|

|

|

Viewing the 'Uncategorized' Category

September 16th, 2021 at 08:27 pm

Yesterday was payday, which is always exciting, even if I am not starting off broke like I used to!

I briefly mentioned this in my last post, but I received my tuition reimbursement for the summer semester with my last payroll. There was a bit of a mix-up, and they taxed it when it is not supposed to be taxed, so that was corrected with this payroll. I was able to send a big chunk of that reimbursement to 401k loan #1, and will send the remainder by the end of the month after I move some more money around. That will go a long way to getting that loan paid off - as of right now, between regular payroll deductions and about half of my tuition reimbursement for the fall semester, it's looking like that will be paid off in January. I will then shift my focus to paying off loan #2, and if all goes to plan, then that should be paid off by June 2022. I will happily accept the increase to my take home pay for a while before I take out a loan to cover my plastic surgery, which is likely going to be no sooner than Fall 2022. Have to wait and see - the plan there has shifted a bit and will lead to it being further out than I originally thought. I wish it was tomorrow, but all things considered, will work out better this way.

Otherwise, it was an uneventful payday - paid a bunch of bills, moved a bunch of money around to various places. I have 2 bank account bonuses pending - one should be in my account within the next week and a half, the other is a 3 part bonus from a hyper local credit union that I think will come sometime in October. I haven't decided if I am going to try for any more bank account bonuses this year, I've had a very good year in this area ($3000 in cash, not including points that were converted into gift cards for a few), and may hold off so that I can save a few for next year. Not many more that I am eligible for anyway.

School is very busy this semster, I am taking 15 credits, and only now at the start of Week 3 am I starting to fall into a rythym. I am doing better in the math and statistics classes than I expected to. Just gotta get through, then one more math class and I am done with math classes for the rest of my life!

I'm still doing plenty of plotting and planning, but now it all seems to be falling into place with the systems I have created and have been diligently working inside.

Posted in

Uncategorized

|

1 Comments »

September 1st, 2021 at 05:34 pm

I keep thinking to myself that I should write an entry, then I decide I don't have anything interesting to write about. But then I go to do one of these entries and realize I have too many topics haha. Oh well, I'm wordy sometimes.

August Spending:

Hopefully this month is the last month that spending is this high (she says naively....). Actually I know that's false, I am going to be ordering an expensive piece of workout equipment this month, just waiting for some checks with extra funds to arrive to cover it. But hopefully that's the only out of the ordinary spending.

Rather than going category by category...my total spending for the month was $3,074.36, and my YTD spending is $15,323.63. I do not include bills in my spending, I have minimal control over these in the short term so they're pretty static. My categories are Alcohol, Car/Gas, Clothing, Dining/Entertainment, Education, Gifts, Grocery/Household/Toiletries, Medical, Miscellaneous, Office Supplies, Personal Care, Pet, Subscriptions, and Travel.

My highest category is usually grocery, and this month was no different. Personal care was also pretty high, as I had a pricey hair appointment, and also stocked up on some of my expensive hair products while I was at the salon. Dining/entertainment was also pretty high, but that included a few different outings. I was on vacation at the start of the month, and had a friend come to town, so we were out and about. Looking forward to September being a boring, quiet month.

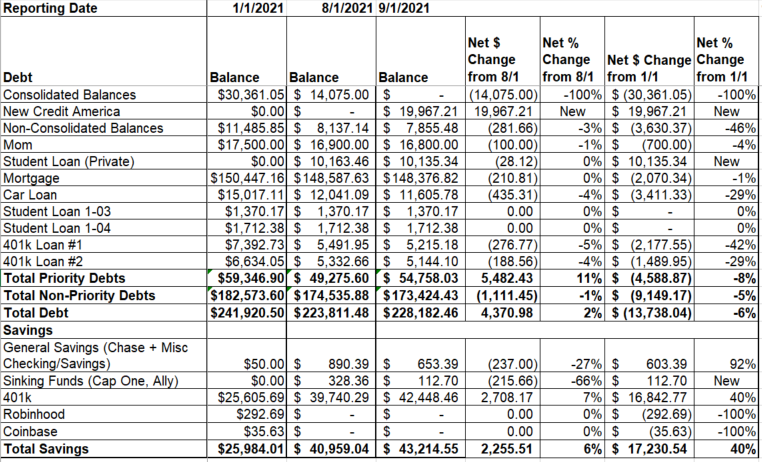

August Summary:

