize it is 2021....), and unfortunately, they do not do money orders at that location. I had $4 in extra bucks that were expiring soon, so I bought some chocolate to treat myself with over the weekend. Total out of pocket cost was 14 cents  I then ran over to the supermarket, in hopes that their customer service desk was still open, and luckily was able to get the money order there. I was pleased to find that the MO fee was cheaper than the post office. Win win all around. I then ran over to the supermarket, in hopes that their customer service desk was still open, and luckily was able to get the money order there. I was pleased to find that the MO fee was cheaper than the post office. Win win all around.

Everything with my school is a waiting game right now. All of my transcripts have been requested, and I need them to be received by the school before they will make their admission decision. FAFSA was completed and processed. I'm not expecting any aid, so it was a moot exercise really (but needed to do it in order to get loans). The transfer admissions advisor has been wonderful, and is answering all of my (many) questions via email. It's helping me sketch out my roadmap. That obviously won't be solidified until 1. I am accepted and 2. they complete my transfer credit evaluation, but I will take any opportunity to go down the rabbit hole lol.

Much like school, finances are also a waiting game. Waiting for further updates from debt consolidation, waiting for next paycheck, waiting for federal tax refund, waiting for state return to be available, waiting for potential 3rd stimulus info.......this is sometimes the problem with planning too much ahead. I know what I am doing with all of these things when they come in, but can't make them happen faster! Because I front loaded so much of my Feb grocery spending, I am not even planning on hitting the grocery store again until mid next week haha. I usually go for small trips 2-3 times a week depending on what fresh items I need to replace. I'm very good about making a list and sticking to it, so this cadence works for me. I just happen to not need anything fresh before then this week. It's all kind of boring and frustrating.

Lastly, and this is semi financial related.....weight loss journey is slow but progressing. I have 15 pounds to lose this year. I am determined to do it. I recently tweaked my daily caloric intake, and think I may have finally found a sweet spot where I am not hungry at all based on the mix of foods I eat in a day, but it's also low enough to have a consistent deficit. I've been looking into different plastic surgeons who specialize in the procedures I am looking for, in the population I fit into (post major weight loss/bariatric patients). I've started getting some pricing and am very surprised to find that there's a surgeon whose work I am very impressed with - he has done a number of patients in the extended community I follow. It looks like I can get all of the procedures I want/need for under $20k. Which is half of what I would pay at the surgeon I really want. This makes getting this done next year sometime much more within reach than it seemed. I am starting to reach out to docs for quotes/virtual consults etc just to make sure I have the right numbers in mind as I (overly) plan.

Posted in

Uncategorized

|

1 Comments »

February 2nd, 2021 at 07:39 pm

I've been in full steam discovery mode since learning last week that my company is now offering tuition reimbursement. I was going to hold off and take my time, but.....that's generally not how I operate haha.

I looked into what schools in my state system (as well as NYC since I am eligible for resident tuition there as well) would work, narrowed it down to 2 programs, and chose one based on where I thought I could complete it faster/more credits would transfer etc. It's a completely online program at one of the State University of NY campuses.

I submitted my application today ($50), requested transcripts from previous school ($17.40) and the College Board for CLEP exams ($20). I need to go get a money order for $7 and mail in the form to request my high school transcript. We had a blizzard here yesterday so that will have to wait a few days haha. Not worth trekking out in the snow to do! I also submitted my FAFSA. There's now an app for that, that made the entire process take about 10 minutes.

I also modeled what transfer credits I think/hope they'll accept, what CLEP exams I have already taken that they should accept, what CLEP exams I can take to satisfy requirements/get more transfer credits, and finally what of their courses that leaves me with. It's a little rabbit hole-y....but it's kind of what I do lol. It leaves me with about 4 semesters of full time study. Based on tuition costs alone (not sure what fees/books will run), I am looking at paying around $3,300 out of pocket, and the rest will be reimbursed. Additional CLEP exams will be on top of that, and I don't think those are eligible for reimbursement. The College Board charges $89 per exam, and the test center at can also charge something on top. Right now I am looking at needing to take 10-11 exams (CLEP exams are essentially exams you can take to demonstrate your knowledge in a subject area, and you can treat them like transfer credits). I could of course take the equivalent courses, but....I don't wanna. This would also be way cheaper and far faster than taking the courses. The total cost for an exam is usually less than a single credit.

