|

|

|

May 5th, 2022 at 07:54 pm

This post comes a few days later than usual, this week has been busy busy busy, lots going on in life!

April Spending:

As always, this does not include my bills, only "discretionary" spending. I cannot change my bills as easily as I can change discretionary spending. My goal is not to live as frugally as I can, I only track my spending to be able to establish patterns and made decisions based on those patterns.

Category - April Spend/YTD Spend: context

Car/Gas - $148/294.28: this one is deceptive. While it does include an expensive tank of gas (ouch), it also includes a toll pass replenishment that will be reimbursed (went to another office for the day for work) next week, so the credit will appear in May. I also ordered a replacement copy of my car title, as I noticed last year that it had my old address on it.

Clothing/Accessories - $134/$742.07: sigh. I don't need to be buying clothes. And yet....

Dining/Entertainment - $484.07/$1428.73: ewwwww - the slightly good news is that I was able to submit for reimbursement for about $210 worth of this based on a temporary stipen my company gave us. Still horrifying total but that helps. I've been so uninterested in my usual meal prep for the past month+, but hoping to get back on track now that school is over for the semester.

Gifts - $0/$81.85: nothing here this month, yay!

Grocery/Household - $702.52/$1715.40: this is quite high due to some stocking up I did this month. I won't need to buy several of these items for a while now, so I am ok with it. Since I had Covid earlier in the month, I also had to use Instacart to get some grocery deliveries which is always more expensive than just going myself.

Health/Wellness - ($224)/$339.97: this is coming up as negative because I received my health & wellness stpiend reimbursement from a purchase made in this category in February. The only actual spending here this month was my monthly Peloton membership for $26.

Home Decor/Furniture - $320.68/$708.38: I splurged on a table I have had my eye on. Completely unnecessary and I did not deserve it lol. But here we are.

Medical (non FSA) - $1400/$1289.22: I put the deposit down for my surgery - this was 10% of the portion I owe OOP after insurance pays their part. The YTD number reflects a refund I got earlier in the year for a payment I made in 2021. This number will be ugly by the end of the year but it has been planned for a long time, so I'm thrilled to have it look like this.

Miscellaneous - $510.98/$626.14: I will probably rearrange some of the items I put to this category - this was a new vacuum (mine died ugh and I cannot be without it since I have carpets and cats), and a copy of my birth certificate I need for a family project I am working on. Can't decide where to move the vacuum to, but it'll be somewhere different by next month haha.

Office Supplies - $0/$126.21: another no spend category!

Personal Care - $352.73/$1347.44: needed to replenish a lot of products. This is even a hair salon month, and I didn't have my monthly mani/pedi date with mama since I had covid. Blergh.

Pet - $173.22/$340.59: had to stock up on litter and both types of food, plus I bought a new litter box.

Subscriptions - $2.99/$140.93: monthly iCloud only this month.

Travel - $0/$1689.37: this one shouldn't see much more action until the fall.

Total (excluding FSA spending) - $4005.19/$10870.58

Medical (FSA) - $279.38/$856.21: I don't include this in my total since the money has been set aside for this purpose at the start of the year and is funded pre-tax from my paycheck. This account is going to be getting a workout for the nesxt few months tho! This month was a few co-pays, prescriptions and covered supplies.

Overall, my spending is getting out of hand again and doing this exercise every month helps me recognize that.

April Summary:

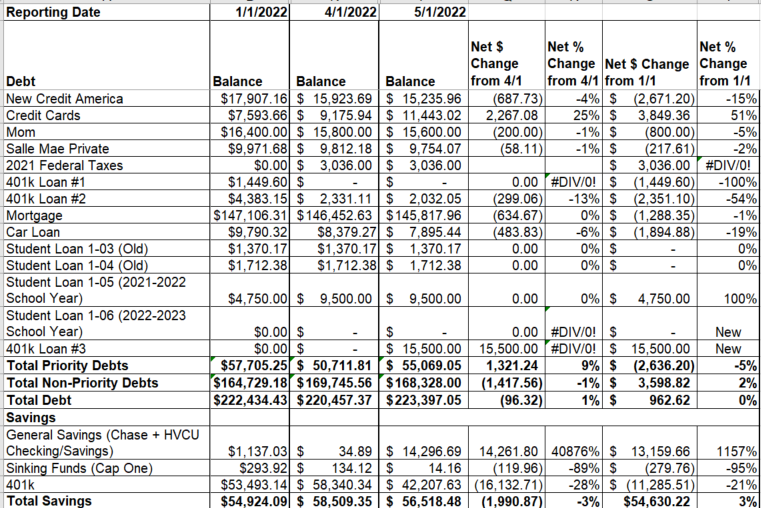

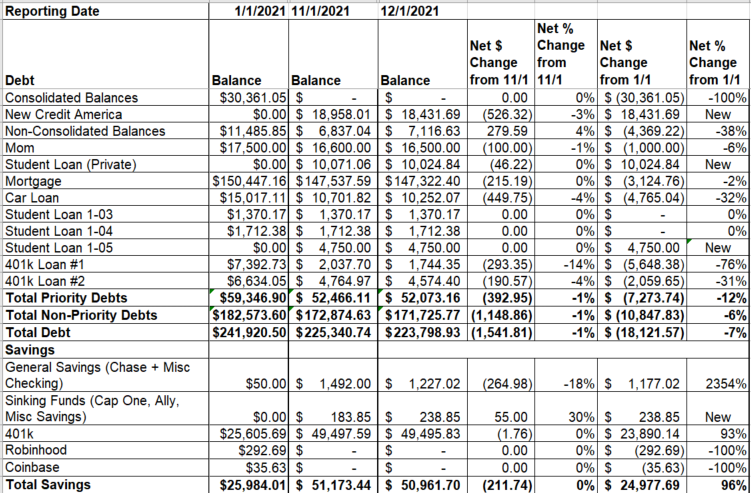

Some of this bleeds a little into May but I didn't get a chance to take the screenshot earlier. Usually, this does not include the 401k contribution/loan payment from my last paycheck of the month, but this month it does!

Credit card increase is concerning. Everything else is as expected. I did go ahead and take the 401k loan I have been planning for my surgery, and have it sitting in savings until I need to make final payment. I also took enough to cover potential coinsurance and deductible I might still need to meet, but can hopefully use my FSA for that. 401k loan 2 should be paid off by the end of this month or mid next month depending on when my final grades are posted, and my tuition reimbursement is processed. I will also start tackling my federal tax balance this month. Lots going on. I will do another post about it, because I am tired now lol.

Posted in

Uncategorized

|

4 Comments »

April 11th, 2022 at 06:15 pm

The same day I posted my last entry, about my my 2022 merit increase, and ended with that I wouldn't be interested in changing companies for a while now, I ended up having an interesting conversation.

My former boss, who left last year, and I had been trying to figure out a time to catch up. We are the same age, have remained very friendly, and get along very well. She was always an advocate for me, even when she was not my boss. We last minute chatted later that day.

During the course of the convo, she basically said she wanted to hire me to come with work her at her new company. For background, it's essentially the same kind of company - same industry/vertical etc. Slightly different role, but she is the department head, and I would be her second in command essentially.

I was upfront with her, and said that I would not be able to make a move until after my first round of surgery since there's STD and insurance to consider there (those things aren't a factor for the second round). She was amenable to that and we are going to stay in touch. The new company does have tuition reimbursement, and I could negotiate a signing bonus to cover the amount I would have to pay back to my company for leaving before the time period is up (I have to pay back any TR from the past year - at that point, it would be 3 semesters worth so just about $8k). My workload for school for the remaining 3 semesters should be easier, and I'll be through the hardest parts of school and recovery.

It would be at the next level, with probably a considerable salary increase, and comparable benefits, work/life balance, etc. A lot to think about!!!! I am probably going to make plans to go see her in May/June (she lives in the next state over, about 2 hours away), and we can talk about it more.

Posted in

Uncategorized

|

3 Comments »

April 6th, 2022 at 07:39 pm

Our annual merit increases came out the other day, and I was given 3.5%. My new salary is $119,025.

I am mildly disappointed by this, as others on the team who did not receive as high of a rating/are not as high of performers received larger percentages, however my overall salary is quite a bit higher than theirs so my raise in dollars was higher. My manager expressed that she felt that she should been included in the convo on how to allocate the pool of funds, but it is what it is.

It goes into effect for my next paycheck on April 15th. I ran an estimate and the increase to my net pay should be around $150. I am waiting to make plans for the money until I see exactly what it is. This will also lead to a small increase in my 401k contribution, since that's determined based on a percentage of my gross salary. I contribute 15%, and in order to max at this salary, I would need to contribute 17.2%. As already planned, I will probably not actively increase to get to maxing, as my next promotion will likely get me there with my current level, and that will be happening within the next year.

I could very likely make more money (potentially significantly so) if I were to change jobs, but there are other factors that make staying here worth it. My work life balance is excellent, I have tuition reimbursement, and excellent health insurance/short term disability benefits that are key for my surgeries this year. I am recruited often, but don't plan to make any moves until at least 2024 unless it's an opportunity I cannot pass up.