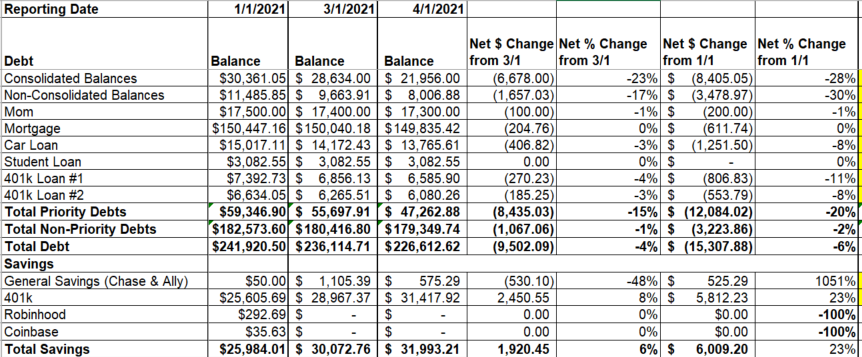

There was lots of action this month, what with transferrring the consolidated balances to a new personal loan. I went back and looked at July's summary entry, and not sure what happened with the screenshot in that one, but oh well.

Everything is still going in the right direction, and should continue to do so for the rest of the year.

I have some big chunks of money coming in September that will (mostly) go directly to debt. I received my first tuition reimbursement check yesterday, and although it was incorrect and needs to be fixed (it was taxed and should not have been), once that is resolved, it will be sent in full to 401k loan 1. Still waiting on a rebate check from the state for what every other state calls a homestead exemption, my state calls it the STAR rebate. That should have been received already, so I am going to have to call them next week if it doesn't come this week. That's going to be split between savings and non consolidated credit cards. There are a few more things coming, but not sure when. Everything has been asigned a purpose!

I'm really looking forward to seeing where I'm at in 2022 and beyond. 2022 is going to be very focused on continuing to pay down this new personal loan, my private student loan, and the remaining 401k loan (in prep for taking another to fund surgery midyear). I would also like to see about refinancing my mortgage, but I need my liquid savings to increase before then, and my credit score to go up. 2023 will depend on what happens in 2022, haha, but should be more of the same, with contuining to attack the non-mortgage debt. My car also gets paid off that year, and I will hopefully be able to start throwing a lot of money into a new down payment fund (fingers crossed for another promotion that comes with a sizeable raise by then!)

My goal is to, by the end of 2024, be in a position to buy a new home. To do that, I will need my debt to be as low as it can be considering that I will still have a mortgage and student loans....I need to have saved $50k or so.....and my credit score needs to have returned back to at least good lol. Not sure if I will be trying to do a bridge loan for the remaining down payment or what. I'm looking in the $500-$550 range. Once I sell my current home, any net proceeds I receive will be likely sent as a lump sum to the new mortgage, and I'll either recast it or refinance, depending on the numbers.