I will be taking out new student loans to cover the cost upfront. The estimated loan amount (again, based on tuition alone) is around $14,000. I will most likely use the reimbursement amounts to pay off higher interest debt rather than putting it towards the loans. I'll have to see where things stand at the time of each reimbursement though.

Exciting stuff!!!

Posted in

Uncategorized

|

0 Comments »

February 1st, 2021 at 05:21 pm

Friday was payday, and it was uneventful. For some reason, my spreadsheet "checkbook" register is showing $39 less than my online banking.....I can't see anything missing, but there are too many pending transactions and it's annoying me. I'll give it a day or two then go back in and look.

The increase to my net pay after adjusting my withholdings does not seem to be enough to meet the ongoing shortfall....but this was an anomaly check. I received a $50 gift card for a project I worked on and it was taxable, so that was factored in to this check. Shouldn't be very different, but I'll still wait til next check to adjust and decide if I need to make more changes or if I can get by on this. I did decide to sell some dumbbells that I acquired in 2020 that should bring in some cash, so that should help. Right now the going price for the ones I am definitely willing to sell is around $825 conservatively (at $2.50 a pound). I am not planning on using these anytime soon....weight training makes me too hungry and I eat more than the calories I need to intake in order to lose weight. So I am going to hold off on starting to left weights until after I hit my goal weight and can increase to maintenance calories. At that point, I'm hoping that I'll feel comfrotable going to a gym and I won't need as extensive of a weight collection at home. Eventually I'd like ot move to a larger home and will build a gym but the supply chain issues surrounding weights will have hopefully been cleared up by then. Right now, they're not being used and can help plug some of the leaks, so out they'll go.

In the meantime, I sold off/cashed out the assets in my Coinbase and Robinhood accounts. I realized that while I'd like to keep some stuff on the side invested and potentially growing, if I need money to pay bills now, then I had to prioritize that. Coinbase has already been transferred to my checking, and Robinhood should arrive in a few days. It honestly had nothing to do with the $GME controversy although the timing aligns lol.

After all of my bills from this pay period are posted (some are autopay and don't come out right away), I am left with a surplus, woo! I'm either going to move it to savings, or keep it in checking as a buffer. I don't foresee much spending in the next few weeks, as I pre-bought a lot of groceries that count against January spending. There will be some grocery spending (fresh produce etc), but nothing major.

The final tally for January spending (anything that isn't a bill) is $706.83. Way higher than I hoped for! Of that, almost $400 was groceries/household/toiletries. It's artifically high though, and should not be indicative of what I spend on groceries in a month. I had to replace some protein powder earlier in January, that's $30 right there....and I also got a FreshDirect offer (that's a NYC based grocery delivery service). $50 off each of my first 2 orders of $99 or more. So basically $200 worth of groceries for $100. They are a little pricier, but it seemed like it was worth it to stock up on non-perishables. I placed my first order this weekend (included in Jan spending), and will place my second (offer expires 2/17) next weekend. I went to the grocery store on Friday and again yesterday, and spent a total of $80, but those trips were basically pre-buying February groceries. So I am hoping that I can keep groceries to $250 or so for Feb. Otherwise, I spent $32 on prescriptions (90 day supply), and $291 on variables (sparking wine for New Year's Day brunch, parking meters/gas, a gift for my cousin when her cat passed, some office supplies, my annual Prime subscription, and some miscellaneous items. Happy to see that I only spent $15 total on my takeout/entertainment category.) Looking forward to having a few months of this spending data to really hone in on what I should be ballparking every month.

I also decided to take a look at where my baseline debt/savings numbers progressed to. Small changes but in the right direction.