Posted in

Uncategorized

|

2 Comments »

April 4th, 2022 at 07:38 pm

This will likely be a long post, but I don't have the brain space to separate. I'll be looking at my March spending, my 3/31-4/1 summary, and check in to see where I am with regards to my 2021 goals.

March Spending:

Reminder, my spending does not include bills, those are fixed and I cannot adjust them as easily in the short run. This is anything variable or discretionary. I track every penny I spend, for better or worse, and use this data to try to make decisions. My goal is not to be as frugal as possible, but it is to know where my money is going. I am not looking for advice on how to cut spending by sharing this, sharing mostly for myself and to provide a full picture of my financial life.

Key: Category - March spend/YTD spend: context

Car/Gas - $68.90/$146.28: this was one gas fill-up, a toll pass refill, and parking. If I use change to pay for a parking meter, I don't count that, but if it's via an app that is paid for with a card, I do include. The gas fill was about 2 weeks ago, and I still have 3/4 of a tank.

Clothing/Accessories - $26.53/$608.07: I had birthday rewards from two stores I frequent, so the $26.53 was my OOP portion from what I ordered. I was able to get 2 bras for this amount, which is crazy. A single one of my bras runs $50-$60.

Dining/Entertainment - $280.54/$944.66: this amount is crazy to me, and I am clearly getting out of hand with this spending category. To be fair though, $60 of this is an annual payment for one of my streaming services. Better but meh. I categorize this in entertainment rather than subscriptions because it's something I can cancel if I can't afford it.

Gifts - $81.85/$81.85: Mama's birthday was in March, and this is the only occasion I have bought gifts for thus far. I pretty much buy gifts for her birthday, Mother's Day, my sister's birthday and Christmas gifts for my mother, brother and sister (he and I do not exchange birthday gifts). This is never a category I worry about.

Grocery/Household - $269.77/$1012.88: taken by itself, this category looks great (I budget $400 a month for groceries), but clearly it's only low because I was ordering too much damn takeout.

Health/Welless - $26/$563.97: the only spending here was my monthly Peloton membership.

Home Decor/Furniture - $0/$387.70: no spend here! Not anticipating much in this category for the rest of the year honestly.

Medical (non-FSA) - $0/($110.78): all of my medical spending this month was done via my FSA which I track separately. This category is still net negative YTD due to a large refund I recieved in January.

Miscellaneous - $0/$115.16: another no spend! My goal is to have as little in this category as possible so I can accurately group spending.

Office Supplies - $0/$126.21 - on a roll  This one is generally used for printer ink and paper. I should be good on ink for a while, although I will need paper soon. This one is generally used for printer ink and paper. I should be good on ink for a while, although I will need paper soon.

Personal Care - $320/$994.71: March was a hair appointment month, as well as my month to pay the tip for my monthly mani/pedi date with Mama.

Pet - $15.41/$167.37: just some litter deodorizing crystals. I do have to buy some food and litter this week, which will hopefully stock me up for another month or two.

Subscriptions - $2.99/$137.94: monthly iCloud. I have started trying to track subscription costs in the category that they truly live in, although I go back and forth on it.

Travel - $979.35/$1689.37: my trip to New Orleans is basically all that is captured in this category. Not expecting much else here this year due to other stuff going on.

Total excluding FSA - $2071.34/$6865.39 - I'm averaging about $2300 a month in discretionary/variable spend. This is about 24% of my gross income.

Medical (FSA) - $251.98/$576.83: this month's FSA spending included co-pays, prescriptions, my responsibility for a visit earlier in the year that was billed, and the new cost for my therapist since she has gone out of network.

Grand Total including FSA - $2323.32/$7442.22

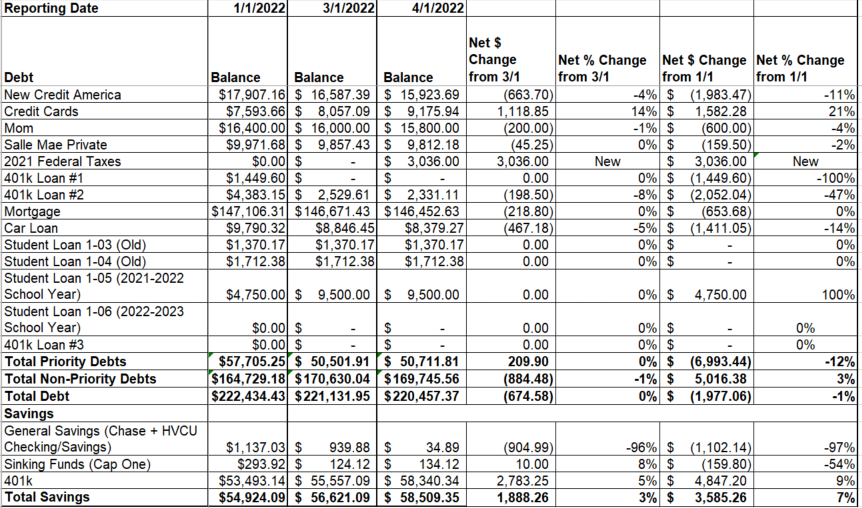

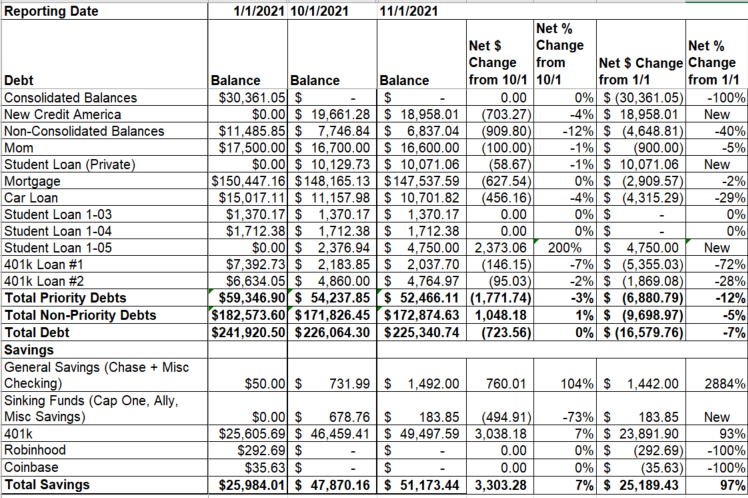

March Summary

Below is the image of my chart where I keep track of my monthly summary, in a month over month view. As always, this does not yet include my 401k contribution/401k loan payment from my most recent paycheck, it hasn't posted to the account yet.

Not thrilled with this month's snapshot, although as usual not surprised. I added debt in the form of an installment agreement for my federal taxes, so it looks like it's wiped out all of the progress I have made YTD (which before that wasn't as much as I would have liked to see). The federal taxes should be paid off by the summer, the terms of my installment agreement are that they must be paid in full by 10/1. I also had to raid savings to pay the state portion of my tax bill in full. Not happy about that but better than adding another installment agreement/more debt.

Goals Check-In end of Q1

Financial Goals (in order of priority):

1. Pay off 401k Loan #1 - done!

2. Increase 401k contribution to 15% - done!

3. Refinance mortgage - goal removed, this is not the right environment for my financial situation, so I will revisit this next year, maybe. Or not bother, depending on how things are going.

4. Pay off NCA loan - goal removed. This was contingent on the refinance, but I will just continue to make my scheduled payments (which includes an additonal $300 per month to principal).

5. Pay off 401k Loan #2 - end of May? this is on track. Balance is currently around $2300, before the latest payment which has not yet posted. It should be around $1800 by the time I receive my tuition reimbursement from this semester, and will be paid in full.

6. Pay main credit card down to 50% utilization - EOY. I will likely need to revisit this goal since the refinance didn't happen, but am still hopeful.

7. Pay off private student loan - goal removed. With the refinance off the table, I will just continue paying the regularly scheduled payment and re-assess later in the year/next year. I did want to have this loan paid off before I graduate, but that might not be in the cards.

8. Pay main credit card down completely - stretch goal, EOY. this is likely off the table as well, but leaving it here in case I can make some magic happen.

No priority assigned - these "goals" have either been completed already, or are guaranteed to be completed when the time comes so they do not have a priority. I still think there is power in putting them down on paper so I can take stock in goals I have accomplished, even if it was easy!

a. increase autosave - the day after every pay day, my bank automatically transfers $$ to the savings account I have with them. I ended 2021 with it being $50 per check, and have increased this to $100 per check.

b. increase payment to Mom loan - throughout 2021, I paid her $100 per month. I have budgeted in for $200 a month this year. This will get me down to $14k by the end of the year, so I have a lot of work to do on this one, as I would like it paid off before I buy a new home.

c. Fund two rounds of major plastic surgery - estimating my OOP cost will be around $30k. This will be funded from 401k loans. I'm not thrilled that this is how I am going to do it but it's the best option based on other factors. Sincerely hoping this is the last time I need to take one of these guys. I'll need to wait and see what the terms will be based on how much I take, do I split it into two loans, etc. But either way, the money is there, and I cannot wait any longer to save the money up in another fashion.