Posted in

Uncategorized

|

1 Comments »

August 16th, 2021 at 08:23 pm

As I mentioned a few weeks ago, I finished my first semester. My official grades finally posted last week, and I received an A in one class, and an A+ in the other. Good by me  I went ahead and submitted the grades and payment receipt for tuition reimbursement, and got confirmation this morning from HR that they will be reviewing all of this period's requests on Wednesday and will let me know if they need anything further from me. If all is good, then reimbursement will be processed along with the Aug 31 paycheck. That reimbursement will get sent directly to one of the existing 401k loans, and in combination with reimbursement for the fall semester (which HR coincidentally informed me that I am approved for as well lol), will pay that loan off, and I will begin looking at what I am eligible to take as a new loan for surgery (which I've decided to push until next year, for a multitiude of reasons. That should eventually be its own post...) I went ahead and submitted the grades and payment receipt for tuition reimbursement, and got confirmation this morning from HR that they will be reviewing all of this period's requests on Wednesday and will let me know if they need anything further from me. If all is good, then reimbursement will be processed along with the Aug 31 paycheck. That reimbursement will get sent directly to one of the existing 401k loans, and in combination with reimbursement for the fall semester (which HR coincidentally informed me that I am approved for as well lol), will pay that loan off, and I will begin looking at what I am eligible to take as a new loan for surgery (which I've decided to push until next year, for a multitiude of reasons. That should eventually be its own post...)

I took another one of the exams for credit last Friday, and missed the mark by 4 points. Ugh. Thankfully, I can re-take the exam (have to wait 3 months), and can get another voucher to do so for free. I'm bummed but it is what it is....I have another one scheduled for this coming weekend that I am a bit nervous about, and then waiting for vouchers for the remaining 3 that I am quite confident in the material so shouldn't have any issues passing. Once these are all done, and I finish the fall semester, that will take me to 44 credits earned since June 1! I couldn't be more pleased with how school is going.

On another topic, I received an offer to convert my remaining balance with the debt settlement company to a personal loan from one of their partners. I was approved, and even though the terms are terrible, I decided to go ahead and accept. This fixes the "reporting issue" I was having with regards to keeping track of what I actually still owed, vs the balances that were left to settle. It also pays off all of my balances still with the creditors, so that they reflect as paid off on my credit and hopefully makes an improvement there faster. I've zeroed out the consolidated balances line item on my tracking, and added a new one for the loan (they don't balance because of the reporting issue I just mentioned, but now this is an accurate picture of how much money I actually still owe everywhere!). I will be aggressively throwing extra money at it so that it is still paid off when the debt settlement program would have been completed. It is not the wisest financial move, but overall will be better, in my opinion. I'm aware of the drawbacks, and since I'm the one paying for it, I'm the only one who gets a say haha. I'm hoping that I can maybe refinance (either with a new personal loan, a mortgage refi, or a credit card balance transfer) at some point in the next few years to try to save on interest and pay it off faster. I'm still on schedule to be debt free (except for mortgage and student loans) by August 2023.

Posted in

Uncategorized

|

1 Comments »

August 1st, 2021 at 05:17 pm

How is it August already?!

July was a doozy of a spending month, and I almost didn't post this because of that. But I guess the whole point of tracking this is to see the ups and the downs (or......I guess in this case the ups are not the good times haha). While everything came in kinda to very high this month, I was also traveling and celebrating my promotion. I have a little more travel and celebrating planned for August before I buckle back down and finish the year strong.

Spending:

Category - July / YTD - context

Alcohol - 0/$279.80 - after a spendy trip to a fancy liquor store in June, I didn't have any need to buy anything this month.

Car/Gas - $83.02/$362.96 - this was gas (at a more expensive station than I usually go to but when the light comes on, you gotta react) & my annual safety/emissions inspection. Thankfully, there were no issues that needed to be fixed in order for my car to pass. I'll need new tires in the fall, but actually have the money in savings for this so it's more of a scheduling/convenience thing, which is so nice and refreshing.

Clothing - $385.16/$794.78 - yikes. I went a little nuts this month on clothes, I do have some returns to make that will be reflected in August, but I guess $800 in clothing for half a year isn't the worst.

Dining/Entertainment - $445.75/$995.37 - double yikes. I ordered delivery a lot more often than I normally would this month, had a few meals out, so it added up. Gotta get this back under control too! $50 of this is also Kindle books I bought last night. Since I have the next few weeks off from school, I hope to be able to spend some of that free time reading for pleasure.

Education - $100.96/$958.57 - I think this was proctoring fees for two exams for credit (that will eventually be reimbursed) along with study materials for two more exams I'm planning to take this month. Oh, and a scientific calculator for one of my classes this fall. These are all worthy expenses!