| |

1/1/2021 |

2/1/2021 |

| Debt |

Balance |

Balance |

Net $ Change |

Net % Change |

| Consolidated Balances |

$30,361.05 |

$29,519.00 |

-$842.05 |

-3% |

| Non-Consolidated Balances |

$11,485.85 |

$11,211.01 |

-$274.84 |

-2% |

| Mom |

$17,500.00 |

$17,500.00 |

$0.00 |

0% |

| Mortgage |

$150,447.16 |

$150,244.09 |

-$203.07 |

0% |

| Car Loan |

$15,017.11 |

$14,599.36 |

-$417.75 |

-3% |

| Student Loan |

$3,082.55 |

$3,082.55 |

$0.00 |

0% |

| 401k Loan #1 |

$7,392.73 |

$7,125.07 |

-$267.66 |

-4% |

| 401k Loan #2 |

$6,634.05 |

$6,450.11 |

-$183.94 |

-3% |

| Total Priority Debts |

$59,346.90 |

$58,230.01 |

-$1,116.89 |

-2% |

| Total Non-Priority Debts |

$182,573.60 |

$181,501.18 |

-$1,072.42 |

-1% |

| Total Debt |

$241,920.50 |

$239,731.19 |

-$2,189.31 |

-1% |

| Savings |

|

|

|

|

| General Savings |

$50.00 |

$50.39 |

$0.39 |

1% |

| 401k |

$25,605.69 |

$26,913.12 |

$1,307.43 |

5% |

| Robinhood |

$292.69 |

$0.00 |

-$292.69 |

-100% |

| Coinbase |

$35.63 |

$0.00 |

-$35.63 |

-100% |

| Total Savings |

$25,984.01 |

$26,963.51 |

$979.50 |

4% |

Glad to see that debt went down and savings went up, even with cashing out the Coinbase and Robinhood accounts. This doesn't include the 401k contributions and loan payments from Friday's paycheck, those take a few days to reflect. So the progress is even a little more than shown here, but I wanted to keep it clean and set the update on the 1st of every month.

Posted in

Uncategorized

|

1 Comments »

January 28th, 2021 at 07:30 pm

This is probably going to be a bit of a scattered entry. Stream of consciousness lol.

2020 Taxes - 2020 W-2s became available from my employer early this week. I went ahead and entered it, and entered an estimate of my mortgage interest (I have this info already), my share of the building mortgage interest, and my share of the property taxes (these are both estimates based on 2019). Based on these numbers, it looks like I am still better off by a few thousand dollars using the standard deduction, and early estimates show my federal refund coming in at $2k. I know this can change a lot as you move through the different steps so I am not holding my breath yet lol. Hopefully the info on the building comes in the next few days, and then I can go ahead and complete my taxes and know for sure what I'm getting back and when. Either way, whatever I get back will be divided between extra debt pay down and getting at least a baby EF going since I have not been able to add to savings yet via paychecks. Once my 2020 state refund is received, I'll go back and file the amended state return for 2019 to claim the additional money I think I'm due back for that year. Since that has to be filed with a paper form, I don't want to hold up 2020's returns/refunds by doing so.

Payday - it's tomorrow and I am hopeful that the changes in withholding that I made move me in the right direction. I am looking at a budget shortfall of $163 (based on previous take home), and that doesn't even include spending categories such as groceries etc. So we shall see what's what after tomorrow.

Amazon returns - one more processed, and so there's only one more outstanding. Hopefully that will be processed soon. Right now my gift card balance is $36.22, and will be around $88 or so when the remaining return is processed. Haven't decided what I am going to spend that on, but I'm in no rush. I also have $19.60 in Target merch credit (can only be spent in store).

Tuition reimbursement - My company announced today that starting in 2021, they are offering tuition reimbursement as one of our benefits. This got my wheels turning. I did not finish my degree, and it's always bugged me that I have student loans (low as they may be) without a degree to show for it. I have proven that I don't need a degree at this point in my career, but it would be helpful in terms of obtaining a common certification (the years of documentable experience needed are less with a degree). It's a great thing to put on my resume, and I know for certain that my company would pay for the exam fees. So, I am looking into degree programs, and pondering the thought in my head. I would likely be attending one of the state univerisities, and full time tuition for the year is around $7k plus fees. My company would reimburse $5250 per year. I have to work out how long the program would take based on my current credits, and how much it would cost, and what I would end up paying out of pocket. Still lots and lots to think about. But I think overall it would be a good idea, even if it ends up with me taking on a small amount more of student loan debt. I gotta play with my spreadsheets lol.

Otherwise, keeping spending very tight is still going well. Starting to plot out getting my spending categories/slush funds to eventually be funded (well, I can't fund them yet, right now we are still in the discovery phase haha). Weight loss journey is going well. Sticking to my plan, annoyed with the scale being slow to respond, but that's kind of what they do so....