Non-Financial Goals:

1. Get to goal weight - done!

2. Complete two rounds of plastic surgery - first round early July, second round mid-December. on track, I have received approval from insurance for their part of Round 1, and have a follow-up appointment scheduled for the end of this month to talk next steps.

3. Stay the course with school - ongoing. on track, I am a few weeks away from the end of the spring semester, and have registered for my fall classes. 5 classes remain to register for.

4. Work towards my next promotion - ongoing. on track, based on recent conversations with my boss it seems that October is on the table for this.

Posted in

Uncategorized

|

1 Comments »

March 23rd, 2022 at 10:06 pm

Just a few mid (ish) month updates.

My vacation came and went. Spent more than I would have preferred to but it will be my only vacation this year, and I'm very glad I went. New Orleans is a lovely city, I got to have some special moments, and hope to go back soon to see and do more.

Finally completed my taxes. I owe about $3k to federal and about $500 to state. I will pay state outright, and will have to do a payment plan for federal. Between my bonus coming in May, and my homestead exception for property taxes that is paid out over the summer, that should pay them off completely. The amount owed is more than I had hoped for, but an additonal $22k of taxable income was added for 2021 between bank bonuses and cancelled debt so it is not a surprise.

I decided not to move forward with the refinance at this time. It just wasn't a good deal, and even if I feel it would have gotten me further ahead than where I can get by staying the course and making the planned payments, it was at too great a cost. There were a few helpful commenters, a few condescending judgemental commenters, and a few who clearly haven't read any of my other posts. While all but the first category of commenters annoyed me quite a bit, I decided to ignore them and move on.

The increase to my 401k contribution went into effect with my last paycheck. My estimate for the impact to my net pay was fairly close. Now I am just waiting for my annual merit increase to come out, which should be within a few weeks. Once I have that, I can do a little more concrete short term planning.

Posted in

Uncategorized

|

4 Comments »

March 7th, 2022 at 05:32 pm

I am rarely looking for advice when I post, so I want to be clear that this time, I am! Ha.

The bank with whom I had submitted an application for my refinance unfortunately denied me, saying that my credit score doesn't meet portfolio guidelines (mildly annoying since I was open with the team's assistant about where I believed it was when I spoke to her prior to formally submitting - and I was in the right range for 2 of 3).

However, on the next page of the denial letter, it's a bit more detailed, and goes bureau by bureau. Scores are 645 EXP/632 TU/600 EQ, and the reasons given are "serious deliquency" (2/3), "serious delinquency and derogatory public record or collection filed" (1/3), "proportion of balance to high credit on revolving accounts" (3/3), "number of accounts with delinquency" (3/3), "length of time accounts have been established" (1/3), "time since delinquency is too recent or unknown" (2/3). So basically, my utilization is too high, and all of the derogatories, while resolved, are too many/too recent for this loan. Not worried about the length of time one, I know the average age of my credit went down as some of my older accounts got closed, and that's only one report.

There are no current delinquencies on my report. There are a lot of accounts that were settled for less than the balance due, and the timeframe ranges from late 2020 through Aug 2021. I need to go through account by account again and double check that all reflect $0 balance, but I believe they do.

I got in touch with the gentleman who did my current mortgage (at a national bank), and using the info I fed him (ie, he did not do a pull, just entered my credit score as I gave him, based on the ranges from the denial letter (I did not see the 600, as it's on another page lol - perhaps subconscious denial lolol), so I gave him a range of 630-645. He was able to do a quick estimate but obviously nothing is certain. He was able to estimate that it would be a rate of 4.75%, I'd have to buy points to get that rate for a cash out refi, my closing costs would be around $8k, and, assuming my value is $220k, I would receive $20-21k at closing, and have a new payment of $918. For reference, my current monthly payment is $830, rate is 5%.

If I can successfully refi, I will be using the proceeds for payoff of the personal loan I took out to pay off the settled credit cards (this feels full circle lol). The current balance on that loan is about $16.5k. Without any extra payments, it is scheduled to be paid off in April 2025. I do pay extra twice a month. Currently the payment on this loan is $349.07 semi-monthly ($698.14), plus an extra $150 semi-monthly - for a total of $998.14 a month. The closing costs are high, but this frees up so much cash flow ($900 a month after accounting for the increase in my mortgage payment) that I can put towards the revolving debt, and then hopefully start saving for my next down payment.

My line of thinking is....I think I gotta settle for another crappy move in order to clear out of here, but I also may be not seeing it from all angles. By my math, if I take this offer, the closing costs will have have paid for themselves in 9 months, which is a full 2 years before the loan would be paid off otherwise. Much harder to quantify the positive impact this would also have on my other debt and my overall financial picture...with the freed up cashflow, I can probably have the credits cards paid off completely before the end of the year as well, not including other cash already budgeted to do so, and snowflakes that come in throughout the year. The closing costs are high and will cost me money, but less money than continuing the pay the insane interest on this loan and the credit cards. In my mind.

So....my two questions are....

1. Is this line of thinking sound, based on the context? Even knowing that this is an expensive mortgage to undertake, based on points/closing costs, I do still feel that paying the money will be better off in the mid term and beyond. But I am looking for external viewpoints. I may not end up agreeing in the end lol but seeing an opposing opinion is always good.

2. Based on the reasons for denial from the first bank, is it even reasonable to think I will get approved from another bank? Is it worth taking the hit for the inquiry to see, and go from there? If I get denied again, then I guess I have no choice but to wait a bit longer, and continue paying things as I am right now. I have reached out to a mortgage officer at another national bank (who just did a refi for a friend), but have not heard back. A broker nearby basically told me the closing costs were too high and he didn't recommend even trying then stopped responding to my emails <insert eye roll>.

Posted in

Uncategorized

|

10 Comments »

March 1st, 2022 at 05:25 pm

February is my least favorite month, so I am not sad it's over. The good news is that it's a short month, and it appears to have been a less spendy one, that's something anyway...

Off we go! As always, this captures just my "discretionary" spending, not my bills. I do not consider bills to be spending as I have less control over them in the short term.

The convention here is Category - Feb Spending/YTD Spending: context

Car/Gas - $41.60/$77.38: this was a tank of gas and some parking. I have definitely noticed gas prices going up, but since I don't get gas often, I haven't started to "feel" it yet. I average once a month or so.

Clothing/Accessories - ($2.48)/$581.54: after a lot of shopping in January, I had a bunch of returns that ended up leaving me with negative spending for Feb. I've talked about this before, but a lot of the time clothes shopping for me is necessary since my body has changed so much. Anytime things start to ease up and there is an opportunity for socializing, I realize how many holes there are in my wardrobe now!

Dining/Entertainment - $319.52/$664.12: this month included a birthday dinner that I covered for one of my best friends, as well as my share of drinks and dinner out with a friend I haven't seen for a long time. The rest was takeout and delivery. Blah, higher than I'd like, but my grocery category was fairly low, so I guessss it balances? Sorta?

Grocery/Household - $253.24/$743.11: as mentioned above, pretty low this month. I guess I just didn't need much. The amount I budget for groceries is $400 a month. If I can keep it on the lower side in March, that would also be helpful.

Health/Wellness - $473.42/$537.97: this number is misleading, as I purchased something that will be covered mostly by a wellness stipend from work, which I will receive reimbursement for in March, so there will be an offset. Otherwise, this includes something I moved from the FSA category as it was denied so I had to reimburse the account and my monthly Peloton membership.

Home Decor/Furniture - $0/$387.70: a no spend category!

Medical (non FSA) - $89.22/($110.78): this category is still negative YTD due to a refund I got in January. This month was some delayed medical bills from last year, so I could not pay for them using my FSA.

Miscellaneous - $0/$115.16: another no spend category!

Office Supplies - $0/$126.26: another one! This category should remain low this year, it pretty much gets used for printer ink, which I just bought in January.

Personal Care - $148.03/$674.71: it was my month to pay for mani/pedi with mama.

Pet - $151.96/$151.96: the usual. Cat food and litter. Got a good deal at Target so I stocked up, so I shouldn't have much if any spending here in March. Looks like I hadn't bought anything yet this year so that works for me.

Subscriptions - $2.99/$134.95: just my monthly iCloud this month. In March, I have a streaming service renewal coming (I prefer to pay annually rather than monthly).

Travel - $710.02/$710.02: this is the cost for the flight and my share of the hotel for my upcoming trip to New Orleans. The hotel actually didn't technically charge me yet, but my friend already paid me back for her half, so I figured it was easier to just leave it in February. With two major surgeries this year, I don't foresee much traveling this year, so while I would have liked to pre-fund a travel category to cover, it is what it is.

Total excluding FSA - $2187.52/$4794.05: not a very spendy month, even with the large travel expense. I'll take it

Medical (FSA) - ($146.06)/$204.85: I don't include this in my spending, since it is not money directly out of my pocket. I am aware that it's my money funding the account, but I don't have to directly budget for it  This month ended up being net negative, since I made a return/reimbursed the account for a purchase I had made with it in January that was subsequently denied. Otherwise, it was used for the usual - co-pays, prescriptions, etc. This month ended up being net negative, since I made a return/reimbursed the account for a purchase I had made with it in January that was subsequently denied. Otherwise, it was used for the usual - co-pays, prescriptions, etc.