Gifts - $87.32/$510.25 - my sister's birthday was this month. All of the spending this year been on my mom and sister, I believe. I'm good with that!

Grocery/Household/Toiletries - $775.86/$3591.51 - infinity yikes. This is usually my biggest category, and I'm not 100% sure why it's so high this month, I definitely included some food that I picked up for socializing here....I must have bought a bunch of stuff for the house as well (not too worried about it so I don't feel like going back to check). Hopefully will be back down to normal levels next month. I officially have a line item in my budget for grocery sinking now, but it's not for nearly as much as this haha.

Medical - $94.78/$403.91 - this was two co-pays for my therapist, included in budget and a co-pay/my responsibility for some bloodwork from June (but paid in July).

Miscellaneous - $11.91/$251.93 - literally have no idea, and it's a low enough amount that it doesn't seem worth it to switch to another tab in my spreadsheet haha.

Office Supplies - $0/$106.92 - hopefully the printer ink I bought in June lasts a while.

Personal Care - $316.45/$567.60 - got a haircut, bought a giant size of my expensive conditioner at the salon since they were having a sale, and think a mani/pedi is in here too.

Pet - $88.21/$623.11 - food/toys and such.

Subscriptions - $2.99/$260.37 - monthly iCloud storage

Travel - $1773.99/$2540.20 - wowsers. I did have a fairly decadent weekend away with my bestie. She owes me some money once we reconcile all of the Ubers etc but that will be reflected in August since she hasn't tallied her share yet. I also went to Philly the other night to meet up some coworkers for a happy hour, and while I didn't count the cost of the train ticket (was purchased with my commuter card that is pre-funded), I did have Ubers and pricey parking.

Grand Total - $4166.40/$12247.27 - sheesh. Let's hope I return to the $1k-$1500 range soon lol.

Summary:

As always, this does not include the 401k contributions/loan repayments from my last check of the month. This is all mostly still going in the right direction, and if it is not, it was calculated and expected (private student loan increasing, spending some money from sinking funds to pay for travel, etc).

Regarding the consolidated balances, I am still waiting to hear back about whether or not I was approved for the loan. If approved, it will close out my program with JG Wentworth, and clear this line item, but create a new line item for the total loan balance. The amount needed to pay off all of those balances is somewhere around $20k. It will look like I'm taking on more debt, but it's just a more accurate way of representing it, I guess.

Now that I have gotten two paychecks at my increased take home, I've settled on how it will be allocated for the rest of this year. I added money into my budget for groceries ($200 per check, twice a month), added in the payment for the private loan (the minimum is $25 while I am in school, but I will be paying $150. Once my surgeries are all handled, then I will look to directing tuition reimbursements to this loan, and can hopefully have it paid off before I graduate), and am putting the rest of it towards knocking out my big credit card, which should be paid off by the end of the year, along with the other two cards I paid off that started creeping back up a bit.

The goal is to start 2022 with very little credit card debt (the only balance remaining is on a fixed promo that will be paid off in early 2023). Depending on the scenario at that time, I plan to start a Roth IRA, increase my general autosave amount, add to the buffer in my mortgage/HOA checking account, and stay outta debt. The current 401k loans should be paid off, but will likely be exchanged for a much bigger one that will be covering my out of pocket costs for surgery (~$30k?). If I can keep this momentum up, then I can continue increasing savings, so that I'm well positioned for buying my next home in 2024. I believe I will get promoted again in that time, and assuming I get a comparable increase as this, things should be looking excellent.

For the next home, I will be doing a lower down payment initially (hopefully the market will have cooled by then!!!), and then once my current home sells, I will be putting any proceeds into that mortgage, so I can either refinance or just straight out drop PMI. I'd like to have $50k in savings to put towards this, and am shooting for a home in the $500k-$550k range. Once I sell my current home, I should be able to put at least another $50k into the mortgage, but who knows what will happen with values by then. Based on my purchase price, I have $50k of equity, but that's not taking into account the improvements I've made. I would like to think I have about $80k of equity.