Posted in

Uncategorized

|

2 Comments »

January 25th, 2021 at 05:21 pm

Since the last time I posted about it, I ended up deciding to increase my withholdings from my twice monthly check. I had been referring to it as "single zero" and "single one" but it appears that in 2020, the W-4 changed and is now completely different and confusing lol. After a lot of googling and researching, I was able to figure out how to update my online W-4 in such a way that I would get a very small refund next year, and increase my take home pay every check. Hoping I did it correctly, I guess I'll find out Friday haha. I did also model what lowering my 401k contribution would look like....knowing that I didn't want to take that step. It turns out that my take home pay would go down, since I'd be increasing my taxable income. So less take home and less being contributed? No thanks. Not helpful at all. I'm estimating that the change in my withholding should net another $100-$150 a check. Between that, and the extension on student loan forbearance, hoping that that closes the budget gap a bit. Still more work to do but baby steps.

I also stopped procrastinating on resolving some tax issues I had with my 2019 state return. I purchased my home in Sept of 2019, and moved out of NYC (which has an income tax) to a suburb that does not have one. I reflected this incorrectly in my state return (no impact on federal), and instead of getting a refund like I thought, the state came back to tell me that I owed them money. Yuck. Once I saw their notice, I understood what I had done to screw it up, but I also realized that they had screwed it up too....I didn't have the patience to work it out at that time, so I just paid the money they said I owed, so I didn't get any penalties, and knew I'd eventually fix it, and hopefully get some of that back. I figured now was as good a time as any, so I spoke with someone in my state tax department on Friday, they walked me through what I needed to do, and if my new math is correct, I should be getting about $400 back from the state for 2019. I do need to amend my 2019 state return, so I think I am going to file 2020 taxes, and then file the amendment, since I have 3 years to do it. My assumption is that the amendment will take longer to process than the current year taxes, so I don't want to hold up 2020's waiting for the 2019 amended to work it's way through. That also gives me time to find a tax preparer to possibly just handle the amendment for me for a reasonable price. If someone wants to charge me more than $100 for it, it's not worth it to me. I'll just go through it again on my own. For 2020, I have most of the documents I need to prepare them. I do my taxes on my own and this is (usually lol) a simple affair. Although I am a homeowner, I own a co-op (similar to a condo), and so the portion of my ownership expenses that I can deduct are not huge (my personal mortgage interest + my portion of building mortgage interest + my portion of property taxes). The standard deduction is still far more beneficial to me. Since this is my first full year owning, I will wait until the documents from the building's accountants come through, but am assuming this will be the case. I'm roughly estimating a $1400 refund from federal and owing a small amount (less than $100) to state. I can live with these.

Tracking of spending continues. 75% of the way through the month, and I'm a bit dismayed by my total spending amount so far - I've spent about $525 on non-bills. Of that, $135 is a yearly cost paid in a lump sum, $90 is periodic but not monthly costs, and $70 are one-off amounts. The remaining $230 is food, with 96% of that being groceries. If I weren't being as granular as I am with tracking the spending, I would freak out. I'm not thrilled as that seems like a lot, but hopefully when I have the picture of a few months and can see an actual trend, not a standalone data point, it looks a bit better. But for now, the grocery spending seems ok to me. A touch high but I did replace some protein powder this month which is always spendy.

Once I have a few months of this data, I'll use to start incorporating these amounts into my budget - to fund spending categories, ala the envelope method without actually using cash. My primary bank doesn't offer sub accounts that I can easily set up this way, so I think I'm going to do a bit of research to see if another bank nearby offers this. If not, I'll just keep it all in one bucket (my main checking) and track the breakout manually.

Other than that, nothing big to report. Just waiting for the next payday to make some more progress! Still going strong on no unnecessary spending.

Posted in

Uncategorized

|

2 Comments »

January 19th, 2021 at 08:28 pm

I received a surprise $50 gift card from my company for a project I've been working on today. It was a virtual Visa, I decided the best way to use it was to purchase an Amazon gift card for $50 (so I didn't have to worry about lining up amounts, etc.). After a few minor technical difficulties, I was able to reload my Amazon gift card balance.