Grand Total including FSA - $2041.46/$4998.90: Funny how it goes down when I include another category!

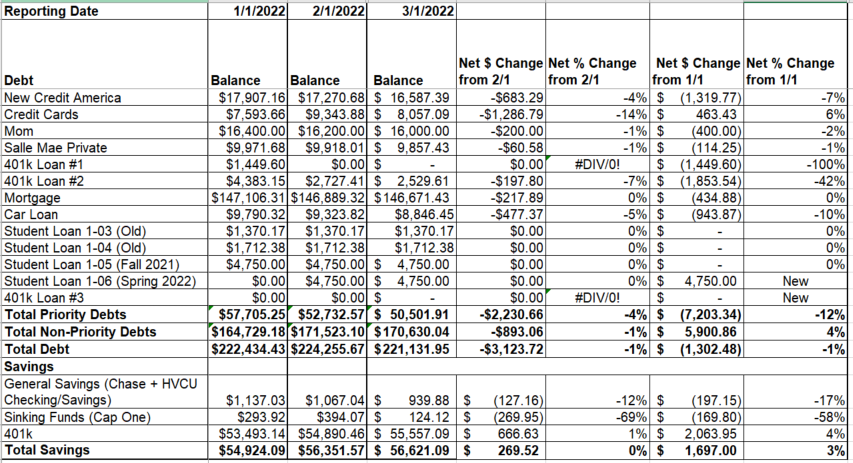

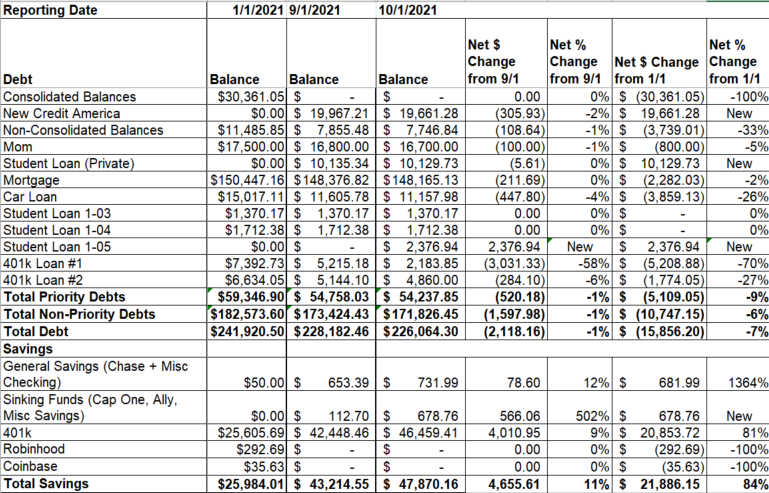

Below is this month's summary:

Debt still continuing to go down, still struggling to get those credit cards back down to where they were at the start of the year and beyond, but working on it. Cash savings took a hit this month to pay for upcoming travel, but at least it didn't go on a credit card. As always, this does not include the 401k contribution/loan payment from my end of month paycheck. Doesn't feel like a ton of progress was made, but I know I'm chugging along.

Posted in

Uncategorized

|

0 Comments »

February 18th, 2022 at 03:57 pm

I have officially started the refinance process. My current mortgage is a 30 year fixed, at 5%, with a balance of just under $147k. I am about 2.5 years into the loan, and my current payment is $830 a month. When I purchased my apartment in 2019, it appraised for $199k, but afterwards, I did a fairly extensive renovation, including completely gutting the kitchen. I am hoping for an appraisal of $220-225k. I would like to take $25k out to pay off a few much higher interest debts, and free up a large amount of cashflow every month.

I submitted an application with a bank nearby yesterday, and had a call this morning with the assistant on their team to discuss. Based on the soft pull, they're offering me a 30 year fixed at 3.875%, no points, and if the new mortgage is $180k (which would require an appraisal of $225k), my closing costs would be $3500-$4000, my monthly payment would be $846, and the cash received upon closing would be $28k. I am completely fine with resetting the term back to 30, as I don't plan to be here for longer than another few years, so paying it down completely is not on my list of goals.

I own a co-op which is a complicated kind of ownership structure, so I can only work with certain banks, it's a different type of mortgage as well. This bank is well versed in them, so I am hopeful that it moves along smoothly. She said their typical time to close is 45-60 days, which I am fine with. Fingers crossed!!!!

Posted in

Uncategorized

|

1 Comments »

February 15th, 2022 at 04:00 pm

Today is payday, and I was pleased to see that the loan I paid off last month has stopped being deducted from my check. I went ahead and increased my 401k contribution from 10% to 15%. Felt pretty momentous, and I'm not gonna lie, scary haha. While this is not quite maxing, it is not far off. To max, I would need to contribute 18% (technically 17.8 lol). I'll obviously get closer after my merit increase in a few months, and then will see how far from maxing I actually am. My next promotion should net quite a large raise, at which time I'd need to actually lower my contribution to keep it stable through the year (I prefer consistency over getting the money into the market a little earlier).

I'm currently trying to balance 3 objectives from a financial standpoint - 1. set aside as much money as I can for taxes blah. 2. pay down the balances I ran up in December/January on the credit cards I had paid off last year. 3. Cash flow a short trip away with a friend - the flight and hotel are already paid for, which are obviously the biggest costs. Now I need to put together spending money. This trip is in 3 weeks, so not a ton of time to do so, but it should be ok. I have a lot of non-budgeted needs for money over the next few months, but I also have a lot of extra money coming in as well.

Next on my list for today: make a few phone calls about refinancing! I am somehow almost caught up on work tasks, and schoolwork is in a good spot. I am in a state of tenuous peace lol.

Posted in

Uncategorized

|

0 Comments »

February 14th, 2022 at 06:36 pm

My therapist let me know at our last session that she is leaving the current practice, and starting her own, and that she will be out of network for all insurance. Sigh. I've had it very good - mental health is exempt from the deductible, and my co-pay was $30. My FSA modeling was all based on this obviously. In the new world, I will be subject to a $1400 deductible, then after that, they will cover 60% of the allowable amount. What's the allowable amount, you ask? Good question, one which my health insurance company cannot answer. It's apparently a proprietary number that the phone reps don't have access to. So the only way I can find out is to file a claim, and see if it comes back on the EOB. Not sure if that detail will be on there before I meet the deductible though.

She will be charging $150 a session. I obviously don't have this built into my budget to pay for up front, so I will be using the FSA to pay for it. By the time I start getting reimbursements, I have a feeling that they'll be somewhere around $20-$30 a session (ouch). My plan was to use as much of the FSA as possible to cover off on extra medical appointments this year related to surgeries (clearances, lots of extra bloodwork, etc)....but I guess that's scuttled. I was also hoping to be able to incorporate medical massage. Oh well. I am glad I have this option.....pre-FSA, I likely would have had to try to find another therapist in-network, and from all I'm hearing that's not an easy proposition these days. I will likely have to change the cadence of my sessions to monthly, rather than bi-weekly. Assuming that I go down to monthly, it looks like I will have about $1000 in the FSA to play with.

In other not-so-fun news, I have kept cracking away at my taxes. I'm still waiting on some forms that could be coming, but as we approach later in Feb, I will probably start to mentally strike them off the list as likely to show up. So these numbers could obviously still change (although it woud be nice if they didn't).....as of right now, it's looking like I owe about $3k. OUCH. I'll be able to pay the state taxes in full, and will have to do a payment plan for federal. The bonus I mentioned in my last entry will come in May. That will all be directed towards this. I also may be receiving a referral bonus if a friend I referred is hired.....this is usually a few thousand dollars. I have no idea what the amount is these days as it keeps changing lol. If she's hired this month, it would come sometime in June (90 days after the new hire starts). So, it should all be fine, but not what I was hoping for the year.

Posted in

Uncategorized

|

0 Comments »

February 4th, 2022 at 06:38 pm

My company has been in the industry news for the past few days. Apparently we blew past our 2021 financial goals, and all of our employees (about 80k worldwide!) are getting a bonus. I don't normally get bonuses, and actually don't think I have ever gotten one, so this is exciting. Upon digging into it, and finally watching the video our CEO sent out the other day, it appears we are each getting a week's salary as a bonus. That's slightly less exciting lol....for me, it's about $2200 after taxes, so not terribly much. However, it is still extra money, that I can definitely use right now.

I got an email from my 401k provider yesterday, stating that they were sending a refund for the overpayment on the loan I just paid off, sent via ACH to my bank account on file. It didn't have an amount specified, but I got a text from my bank this morning that a direct deposit of $148.98 had posted. That's the amount that was deducted from my last paycheck for that loan, so I think I am probably ok to go ahead and increase my 401k contribution percentage......but I'm still gonna wait til the 15th to make sure. I can certainly manage it if there's an overlap but I'd rather not.