Posted in

Uncategorized

|

1 Comments »

July 28th, 2021 at 02:26 pm

I finished the summer semester, and am so relieved. I definitely need a break, even if it's just for a few weeks until the fall semester starts. I enjoyed both of my classes, but was moderately annoyed by things both instructors did. I'm waiting for my official grades, but should be A/A- for both. Once the grades are posted, I will submit for reimbursement. Reimbursement funds will be directed to existing 401k loan balance. One semester down, four to go!

Not sure if I mentioned this or not, but I am also getting a bunch of credits via exam. I took the first two of those exams a few weeks ago, and the credits have appeared in my online degree progress from the school. Through a non-profit, I was able to get the vouchers for the exam itself for free (normally $89), and they will reimburse me for the test center fee ($30 for remote proctoring x2). I'm planning to take three more in August - the three subjects I am not as familiar with, so will have to put in a little more studying. So far, I have tackled one already, and submitted the request for the voucher (takes a few days), and this week, hope to tackle another. This way I have both vouchers in hand. I did purchase an external study guide as well, where I think the real meat of the exams will be covered off on. For the one completed, I didn't do terrrrrribly on the practice exam, but would like to feel a bit more comfortable going in. I'd like to not waste my chance for free credits. Later in the month, I will repeat the process for the last one this summer. Sometime in the fall, I'll take two more, but I am confident in that subject matter, so it shouldn't be a problem to take them while in class.

Hoping that August gives me a small chance to reset and catch my breath before we start all over again. Work is very busy and I don't feel like I have been putting in my best effort there, because I have been distracted by school. Need to fix that and get my projects back on a strong track. I also have a week's vacation as well as a few other random days off. Hoping I'll be nice and refreshed by September, when it starts all over again!

In other financial news, I got a few more bank bonuses that I have been working towards. I am still waiting on 3, and then I think I am taking a break there too. I've kind of run out of banks that are local to me - there are 2 offers I could do, but the bonus seems meh for the amount of direct deposit I will have to direct there, so I'm undecided. I've been using those bonuses to chunk away at credit card balances (non-consolidated). Still hopeful to have the majority paid off by the end of the year, with the exception of a furniture store on a fixed promotion. I'd like to pay it off, but not at the expense of other progress.

I'm still waiting for a loan decision for the consolidated accounts. Once I hear that, I can figure out the best path forward there. If the loan terms (monthly payment and length) are close to to what I will be paying with the debt settlement company, then it's definitely a win and the math checks out.

Everything is chugging along nicely, and though my spending is far higher than I would like it to be, it's been an abnormal month what with being away and not caring how much I spent on the trip lol.

Posted in

Uncategorized

|

1 Comments »

July 21st, 2021 at 04:05 pm

I got back from a long weekend in Chicago the other night. It was so good to spend time with my bestie, and see her new home (she purchased a condo this spring).

It was a SPENDY trip though....still waiting for final numbers, but looking like ~$2kish. Oh well. It was definitely needed, and I'm going to go ahead and say definitely deserved as well. We had a great time, and ate some amazing meals, so I don't regret any of it.

While I was away, I received my first paycheck at my increased salary. My new net pay is $700 more per pay period than my previous pay. This will be really helpful, not only to shore up some of the gaps in my budget, but will also help me accelerate paying off the last of the credit card debt. Once that's gone, by the end of the year hopefully, I can focus on savings. Initially, the pay increase will go towards some sinking funds (grocery, pet, and homeowners' insurance) and big chunks thrown at the credit card balance. Once it's paid off, I'd like to go back to running normal expenses through there and paying in full monthly since it's a rewards card, but I just need to be cautious not to lose sight of the goals and spend money I don't have. I've definitely gotten a little too free and loose with spending, especially considering where I was at the start of the year. I've made significant progress, but not enough where I can buy whatever I want without thinking about the impact it makes on the long term plan.