I then ordered the 12 pack of half pint jars that I was looking at, plus a 5-pack of foot peel masks, and a set of mason jar lids that have straw holes so I can take my smoothies on the go with me if that's ever desired. None of these things were necessities, so they needed to be funded from "found" money. The total came to $44.76, and I have $5.24 remaining on my gift card balance. I still have ~$45 pending as mentioned in my last post, and another $50 or so for an item I haven't yet dropped off at the UPS Store yet. I'll decide what to order with that balance at some point in the future.

Over the weekend, I received a refund to my gift card balance of $15.15 for something else...I ordered a flat sheet which came to $15.16. So the penny came out of pocket....I decided I could live with that lol.

So far so good on not spending any "real" money on wants.

Once my transfer from the new checking account comes through (hopefully tomorrow?), I can pay the remaining bills from this pay period, and hopefully make a transfer to savings. I also need to get some more grocery/household items. I go grocery shopping a lot, but they're usually small trips. I find that if I do a big shopping trip, it's less likely to be things I will use imminently, and moreso stocking up on random things because they're on sale. Trying to only buy what I need.

Speaking of groceries, I've been trying to focus on cleaning out the freezer. All through the pandemic, every time they said there was going to be a meat shortage, I would panic and buy meat - then never use it lol. I also bought frozen veggies. I've been going through and finding uses for the things in the freezer, so I haven't had to buy much in that regard - this week's dinner was completely out of the freezer, as was last week's. Plus I made a large batch of meatballs & sauce, that covered dinner with a friend Friday, dinner with my mom and sister Sunday, and 2 containers of just sauce for the freezer. All of that was made with things I had already. I have plans for lots of other things in there as well. I did realize that I have no bacon left - which is ojnly funny to me because for the last few years, I have eaten bacon every day as part of my breakfast meal prep. Through most of the pandemic, I had 3-4 pounds in the freezer at a minimum at all times, I would buy a few pounds every time it was on sale, or buy it in bulk from the warehouse store if I was there. I changed up my breakfasts in November sometime, and haven't made bacon more than once or twice since then....nor have I bought it because it wasn't top of mind. Over the weekend, I had a use for it, so went o pull some out of the freezer, and realized....that was the kast pound lol. So I guess next time I go to the warehouse store I'll get some, unless I see it on sale before then, but it just struck me as funny. Bacon was almost as precious to me as toilet paper was during the early months!

Posted in

Uncategorized

|

1 Comments »

January 16th, 2021 at 10:35 pm

The other day, I was thinking that I needed to check to see when I would be charged for my annual Amazon Prime subscription so I could make sure that I had funds in place for it. Didn't follow through on it, as I was busy.....and woke up today to check my bank account and see that it had been charged to my debit card. Blergh, not part of the plan for this paycheck. Oh well. I made some adjustments and shifted things around to cover it, and decided to add yet another tab to my endlessly evoloving spreadsheet - one to track annual expenses that are not (as of yet) funded in my budget. I'd like to get to a place where anything outside of bills and savings doesn't need to be tracked because it can just be paid for out of "leftover" money....but I am not at a stage where I have leftover money or a buffer to work with yet. I'm hoping that all of my tracking helps me lay that foundation.

Update on Amazon returns - I chatted with them again, and they were able to push through the refund for my purchase. I did get an email confirmation for it, and should see it reflected on my credit card in a few days. They also said that they were pushing through my gift returns, but I have not seen those yet. The rep said that I would see them in my gift card balance in 2-4 hours....it's now been 24 and nothing. I also started another return today, which was supposed to be an instant refund to my gift card balance if I went that route. Also not showing in my balance....so I guess I'm going to have to get back on chat with them. Kind of annoying. I do understand that they're swamped right now, but I would prefer if they were open about delays rather than committing to timeframes that are not realistic. It's mostly annoying since I want to use these gift card balances for "fun money" - I decided I am going to purchase a set of half pint mason jars (I use them for a lot of meal prep and storage but only have 1 in that size), and a fitted sheet. That's about half of my currently pending gift card balance (waiting on about $60, this adds up to $31). I am going to be returning another gift this coming week, a set of sheets I decided against, which should put another $54 or so into my balance. Which leaves me with ~$80 in fun money when everything processes. Not sure what I will use that for, not in any rush. I'm trying to be much less impulsive about just placing the quick Amazon order "because it's only $10".