Taxes are still chugging along. I have gotten more than half of the documents needed now....sadly, the only ones outstanding are going to send my numbers in the wrong direction. At this point, I will owe both state and federal, thanks to the combination of a lot of debt being cancelled last year as well as earning a few thousand in bank bonuses. Hoping for my total tax bill to be under $2k (guess that bonus will come in handy lol). I obviously won't file/pay until the deadline if I owe, but my taxes should be done long before that so I will have about 2 months to put together the money. Thankfully, it'll be a one time aberration - I am used to receiving a refund and prefer it that way. My paychecks withhold more than enough tax to cover them, it's just these outside of normal pay events that got me. Even though I'm feeling the squeeze right now, having settled the debt saved me far more money than I have to pay in extra taxes, which helps to put in perspective. I'd rather be able to use the bonus and all of the other little dribs and drabs coming in over the next few months to be able to pay down more debt, but I guess I'll hold in favor of the tax payment. All in all, if this tax bill had come last year, I would not have been in such a position, and it would have been a real hardship to pay the bill. So for that I'm grateful. My choices this year are to raid savings or forego debt payoff acceleration. Last year, I would have had to go into more debt to handle it. Progress is always good, and recognizing it is even better.

Posted in

Uncategorized

|

1 Comments »

February 1st, 2022 at 09:55 pm

Hello my SA friends! Hope everyone is surviving January lol. I will say that for the past few years, January has been soooo incredibly stressful and felt about 20 years long....and this year was far less stressful (although I could have done without the blizzard the Northeast got last weekend...). I'm not the biggest fan of February either, but at least it's a short month!

Let's get the painful stuff out of the way - January was a spennnndy month, and I only have myself to blame. As I mentioned in my last entry, I've been going a little nutty buying clothes. Sounds super frivolous, and some of it definitely is, but a lot of it was legitimiate, I refuse to continuing wearing clothing that is not reflective of my hard work, even if most of the time, I am home in workout clothes (my typical work uniform these days),

Key: Category: Jan Spending - context

Car/Gas: $35.78 - this was one gas fill-up, and probably some miscellaneous parking here and there. Most of the towns near me have apps for the meters, so it's easy to track. I would not include this if it were throwing a quarter in the meter. I never have quarters for the meter lol.

Clothing/Accessories: $584.02 - welp. Knew that one was going to be ugly. There will be some returns in Feb to offset this but not enough to make it hurt significantly less lol.

Dining/Entertainment: $344.60 - This is actually better than it looks! There was one pricey dinner out with a friend for her birthday, which is about half. The rest is takeout/delivery, so that's actually a lot lower than usual.

Grocery/Household: $$489.87 - A little over budget here, but I stocked up on some pricey items which made up a good chunk. I won't have to buy my breakfast protein shakes for a few months  Hopefully I can keep it down for Feb. Hopefully I can keep it down for Feb.

Health/Wellness: $64.55 - some vitamins, my monthly Peloton membership, and some new resistance bands. Not bad at all.

Home Decor/Furniture: $387.70 - Some of this was needs - new sheets, etc (and I refuse to buy crappy sheets). The rest was not, lol. Some random decor pieces, an ornament, some candles.

Medical (non-FSA): ($200) - a refund for a consult fee from a plastic surgeon I cancelled my appt with was finally credited.

Miscellaneous: $115.16 - I paid for a credit report and score to see how close I think I am to my goal of initiating the refinance process in March. Score looks good, but I'd like to handle some of the credit card balance that's run up before having them take a look. I can absolutely support the refinance on my DTI, just trying to make everything as attractive as possible. I also donated to a charity for a friend's birthday.

Office Supplies: $126.21 - had to buy printer ink. I had been buying off brand ink from Amazon, but my printer did a firmware update and the cartridges no longer worked. I figured I would try to replace them with the OEM cartridges to see if that did the trick before replacing the whole thing (I would have replaced with the exact same model so the ink would not have been a waste). Thankfully it worked but that was unexpected and annoying.

Personal Care: $526.68 - yowza. Hair appointment was a pricey one this month. Plus there was the tip for the nail salon with Mama. This month should only be the nail salon, I won't be getting my hair done again til March.

Subscriptions: $131.96 - Prime (annual) and iCloud (monthly)

Grand Total: $2606.53

I do not include my FSA spending in this total, since it is not money coming directly out of my pocket, but I am tracking it just to make sure I stay on pace and to identify what the expenditures in this category are. In January, I spent $350.91 in this category. Co-pays for appts and prescriptions, some drugstore purchases, and a purchase for a back wheel set. This was denied, so I returned part of the order, and will reimburse the account for whatever the amount left is once the return finishes processing. It will be offset in Feb, and will come out of the health/wellness category instead. The total including FSA spending is $2957.44. High!

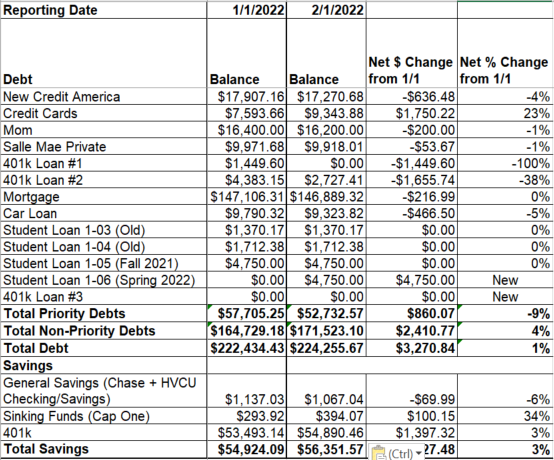

The month end summary of where everything stands is doing ok.

As an overall, debt is up, even with some large pay-downs. That's due to this semester's student loan being added, and not helped by an increase in credit card balances. General savings is down very slightly, sinking funds are up, and so is 401k. This does not include the payment for 401k loan #2 and the contribution from my last paycheck, as it has not yet reflected. It's rthe right direction even if it needs work.

I think my check on Friday had the last payment from 401k loan #1, so once I confirm that on 2/15, I'll increase my 401k contribution to 15%.

I'm still waiting on a bunch more tax documents to finish those, but as of right now, it looks like I owe money, due to the cancellation of debt from the settled accounts last year. Bummer but it's not a huge amount, and could still turn around as some of the deductions have not yet been inputted, waiting on that info from my building's accountant. Still holding out hope for a refund. I'd love to get back on the downward trend debt wise by the end of this quarter.

Posted in

Uncategorized

|

0 Comments »

January 15th, 2022 at 08:20 pm

Payday:

My paycheck was deposited yesterday, 1/14/22, and it was fairly uneventful. The amount I estimated my take home pay would be was slightly off - it was slightly less than I had estimated but that's ok, because I had built in a buffer. I still have lots of changes coming to take home pay this year, so I will wait to make any big changes in the budget until that settles down. I was happy to see my increased autosave amount, and was able to increase the amount I transfer to my mom for loan payback. All in all, a nice positive payday.

The tuition reimbursement from the fall semester was also deposited - I am happy to say that is already gone! I paid off 401k loan #1 completely as planned, and sent the rest to 401k loan #2, also as planned. Processing it quickly and getting it out of my greasy little fingers removes any temptation. I have gotten much better about spending impulsively, but as you'll see in the last section of this entry, I am not completely cured lol. I think there will be 1-2 more payroll deductions for loan #1, and I am a little ways away from paying off loan #2 as of right now. Excited to see those updates hit my balances though. By the time I get my tuition reimbursement for spring, the balance on loan #2 should be low enough through my regular payments to be paid off completely.

Weight Loss Goal Achieved:

On Thursday, I weighed in at exactly 100 pounds down from my high weight. It was a little emotional, knowing how much work I have put into this journey. I am not done yet, but this was the big milestone I really wanted to hit. I wanted to hit this weight before the end of the month, which is 4 years since my bariatric surgery. CHECK! Now, the next goal is to get down a few more pounds before the next appointment with the plastic surgeon at the end of Feb. He initially said last year that he wanted me at a weight that is 10-15 pounds away from where I am right now before surgery (it was 25-30 at that point), but then revised it to "as long as my BMI was under 30", which is where I am now. I am hoping for another 5 pounds before I see him, and then will ask if he wants me to lose another 5-10 before surgery or focus on staying where I am. Because of lots of different factors, I am not too worried about putting weight back on, which is usually a big concern.

Spending:

My spending so far this year has been a little out of control, I think I am missing my structure from being so busy with work and school. Plus I cracked open the door on using credit to buy stuff I want but don't need. So now I am reining that back in! I did run up a little bit of a balance on cards, but the damage isn't too too bad. I am reassessing what I want to keep vs return, and once I can see what the final numbers are will make a plan to attack it. One good thing is that I ordered a new duvet cover....and two ended up being shipped. I obviously only need one, so I will be returning the extra, and will essentially get one for free. Almost makes up for the minor issues I am experiencing with a few other purchases/orders. Almost.  I definitely think I need to start budgeting money for clothing though, I am at the point where I need to replace a lot of things, and it is becoming more difficult to cashflow it, so into the budget it has to go! I definitely think I need to start budgeting money for clothing though, I am at the point where I need to replace a lot of things, and it is becoming more difficult to cashflow it, so into the budget it has to go!

Posted in

Uncategorized

|

3 Comments »

January 4th, 2022 at 05:26 pm

I wrote this post yesterday, and when I went to submit, the site had eaten my post, and I could not get it back. Oh well. This will probably be a shorter version than what I originally wrote lol.