I'm in my last week of the summer semester and am amazed at how it seems to have flown by. Between the two classes, all I have left is some reading, a final project, two quizzes, a few discussion post responses, and a final exam. I am on track for an A or A- in both classes. I also took two CLEP exams last week, and passed, so I will get credit for two more classes. I plan to take three more during my August break, and then two more in the fall. I also learned about another kind of credit by exam that's accepted by my school, so I am just waiting to hear back from the Admissions department on what courses they can replace, to see if those are in my degree plan.

I've been in talks with my debt settlement company lately. I received a notice that a lawsuit had been filed against me for one of the accounts in the program. Fun, but we are actively working with the law firm to come to a settlement agreement on this, so it shouldn't be too upsetting. I do need to go to the courthouse this week to formally respond (basically go to the window and fill out a form). I tried to see if they'd let me fax it in or do it over the phone, but apparently I don't live far enough away....so I'll do that on Friday. The settlement company did receive two settlement offers from the law firm handling the debt, and we are trying to see which to choose. At the same time, I have an opportunity to transfer the debt placed with them to a partner of theirs who offers loans to customers in good standing - if approved and the terms are appealing, this loan would pay off all of my balances with the settlement company, and effectively end my program with them two years early. I'm not sure how the terms will be, assuming pretty high interest rates, but it is attractive to know that my credit score will improve much faster because those balances will all have been paid off, and my DTI will drop drastically. I applied yesterday and my income verification is with underwriting now, so we shall see. If the payment is in the same neighborhood as what I pay to the debt settlement company, then I'll go for it. Plus, since it's a loan, I have the ability to increase my payment to reduce total interest paid. More to come on that!

Posted in

Uncategorized

|

2 Comments »

July 1st, 2021 at 04:10 pm

My favorite post of the month! This will be a longer than usual one, since I am also including a midyear update on my 2021 goals.

June spending was almost double any prior month this year. There were a few one off larger purchases though, so it doesn't indicate a trend I'm worried about. This is why I track it by category as well as overall. My spending does not include any bills - this is all "discretionary".

Category - June spend/YTD spend - context

Alcohol - $185.58/$279.80 - welp. I guess I don't really have any good excuses here haha. I went on a run to an expansive liquor store to pick up something for a co-worker (not captured here, she reimbursed me) and started shopping for my sister's birthday (captured in gifts).....but they had such a great selection that I ended up buying a bunch of stuff for myself, too. Oh well.

Car/Gas - $40.15/$279.93 - one gas fill-up, and a parking meter. Most of the towns in my area have switched over to using an app for parking. If I were just using change, then I wouldn't bother tracking it, but since it ends up being a charge that I have an email for, it's easy enough to pop in.

Clothing - $257.95/$409.62 - getting a little too loose on this!!!! I'm returning some of the items purchased this month, but the returns will be reflected in this month's spending. I will say that what I am keeping are things I needed, and there's nothing overly frivolous. Still, I'm not yet at the point where I can go willy nilly and start breaking rules.

Dining/Entertainment - $151/$549.62 - better than last month for sure. I think this month was mostly takeout spending....I was a bit off the rails when it comes to my diet for a while there, but this has mostly gotten back under control. I'd say I am hoping that this category sees minimal spend in the next few months but realistically, I am traveling in both July & August so here's hoping for September lol.

Education - $650.23/$857.61 - this was for the laptop I needed for my classes, and MS Office for that computer. It's a big chunk, but not expecting any major expenses here for a while. I've been stashing money aside for various education expenditures since I started this journey, so thankfully none of this went on a credit card.

Gifts - $55.06/$422.93 - started shopping for my sister's birthday gift. I'll add more to this category for her this week (her birthday is next week).

Grocery/Household/Toiletries - $443.81/$2815.65 - always a big 'un. Less than last month (high due to purchase of some apartment necessities like a hamper), but a touch higher than I would like. Not too bad, though.

Medical (Planned) - $90/$309.13 - a few co-pays.