Posted in

Uncategorized

|

2 Comments »

January 15th, 2021 at 07:05 pm

I am paid semi-monthly, on the 15th and last day. I was very happy to see the calendar hit the 15th today....both because I want to continue having actionable items on my goals for the year, and also because I needed an infusion of money lol.

I was pretty impressed to see that the HSBC direct deposit is already in effect. That means that I will have met the requirements to earn the bonus with my March 31 paycheck, and can expect to receive the bonus itself by May 31.

I had to lower some of my planned payment amounts for a few line items, because there just wasn't enough to cover it all. This paycheck was my first at my newly increased salary and my estimate on PaycheckCity was a little off, so I need to go back in and recast my allocations.

Overall, I need to either increase income (which isn't all that easy since I am on salary), or get rid of a few obligations. I may have to consider lowering my 401k contribution, which I reeeeeeally don't want to do (but it's an option). I'm also going to take a look to see what impact changing my tax exemptions would have (I currently claim single 0, in the past when I've needed more money in each check, I've bumped to 1, but usually didn't like the results at tax time). That could also be an option just to get me through the next few months until I can set them back to 0. If the newly announced next coronavirus package passes, and we get an additonal $1400 check, I will definitely use that to help it along. I'm also hoping that they extend student loan forbearance (at a minimum).

All a work in progress. Either way, I am really enjoy tracking my spending by category, it'll help me determine what an appropriate amount to allot for that category is based on my current lifestyle. It feels like I am spending a lot on groceries ($123 since Jan 1), but I guess when considering that I don't spend any money on takeout, and make all of my food from that, it's $8 a day. Of the $275 I have spent so far this month, almost everything except groceries was either an outlier purchase or something that is a multi-month supply (prescriptions, printer ink, etc). I would guess my Feb spending will be lower. Hoping so, anyway.

Still waiting for my gift returns to be processed by Amazon, so no "fun/free" spending for me just yet. There's also a non-gift retuen still pending that will be refunded directly to my credit card. They told me on Wednesday that they should be processed no later than last night. Havent gotten any emails about it yet, so I need to get back on chat with them today.

Posted in

Uncategorized

|

3 Comments »

January 13th, 2021 at 07:07 pm

Part of my personality is that I get frustrated with inaction - if I have a goal, I want to always be doing something towards it. Since this doesn't necessarily work for debt payoff (since I only get paid twice a month, and there's just not a realistic expectation that I can do something tangible towards this goal every day), I am constantly tinkering with the tools I use for financial management, because it makes me feel like I'm doing something lol. This does often lead to overengineering of my spreadsheet, but I also really enjoy playing with spreadsheets.

Way back in 2002, I started developing the spreadsheet I call my budget. That's not reeeeally an accurate name, but good as any. The main tab is a grid of what needs to be paid out of each pay period through the year (which means that on payday, I just pull it up and it takes 10 min max to pay all of my bills - I don't pay bills when they're due, I pay them on the payday prior). Over the nineteen years since I started doing it this way (holy crap how did that happen?!), I've added a lot of other tabs to track different things that I've wanted to keep an eye on depending on what my goals were that year.

One thing that I haven't really tracked is spending. For a long time, I had two jobs - my day job, and a second job 4-6 nights a week where I made almost as much (if not more sometimes) as my day job. Day job was for bills, night job was for living and playing. Once I stopped working my night job, I had to figure out how to fund my living and playing expenses. That was 7 years ago and it's been a long time coming that I actually started tracking.

So I recently added 2 new sections to my spreadsheet.

The first is to track spending. My plan is to track, by category, everything I spend on non-bills. So far, my categories are alcohol, grocery/household, toiletries, car/auto, medical, office supplies, and miscellaneous.

The second was borne out of my post to document a 2021 baseline of where all of my debt & savings stood as of 1/1/21. I decided to go ahead and create a tab for that, that will also calculate the net change in dollars and in %. I'm planning to update this monthly to give myself a little bit of a boost when I feel like I'm not making any progress. Numbers don't lie

Posted in

Uncategorized

|

0 Comments »

January 12th, 2021 at 04:58 pm

I don't think I went into too much detail on this in previous posts, but for the next few months, I've put myself into a discretionary spending timeout. The only thing I can spend money on out of "real money" are groceries, and replacement of household essentials (mostly cleaning supplies, etc).