Key: Goal - timing. Context

Financial Goals (in order of priority):

1. Pay off 401k Loan #1 - mid January. The balance on this loan is just under $1500, and will be paid off with part of the tuition reimbursement payment I am receiving on my next payroll. It will likely take a payroll period or two before the system and payroll all agree, and I may have to make a few additional payments while it all catches up. That $1500 also does not include the payment from my 12/31 check which has not posted yet.

2. Increase 401k contribution to 15% - as soon as the loan payment from item 1 is no longer being deducted from my paycheck. This is a big increase - I am currently contributing 10%. At my current salary, I would need to do 18% to max, but that is not possible just yet. I will likely not increase the percentage any higher anyway....between my merit raise this spring and hopefully another promotion later this year or early next, the salary increases will get me there at 15%. I may even have to reduce the % to not go over.

3. Refinance mortgage - initiate the process around March. My mortgage balance is currently around $147k, and the appraisal amount from when I purchased just over 2 years ago was $199k. This means that with zero appreciation, I have equity here. I am hoping for at least 10% appreciation, which would mean valuation at $220k, but higher is really not crazy in my market. I would like to take out as much as I can to be at or under 80% LTV, and will use those funds to pay off some much higher interest debt (see items 4 and 7). Since I will almost certainly get a lower interest rate (currently at 5%), my payment could potentially stay the same, or just go up slightly. I will be resetting my mortgage back to 30 years, but I don't plan to stay here for more than another 2-3 years at the most, and would be resetting to a 30 year at that point anyway.

4. Pay off NCA loan - as soon as refinance closes. This is the personal loan I took out last August that the remaining balances from my debt consolidation were transferred to. The interest rate is abominable, and the total of the monthly payment plus the extra I pay is quite high (higher than my mortgage!) While it's just moving debt around, it mathematically makes sense, and frees up a ton of cash flow to attack other debt. The balance is currently just under $18k.

5. Pay off 401k Loan #2 - end of May? This balance is currently around $4400, again not yet reflecting the payment from my 12/31 check. I will be putting a big chunk from the upcoming tuition reimbursement to this one (basically the difference between Loan #1 balance at time of payoff and total payment which is $2625), between that and the scheduled payments between now and then, this should in a place where it can be fully paid off with tuition reimbursement from the spring semester.

6. Pay main credit card down to 50% utilization - EOY. This should be quite doable once my cash flow is eased up - I can redirect those payments here, and also start plumping up sinking funds etc so I don't rely on the credit card as much.

7. Pay off private student loan - stretch goal, would be as soon as refinance closes. Basically, if I am able to take out enough from the refinance to pay off the other loan AND this one, I will pay both off. If I am not able to pay this off, I will continue paying it down monthly, with the goal to have it paid off prior to graduating in 2023.

8. Pay main credit down completely - stretch goal, EOY. I know I can likely get a bit farther with this card than item 6, but am hesitant to commit to paying it off completely, since there's a lot going on this year. But putting it as a stretch goal keeps it on my radar.

No priority assigned - these "goals" have either been completed already, or are guaranteed to be completed when the time comes so they do not have a priority. I still think there is power in putting them down on paper so I can take stock in goals I have accomplished, even if it was easy! a. increase autosave - the day after every pay day, my bank automatically transfers $$ to the savings account I have with them. I ended 2021 with it being $50 per check, and have increased this to $100 per check. b. increase payment to Mom loan - throughout 2021, I paid her $100 per month. I have budgeted in for $200 a month this year. This will get me down to $14k by the end of the year, so I have a lot of work to do on this one, as I would like it paid off before I buy a new home. c. Fund two rounds of major plastic surgery - estimating my OOP cost will be around $30k. This will be funded from 401k loans. I'm not thrilled that this is how I am going to do it but it's the best option based on other factors. Sincerely hoping this is the last time I need to take one of these guys. I'll need to wait and see what the terms will be based on how much I take, do I split it into two loans, etc. But either way, the money is there, and I cannot wait any longer to save the money up in another fashion.

Non-Financial Goals:

1. Get to goal weight - by Jan 30. As of today, I am 1.2 pounds from my goal weight, which is 100 pounds down from my high weight (truth be told, it was probably even a bit higher than that but I was boycotting the scale lol). 1/30 will mark 4 years since my bariatric surgery, and so I think it would be poetic to have reach goal wieght prior to then. My plastic surgeon would liiike me to be a bit lower than that (10-15 pounds), but we will be ok if I am somewhere in between. Once I get to that weight, then I need to figure out how to stay there haha.

2. Complete two rounds of plastic surgery - first round early July, second round mid-December. This is the timeline and the plan for right now, but we've all seen how our friend that starts with C can throw a wrench into anything healthcare related. I decided to add this as a distinct goal, as while I have the financial aspect of it covered, it's still a huge undertaking...about a million doctor's appointments, arranging for two medical leaves from work, tons of paperwork, and oh yeah, actually physically getting through recovery!

3. Stay the course with school - ongoing. If I stick with the plan, I have 10 classes left to take. I will take 3 this spring, 2 in the fall, then repeat that schedule next year before finishing in December 2023. Going back to school has been such a boon for me - I am accomplishing multiple goals with this, and it's important to stay on track. Thankfully, the hardest work has already been done, and it should be smooth sailing from here on out.

4. Work towards my next promotion - ongoing. Not sure what is a realistic timeframe to expect this in - the cycle seems to be two years, BUT I have been working at the next level for a long time, and truthfully that's the level I should have been promoted to last year (but it generally doesn't work that way lol). I am also going to be taking on leading a larger team this year (my direct reports are going from 2 to 8). But on the flip side, I will have two extended medical leaves (2 months and 1 month), so I am not sure if it's realistic to expect this year. Either way I am going to keep working towards it, and when it happens, it happens. The next level should put me in the range of $130k-$140k. I have no plans to leave my company before hitting the next level, as I am counting on tuition reimbursement through the end of my degree to accomplish a lot of things. once I am done with my degree, and have obtained a key certification in my field, then I may test the waters. (Or not, I love my company and am happy here!)

I guess that didn't end up being shorter after all, lol.

Posted in

Uncategorized

|

0 Comments »

January 1st, 2022 at 08:07 pm

This is going to be a whopper of an entry, please bear with me!!!! Trying to orgranize this into sections. First, December & Full Year 2021 Spending. Next, the usual December debt/savings summary, along with a full year snapshot of that. Then, full year 2021 goals summary!

First up - December Spending...my spending does not include bills, just "discretionary" spending. Some of my categories are a little wonky, but I am adjusting them in 2022 now that I have a full year's worth of spending to reference.

Category Name - December Spending/Full 2021 Spending: commentary

Alcohol - $44.15/$405.20: when my best friend was in town, we went to a winery about an hour away (fun fact, it is America's longest continuously operating winery!), did a private cellar tour, and did a little shopping in their store. Overall, I did not spend a ton on alcohol this year, and will not be carrying this as a separate category into 2022. If it's something I buy at the grocery store (hard seltzer, beer etc), it will go into grocery. If it's something I buy at a wine shop for a special occasion, it'll go into dining/entertainment.

Car/Gas - $87.44/$731.97: this was gas, a toll pass replenishment, and some miscellaneous parking. This year, I had planned to replace my tires, but just didn't get around to it. At this point, I will wait til spring, and it will come out of savings. Glancing at the monthly totals, I would say the majority of this total cost was gas. Not much maintenance this year, I have a newer car, and don't drive a ton. Other than the tires, this category should increase in 2022 due to a registration renewal (ours are every 2 years). Hopefully no other big maintenance items come up, but if they do, I will address them - my car will be paid off in 2023, and I need it to last until after I buy a new home in 2024 (trying to keep my DTI as low as possible since it'll be a tricky transaction....more on that in the future).

Clothing - $354.25/$1873.16: I am at the point in my weight loss where I definitely need to replace a lot of things, and it comes up seasonally. Thankfully, there haven't been a ton of events I needed something to wear for, but they still exist. I'm still trying to pace myself, since there's not a huge call for it urgently, and I expect my size to change again several more times in 2022. Right now I have a couple of large bags slated for good will, it's good energy to clear out as much of the "too big" stuff as I can.

Dining/Entertainment - $468.71/$2634.95: I knew this month would be higher than "normal" (what even is normal these days)...with my best friend in town, and being off from work for 2 weeks, I didn't quite have the enthusiasm for my usual meal prepping haha. Higher for the year than I would have liked, since I know a good chunk of it was takeout, rather than a nice meal out shared with friends, but it is what it is.

Education - $65.01/$1152.61: in December, this was another month of a study prep service for the credit by exams I was taking. This has been cancelled, since I am done with those exams and that part of my degree journey! Overall, the spending on this category was low (it does not include tuition or school fees that I did not pay directly, as those are covered by loans and are considered bills), and the return on the investment was fantastic. Since June 1, I earned 44 credits. I expect my out of pocket spending in 2022 for this category to be quite a bit lower, as I don't have to buy a computer, pay for any study resources, or pay any transcript/application/orientation fees. It'll mostly be books, and it seems a lot of my classes use freely available resources for that.