Miscellaneous - $7.56/$240.02 - I bought plastic sleeves off of Amazon for vaccine cards. Wasn't sure where to put them so here they are haha.

Office Supplies - $19/$106.92 - needed ink for my printer. This should last me a while.

Personal Care - $57.15/$251.15 - a desperately needed pedicure! I'll probably start setting aside money in my budget to get these monthly now that we are in the warmer months.

Pet - $105.65/$$534.90 - man these monsters are expensive lol. This was food, litter, a brush, and of course some toys found their way into my order, haha.

Subscriptions - $52.98/$257.38 - Monthly iCloud storage, plus I paid for a year of an additional streaming service upfront, but in return bartered a log-in on this for a log-in on another one that I've been interested in. Right now, I think I am covered with all of the major streaming services except Apple TV+. Living just fine without cable (and this YTD amount also includes some print subscriptions as well)....the cost for all of the subscriptions plus my monthly internet cost ($62.48 a month) is still far and away less than having cable+internet would cost me.

Travel - $728.30/$766.21 - this month, I booked a flight for a trip to Chicago, using a credit from a cancelled COVID trip (but the new flight was more than the credit). Plus, I pre-paid for a hotel for a trip in August, I'll eventually get half of that back. I think there may be some small expenses in there from a day trip to our office in another city....small items I bought at the train station, etc.

Grand Total - $2844.42/$8080.87 - yikes but as mentioned earlier, this included a few larger one time expenses driving this cost up. When I subtract out the computer/software/travel costs, I'm still around $1465, which juuuuuust ekes under my highest month YTD (by a dollar haha). The increased clothing and alcohol spending don't help. Oh well.

Onto my summary of debts & savings....

Overall, still moving in a good direction. Priority debts are up slightly, due to a moderate increase in non-consolidated credit cards and the addition of the new private student loan for the summer semester. While student loan debt doesn't bother me, this one has a high interest rate due to being private and is co-signed by my mother, so this will be a priority to knock out once all of the funding for my surgeries are handled. I am planning to have this one paid off before I graduate, and have to start paying back my federal loans again. Non-priority debts are down just via a function of regularly scheduled payments. My overall debt is not significantly changed from 6/1, but down 9% from 1/1.

Savings are constantly in flux, but overall, cash savings/sinking funds are up significantly when looking at both time frames. 401k is doing very well, also (and as always does not include contributions/loan payments from yesterday's payday). This should only continue with increased contribution amounts due to my pay increase. Total savings are up 12% since 6/1 and 35% since 1/1. I couldn't be more pleased with my progress.

Onto progress against this year's goals!!!!

Consolidated Balances: At the start of the year, the consolidated balances left to be tackled were 9 of the original 12, with a balance left to settle of just over $30k. The goal was: stay the course and hope that the balance was down to around $20k by the end of the year. As of today, there are 3 left to be tackled (when I say tackled, I mean settlement agreements made, not that the balance is fully paid off, that's a separate calculation that I will probably switch to for next year, but switching midyear is annoying) with a balance of just over $14k. That's pretttttttttty good haha. Of the 9 balances that have been settled, 4 have been fully paid off, and 5 are in repayment. I will complete payoff of one more settled account this year, 3 more next year, and one final one in 2023. I'm assuming that of the 3 remaining to be settled, one of them will extend to 2022, and the other 2 into 2023. This goal is far ahead of where I had hoped to be.

Non-Consolidated Balances: These are my credit cards that did not go into the program. At the start of 2021, there were 5 accounts with balances. My goal was to pay 3 of them off by the end of the year, and bring my starting balance of $11k to around $5k. I didn't originally state this at the start of the year, but did mention in my Q1 goals review that a sub-goal of this was to bring my main card (with the highest balance) down to 75% utilizatiion or better by end of year. As of today, there are 4 accounts with balances, for a total of $9.4k. This is up from the low, where I had 2 accounts with balances and around $8k, BUT with my pay increase YAY, coupled with some irregular chunks coming in, I am projecting that I will only have a balance left on one account of <$2k. The card with the largest balance is projected to be at 0% utilization. This goal is on track but projecting to blow past the goal for the year.