I mention "real money" because I left myself a small loophole so I don't feel like I am completely depriving myself of the shopping dopamine hit haha. Any store credits (ie, returns that could not be given as a refund, and can only be spent at that store) can be used for "fun" spending. My cousin and I joke all the time that it's not like spending real money, because in my opinion, I've already spent it. She disagrees lol.

I'm currently waiting on a bunch of returns from Amazon to be processed. All but one have been dropped at the UPS Store, but I think they're majorly backed up. Usually when I do an Amazon return this way, by the end of the day, I've gotten an email confirming receipt of the return, and the refund is processed. I dropped some returns off last week, and they have not been processed yet. Dropped three more off today, so not sure what to expect timing wise. I have one more to drop off, but I am going to drop that one off at Kohl's to see if that happens faster.

Of those returns, 3 were Christmas gifts that I ended up deciding against. Those will be credited to my Amazon account as a gift card balance. This should be somewhere around $95....based on the rules I've set for myself, I get to spend this on whatever I want, not just necessities. There were a few things on my Amazon wish list that I did not get for Christmas, so I'll have to decide what of those I want. Two of the returns were purchased with my credit card, so the refund will just go back to it, and I don't get to play with those funds lol. And finally, one was something I purchased for my mother. I transferred the money for that purchase from her bank account to mine to reimburse myself. So once I get the refund, I'll transfer it back to her, as the correct item has already been purchased.

I'm playing with the idea of giving myself a small "play money" allowance every paycheck in a few months once I've caught up a little more. I've seen a lot of people do this via these blogs and have always been intrigued. Not sure what amount is appropriate - it'll depend on how much is leftover after all budget line items are satisfied. But I do think that it would help with my impulsive spending. If I set boundaries that I can buy things for myself, but it has to come out of this bucket of money - if I want something more expensive that can't be funded from one month's allowance, then I need to save up for it. Obviously much larger purchases would have to be considered separately, but I can't think of anything that would meet that defnition that I want soon, so I can hold off on figuring that out for now.

Posted in

Uncategorized

|

2 Comments »

January 5th, 2021 at 07:58 pm

For the past few years, I've been using bank account bonuses as a way to make a little extra cash without too much effort on my part. I have access to update my direct deposit on my own via ADP, and I'm already used to managing multiple accounts, so it's worth it to me. I tend to stick to those that don't require minimum balances, and only want you to have funds directly deposited. I also don't mind transaction requirements if they're within reason. Since I am working remotely, and not in NYC for the time being, I am also sticking to banks that have a branch local to me, in case I need to go withdraw it on payday to deposit into my main checking.

In early December, I saw a bonus for Capital One. Open a checking account (no fees on this kind of account), have $1,000 in total direct deposits within 60 days of account opening, and receive a $400 bonus. I opened the account 12/2, and completed my DD requirements by 12/31. Based on their schedule, I should receive the bonus by the endof April, although I expect it'll come sooner. I am hoping to put this completely into savings. There are no fees or minimum balance requirements to keep this account open, so I'll keep it open for 6 months just in case - sometimes there's a stipulation that the accunt has to be open otherwise they can claw the bonus back. Once the bonus is credited, I'll withdraw the majority of the balance, leaving a few dollars in there, and leave it be until mid-June.

The next bonus I chose was an HSBC bonus. I plan to open that account today (just waiting on my replacement printer ink to be delivered....I like printing out the offer pages and account confirmation screens just in case). This one nets a $200 bonus with monthly recurring DD totaling $500 received for 3 consecutive months. To avoid a monthly fee of $25, I'll need to keep a recurring DD going into this account. Once the initial 3 months have passed, I'll reduce it to $100 a paycheck or something like that. The bonus should take 8 weeks once qualifying activities are completed, or 5 months after DD begins. If I open the account today, I don't think it would go into effect for my next paycheck, so I am looking at July 1 or so for the bonus.

Once that's done, I'll see what else is around that I am eligible for and seems easy enough to complete. The downside to these bonuses is that you do get a 1099 on them, but it usually doesn't amount to so much that it drastically changes my tax situation.

Posted in

Uncategorized

|

3 Comments »

January 4th, 2021 at 08:02 pm

I’ve been off of work since Friday, December 18th, only logging on here and there. My company was technically closed from the 24th on, so I really only missed 3 business days, which means there isn’t a lot that happened while I was out. Thankfully, everyone is on the same struggle bus today, my boss and I were laughing about trying to remember how to do our jobs today. It should be a busy week, but thankfully quiet meetings wise.