Gifts - $97.71/$941.12: December was obviously all holiday gifts. Overall I'm not upset with the year's total - hopefully I can get a sinking fund for this going in 2022, but if not, no pressure since this is an easily cash-flowable amount over the course of a year.

Grocery/Household/Toiletries - $537.22/$6538.45: I don't think there's anything out of the ordinary in this, my largest category. I budget $400 per month for this, and I've clearly overspent the yearly budget by about $1800...at some point in 2022, I'll hopefully increase it, but not too worried. This is also a fairly broad category, and some of the spending here will be shifted to other categories in 2022, including stuff purchased at CVS that can be counted under FSA spending.

Medical - $170.13/$1202.41 - in December, this was a few copays, a prescription, and a number of at home COVID tests. Looking at the year in totality, all but a few transactions here are FSA eligible, so while I will track to ensure I am pacing myself, I will not count it in spending since it will not be coming out of my net funds. I fully funded an FSA in 2022, and my net pay has already been estimated to account for that deduction. This category will be split for 2022 into 2 separate ones - Medical FSA and Medical non FSA.

Miscellaneous - -$147.61/$1705.74: this is negative in December because my second wellness stipend for the year was deposited, offsetting the purchase of the Peloton in November which also went into this category. I also bought some home decor items this month. Overall for the year, it's mostly health & wellness stuff, home decor stuff, and truly miscellaneous stuff that I don't need a distinct category for (post office, license renewal fee, etc). In 2022, I will be adding categories for Health/Wellness, and Home Decor/Furniture.

Office Supplies - $0/$106.92 - generally this category is printer stuff lol. Not gonna complain about the yearly total here!

Personal Care - $123.86/$2627.57: December's spending was a tip at a laser appointment, a few makeup items I purchased, as a trip to the nail salon with my mama (we alternate paying/tipping. It was my month to pay, in January I will tip and she will pay). The yearly amount is a little high for something I have not yet managed to budget for, but with my current hair color regimen that has me in the salon every 6-8 weeks, I don't see it going down in 2022. Oh well lol. As a reminder, I am not striving to be the most frugal I can be.

Pet - $87.02/$1194.20: this is the typical stuff....food/litter. No toys lol. In 2022, this should be around the same - they didn't come to live with me until the end of April, but I did have some start up costs that i will not have again going forward.

Subscriptions - $28.99/$457.30: December was monthly iCloud and monthly Peloton (which will go into Health/Wellness for 2022). The yearly total includes a bunch of streaming subscriptions (I tend to pay for these annually), and Prime.

Travel - $0/$2206.69: this is a category that will likely increase next year - I am not planning on a lot of trips, due to having some major surgeries, but I am going to New Orleans for my birthday, Portland for Thanksgiving, and hopefully a few smaller weekend trips here and there. Another one that I would like to start putting money into a sinking fund for, but I'll get there.

Total - $1916.88/$23778.29: December was a middle of the road month for spending when compared to the other months of the year. I would never have predicted that total, though....that's where tracking every penny comes in handy, so I can continue to be realistic with myself!

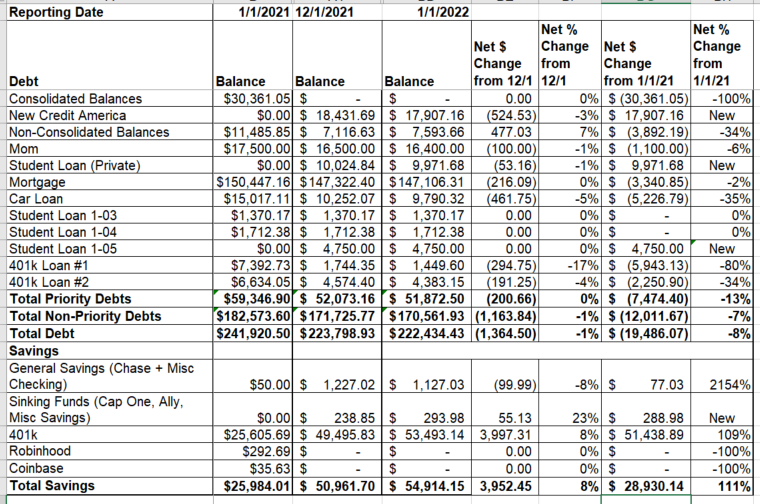

Next Up - the December Month over Month Summary....as always, this does not include my 401k contributions/loan payments from my last check of the year, as those have not yet been reflected. This screenshot shows change from 12/1 as well as change from 1/1/21.

I started the year with a total of $241920.50 in debt. I ended it with $223798.93 in debt, for a reduction of 8%. What that number does not reflect is that there were a few new debts added throughout the year (the new personal loan for my consolidated credit card accounts that were settled, and 2 new student loans), of which I have paid down approximately $2900 total. It's not a big enough difference to make myself crazy with the math, but will sort itself out next year. I'm pretty happy with an 8% reduction, knowing that it's actually slightly higher.

I started the year with $50 in cash savings, and just over $25k in my 401k. I am ending the year with just over $1500 in cash savings, and just over $53k in my 401k. That's quite a respectable increase. My overall savings category has increased by 111% this year.

I don't much focus on net worth, but do track it for my own amusement. My net worth (using an estimated value for my home and my car) has increased from $15k at the start of the year to $67k at the end of the year, for a percentage increase of 348%.

Since this is Year 2 of this detailed tracking, I can start a Year over Year tracker now....this is very high level as the exact line items are definitely going to change year to year. (I am not sharing an image as it doesn't contain anything different numbers wise as the one above).

2021 Goals Wrap-Up

Consolidated Balances: At the start of the year, the consolidated accounts left to be settled were 9 of the original 12, with a total balance left to settle of just over $30k. The goal was to stay the course and hope that the balance was around to around $20k by the end of the year. At the end of last quarter, this was down to zero, as I was able to obtain a personal loan to pay off the remaining amounts, the starting balance of the loan was just around $20k. This loan is now just under $18k, and I am hoping to do a cash out refinance in a few months and knock this out. My interest rate on this loan is very high. Since I bought my home before interest rates dropped so dramatically, I can definitely lower the rate quite a bit. Based on some calculations I've run, it looks like my mortgage payment after taking cash out will either be lower than it is right now or the same. While this does reset my loan back to 30 years, I'm not bothered by that as I'm planning to sell in a few years and buy a new home, which means my mortgage is resetting back to 30 anyway. The spirit of the goal is completed, in my opinion.

Non-Consolidated Balances: These are credit cards that did not go into the debt settlement program. At the start of the year, I had 5 accounts with balances, with a total of around $11k. The goal was to pay 3 off by the end of the year, with a total balance remaining of around $5k. A sub-goal of this was to bring my main card down to 75% utilization. At the end of the third quarter, 3 accounts had balances (total of $7.7k) and two were paid off. As of the end of the year, two remain paid off (although it was three paid off for most of the quarter, I decided to do a little shopping the other day that I will pay off in 1Q220. Of the 3 cards with balances, the total debt is just about $7.5k. While I did not get my main card's utilization quite as low as I had hoped, I am still quite pleased with this progress. Once my mortgage has been refinanced, paying off some of the higher interest loans, the cash flow that is freed up from this will go a long way to helping this balance.

Mom Debt: The goal was just to begin repayment on this. I made 11 payments to her in 2021, it is a part of my budget, and will remain so. This year, I will increase the amount I repay, and then again in 2023. This one is good!

Non-Priority Debts: These include my mortgage, car loan, 401k loans, and federal student loans. The goal here was to just continue servicing as scheduled, without accelerating any of the payoffs. Throughout the year, I added 2 new student loans (1 federal, 1 private), and shifted 401k loans to priority status, using the tuition reimbursement payments I receive from work to tackle those. Of the student loans, the private loan was actually moved to priority status, and will be paid off using equity taken out from the refinance if possible (again a higher interest rate). If I am not able to pay it off via the refinance, then the goal is to have this one paid off before I graduate, and my federal loans come out of deferment. Completed!

Grow savings: I started the year with just $50 in cash savings, and the goal was to finish the year with around $2k in cash savings. At the end of the third quarter, I was at around $1400, not including the extra buffer in the checking account I use to pay my mortgage (which was about $600 - deciding how I want to calculate this reserve for 2022). I am ending the year with just around there in cash savings, as I had to dip into it a little bit for a few things. Not quite as far as I had hoped to get, but still such great progress from where I started. 2022 will bring a new level of aggressiveness in this arena. Not quite completed but still outstanding progress.

Bump retirement savings: I started the year contributing 10% (not including match), and was hoping to bump this to 12% by the end of the year. My promotion midyear did increase the $ amount going into my 401k, even if I did not bump the %. I did not end up increasing the % in 2021, although as soon as my next tuition reimbursement payment comes, and I am able to pay off 401k loan #1, I will be increasing this to 15%. Maxing at my current salary is 17%, so I don't think I will be actively increasing this again, honestly. Any raises at 15% will get me closer and closer to maxing. As my salary increases, I will likely have to reduce this percentage which is funny to me lol. The spirit of the goal is completed.