My $600 stimulus payment was received on Friday. I was hoping to split this between general savings ($400) and my highest balance non-consolidation credit card ($200), but unfortunately there was a bit of a budget shortfall in last week’s paycheck/bills that needed to be paid from it. Ultimately, I think only about $125 of it will end up in savings, and no extra sent to debt. Oh well.

I received word today that another account in the consolidation program will be paid off. That takes me to 4 paid off and 8 to go. Still a long way to go but progress nonetheless. I expect another 3 to be paid off within the next 6-ish months. Then we start getting into larger balances that will take more time.

I also added a new tab in my budget spreadsheet to create a snapshot of where I am at the start of 2021, vs where I’ll be at the end of 2021, so I can track the change. I’m not going to use this to project out, although I easily can. I just thought it would be a nice measure of progress at the end of each year and it took me about 4 minutes to put together (aside from going and looking up the balances lol). It also forced me to log into my mortgage account and student loan account, which I had not done in a while. My mortgage was right around where I estimated. My student loan was (in a happy surprise) about $1k less than I estimated. Below is where things stand as of ~1/1/21:

Debts:

Priority Debts:

Consolidated Balances - $30,361.05

Non-Consolidated Balances - $11,485.85

Mom - $17,500

Total Priority Debts - $59,346.90

Non-Priority Debts:

Mortgage - $150,447.16

Car Loan - $15,017.11*

Student Loan - $3,082.55

401k Loan #1 – $7,392.73*

401k Loan #2 – $6,634.05*

Total Non-Priority Debts – $182,573.60

*Car Loan, and 401k Loans are only in this category because they will be paid off by 2023 on the normal payment schedule. I have bigger fish to fry so I am just going to leave them be and pay as scheduled unless I get some kind of windfall that changes things. The nice thing about the 401k loans is that every payment towards this is a corresponding increase in my 401k balance, since I am paying myself back, in addition to my ongoing contributions.

Total of All Debt: $241,920.50

Savings/Assets:

General Cash Savings - $50 (yikes!!!)

401k - $25,605.69 (this will be fully vested in May, so no point IMO in splitting out what is vested vs what is not. As of January, all but about $3k of this is vested)

Robinhood - $292.69

Coinbase - $35.63

Total Savings/Assets - $25,984.01

This does not include the value of my home, or the value of my car. If I want to calculate net worth, I could add in an estimate for each of those, but one thing at a time.

This is sobering to look at, especially all in one place, but I’m very excited to see the decreases to debt, along with the increases to savings/assets as time progresses.

Posted in

Uncategorized

|

2 Comments »

January 1st, 2021 at 07:34 pm

We made it! While I don't have any illusions that the calendar switching from 2020 to 2021 will solve all of the issues plaguing us as a society, it still feels like a milestone that I definitely had doubts about hitting at multiple points through the year.

So. 2020. What a year.

Focusing on financial stuff only, I started the year with mounting debt, took some steps (401k loan #1, and a balance transfer) to try to tackle it, but they weren't enough, combined with not changing the behaviors that caused me to get into the debt in the first place. In August, I was enrolled in a debt consolidation program (see previous post), and by October found myself taking about ANOTHER 401k loan. This loan was mostly used to pay down my main credit card. By December, this card was maxed again. At the same time, I was in a toxic involvement, that had me spending a lot more money than I should have been (increased grocery and gas bills, plus underlying anxiety about it causing me to shop excessively). Once that ended in mid November, it led me to take a hard and critical look at everything in my life and come up with a plan to fix it. I've always been very good and making a financial plan, but not so good at changing the behaviors. This time was different. I was spending willy nilly. I've pretty much stopped that, and some of my expenses have dropped dramatically as well, so while I could try to analyze what exactly I spent so much d*mn money on, I don't feel like it's helpful at this point so I am just moving on.

I stopped making resolutions a few years ago, as I felt they were too rigid. I try to make goals. This year, I saw suggested somewhere that you set a theme for the year. I liked that, and so my theme for the year is "Forward". All of my goals tie back to the theme.

2021 goals:

Stay the course with current debt payoff