Investments - no change from Q3: The initial goal was to increase my small balances in robo-investing accounts as able, without any set $ amounts. Ultimately, back in February, I decided that I am not in a position to start investing in taxable space yet, and need to focus on debt, cash savings and retirement first. I cleared these accounts out, and have no plans to begin this type of investing again for a few years. Goal removed.

Get promoted (financial goal as well as personal goal) - no change from Q3: BOOM. Got my promotion effective July 1, with a huge salary increase as well. Definitely had a little too much fun celebrating, but now back to being focused. Starting to work towards the next one, which is truthfully the level I have been working at. I'm hoping for next summer for that one. GOAL COMPLETED.

Other non-financial goals: Stay focused on weight loss journey - no measurable goal set, but I show a net loss of about 17 pounds for the year. This leaves me 1 pound from my goal weight, which is 100 pounds down from my highest weight. This also does not reflect the ~15 pounds I put on mid year during a thyroid freakout, which I also had to take back off. Definitely considered this one completed in an excellent way.

Start taking steps for plastic surgery post weight loss - After a lot of consults, I chose a surgeon, and have a plan for timing/funding/school break, etc in place. It is looking like my first round will be early July, and then my second round will be mid December. I'll go into more detail on this in a separate post for 2022 goals. Completed!

One goal that was not on the plan at the start of the year - go back to school. It was something I always wanted to do, but since my company did not at the time offer tuition reimbursement, it wasn't something I wanted badly enough to actually pay for it myself lol. They announced the benefit on Feb 1, and by Feb 18, I was enrolled in an online degree program. I officially started June 1, and by the end of the year, have earned 44 credits since June. This might be the thing I'm most proud of accomplishing this year, and what makes that funny is that it wasn't even on my radar when I set my 2021 goals!

Overall, I think I had an amazing year, and I'm thrilled. I'm still refining my 2022 goals, and frankly this entry is long enough lol.....so I will post about that separately.

Posted in

Uncategorized

|

5 Comments »

December 30th, 2021 at 03:22 pm

I was glad to see my paycheck in my account this morning. I am supposed to be paid on the 15th and last day of every month, it comes early if that date falls on a holiday or a weekend. So I suspected it would be today rather than tomorrow, as my company is closed worldwide tomorrow.

I currently have my paycheck going into two separate checking accounts. One is my main account that I use for the majority of my bills/spending, etc, the other is what I call my housing account. After the 15th's payday, I adjusted the amount going into my housing account to cover a maintenance increase for 2022 (maintenance is basically like an HOA fee for my ownership structure). That was reflected today, so while it's very minor, just one more item on a very long list of little things to make sure happen!

I hustled to get online and pay the rest of the bills (I have very few bills on autopay) so that my balances could update asap - I'm anxious to do my 2021 wrap-up! I'll most likely still have to wait until Monday, but at least it feels like I took action haha. I still need to transfer information over to my 2022 budget file, but that can wait until I have final 2021 numbers. I've done a lot of it, just need to make the move over.

I passed all 3 credit exams I had planned this break - my brain is so very tired but it was worth it. I am officially not opening the school laptop until January 18th!!! I was pretty aggressive when it came to school this year, but it set me up well for the rest of my degree program - I need to take 10 more classes, I will spread that over 4 semesters, and not have a terribly heavy course load again like I did last semester. I am on track to graduate in either summer of fall of 2023.

Posted in

Uncategorized

|

1 Comments »

December 21st, 2021 at 06:22 pm

The year is quickly speeding to a close. While 2021 was a wonderful year for me goals-wise, I am not sorry to see it go. Ready for the fresh start a new year brings!

I'll obviously do a detailed full year wrap up post after the end of the year but I'm so blown away by where things stand vs where I started in January. I met up with an old friend the other night whom I hadn't seen in about 2 years and we were catching up. I was explaining my year to him and his eyes just kept getting bigger and bigger! Early numbers are looking like I paid off around $36k+ worth of debt this year (the net number is lower since I added new debt in the form of student loans), and increased savings by about $27k. That's....pretty damn good haha.

I am done with my shopping for Christmas gifts as of yesterday. It looks like I spent right around $400. I only buy for my mother, brother and sister, and I'm fine with that number. I did not set aside money in a sinking fund for gifts this year, that's on the list for future years.

The season has had a bit of a pall cast over it, with the infection rate skyrocketing again. Even though I am mostly surrounded by fully vaccinated if not boosted people, it still has impacted my circle. My best friend is in from out of town for what was supposed to be 2 weeks. We went to dinner with my cousin, who I also consider a best friend, last week - two days later, my cousin developed symptoms, took an at home test, and then went to a local urgent care for a "real" test. Positive. She had not yet gotten boosted, wanting to wait for her planned time off over the holidays (she has a lot of autoimmune issues, and was afraid of how it was going to hit her - in my opinion that's exactly the reason she SHOULD have gotten boosted asap). My other friend and I had no symptoms, but started doing at home tests over the course of the next few days. We remain negative and symptom free. Both boosted, which seems to be the difference these days. Lots of plans have been quashed though. We had tickets to a Broadway show - we had decided not to go, and eat the cost, but now it has been cancelled so we will get a refund. My friend was supposed to do Christmas Eve with one side of her family - there is a positive there so it has been cancelled. She has decided to go home a week early, and I can't say I blame her. My cousin will be spending Christmas alone, since she can't start counting days until she is symptom free, and she is not yet. Her mother also has serious autoimmune issues so they'll take extra precautions anyway. My mother works in a school and has been exposed several times, but thankfully she is also boosted, and all of her tests have been negative. Today is her last day in the building, so fingers crossed we avoid any more exposures before Christmas and we can still have the small but festive day we had planned.

Christmas Day will be my mom and sister coming over for brunch (fingers crossed!!!) - I am making chai scones, Yuletide Cheer bread, croissant French toast, bacon, and a Buche de Noel. A bit overboard for the 3 of us, but I am determined to make it special amidst everything going on around us.

I am officially on vacation from work until the New Year (although I am actually sitting at the work computer getting a few things done). School finished up last week, I am waiting for one last grade....right now, I got an S in each of the three pass/fail courses, an A+ in statistics, an A in anthropology, and waiting on the grade from math. Hoping for a B there. My goal was a B, I need a C for tuition reimbursement. Once that last grade is posted, I will submit my grades for the reimbursement, which should come through mid January. It was due at noon today so I'm a bit annoyed, but trying to stay patient. I am taking a CLEP exam tomorrow, then 2 more next week. If I don't pass these, I will just take the courses. I need to pass at least 1 of them to keep the same timeline, and am confident I can at least pull that much off haha.

This morning I had a good weigh in, the number on the scale reflected that I have lost 99.1 pounds since my highest, just under 4 years ago. .9 pounds to go to get to 100 pounds lost! Crazy.

I hope everyone has a lovely holiday, in spite of *gestures wildly* everything going on (I am in the NYC area so it probably feels a bit more intense here at the moment).

Posted in

Uncategorized

|

2 Comments »

December 2nd, 2021 at 04:46 pm

I can't believe it is now the last month of the year!

November Spending:

Category - Nov Spending/YTD Spending: Context. This spending does not include bills, just variable spending that I can control.

Alcohol - $81.25/$361.05: this was wine for Thanksgiving. I bought 3 bottles, we only had 2, so I will retrieve the other bottle from my mom's house this weekend and put it in my own fridge ha. This is REALLY not bad considering that we are 11/12 of the way through the year - a few years ago, I was a huge wine aficiciando and my annual wine spending was much higher.

Car/Gas - $170.49/$644.53: ugh. I got a notice in the mail about a parking ticket from Feb 2020 that I apparently never paid, so of course the fees were through the roof. I can afford to pay it, so I just did, grumbling the entire time. I also got gas somewhere in there. I still have not yet dealt with my tires....maybe later this month since I am off the last two weeks of the year.

Clothing - 0/$1518.91: no spend here is surprising - I do need to pick up a few things, and will probably take advantage of great sales this month to do so.

Dining/Entertainment - $187.11/$2166.24: still wayyyy toooooo high. My best friend is coming into town for a few weeks this month, though, so I don't expect it to be much lower in December.

Education - $65.01/$1087.60: this was for a study resource for the 3 remaining CLEP exams I am taking. I was planning to take them in November, but was so busy that I ultimately decided to push them to December. Unfortunately, I did not make any use of this study resource in November, and now need to pay for December. But I decided that "wasting" $65 was far better than over-burdening myself, and while I shouldn't spend it, I can afford to. Not sure if I will need any books for my spring classes, or if I would find out what those are before the end of the year, so December should be similar.

Gifts - $268.91/$843.4: got most of my Christmas shopping done (I only buy for mom, sister and brother). I have a few more things I want to pick up that will hit this month's spending, but overall, looks pretty good for a full year.

Grocery/Household/Toiletries - $609.71/$6001.23: this was about middle of the road, and since I wasn't trying to be especially frugal, it's fine. As of right now, it's my largest monthly expense by FAR when looking at YTD totals.

Medical - $67.05/$1032.28: this was a co-pay and my responsibility for some bloodwork. Seeing this number makes me feel good about fully funding the FSA for next year - everything in this category would have been covered.