Mom debt: the goal was just to begin repayment on this. I started paying her back in February. I will increase the amount I pay her next year when other debts have been paid off. This is scheduled for payoff sometime in 2023/2024. On track.

Non-priority debts: This includes my mortgage, car loan, 401k loans, and federal student loans. The goal here was just to continue servicing these as scheduled. My federal loans are deferred indefinitely, initially due to COVID, and now as in-school deferments. I will be adding to these over the next few years, but the cost isn't anything unmanageable. By the time I need to start repayment, I should have a lot of other debt paid off. On track.

Grow savings: I started the year with just $50 in cash savings. The goal was to be somewhere around $2k in cash savings by the end of the year. Not nearly enough to serve as a comprehensive emergency fund, but enough to cover a major oh sh*t moment. As of today, my cash savings, which includes some sinking funds, is just over $2200. By the end of the year, I am projecting that it should be over $4k, barring any unforeseen issues (but that's what it's there for, if that's the case so....so be it). Ahead of goal.

Bump retirement savings: I started the year contributing 10% (not including company match), and was hoping to bump this to 12% by the end of the year. While an actual % increase may not be on the table for this year, my recent promotion increases the $ amount being contributed. I decided to change up my strategy a bit and before increasing my contributions here, try to fully fund a Roth IRA. Not sure if, amongst all of the other financial goals going on, I'll be able to start this year or not, but I will definitely be building it into next year's budget, even if I am not maxing it out. Once IRAs are fully maxed, as I am able to continue increasing retirement, I will return to my 401k and increase as able until maxed. Goal revised but considering the spirit of it on track.

Investments: The goal was to increase my small balances in robo-investing accounts as able, without any set goal. Ultimately I decided that I am not yet in a position to start investing in taxable space yet, and need to handle my debt, and savings, and retirement first. Goal removed.

Get promoted (this was a financial goal as well as a personal goal): BOOM - done. Coincidentally, my new title is in effect as of today. I'll do a separate post on how the increase from my promotion is going ot be allocated in the overall plan, it's changed slightly from where I thought it would be, but I think the new plan is good. Goal completed.

Other non-financial goals: Stay focused on weight loss journey - no measurable goal set, but this is on track again even after a few ups and downs. Start taking steps for plastic surgery post weight loss - on track, maybe could be considered completed (considering that I have a surgeon, have met with hims everal times, have figured out timing and funding, etc.....now I just gotta get to my stupid goal weight lol).

Overall assessment of where I am mid year vs Jan 1? KILLIN' IT.

Posted in

Uncategorized

|

2 Comments »

June 28th, 2021 at 08:05 pm

Just a quick check-in to say I was notified of my promotion today, and I am over the moon. I was promoted to the next level and received a $30k increase. This is more than I was expecting, and I know it is because I advocated for myself. It goes into effect on Wednesday, and is reflected in my 7/15 paycheck. I have an idea of what my net pay will be but very excited to get the actual amount so I can start planning, it should be a nice chunk more every check, and I already have my plan for how to allocate.

Yay!!!!!

Posted in

Uncategorized

|

4 Comments »

June 16th, 2021 at 04:27 pm

It's been a few weeks since my last post - since then, not much to report.

School is going well, and I have adapted to the workload. I'm happy to say that it feels much more doable, I was just overly excited and doing a lot at once lol. I've fallen into a good groove, and can't believe that the end of next week marks halfway through the session.

Work is still nuts, and I haven't heard about the promotion yet. It would be in effect for July 1, and they usually notify people a few days to 2 weeks before. So basically, I could hear at any point now.

Finances are chugging along. Things are slowing down but that's to be expected. Some big chunks of money are coming in over the next few months, but I already have the plan on what is going to happen with those, so it's just execution. I still think that it'll be a very successful year financially, and even though I am not following the plan quite as strictly as I was at the outset, I've found balance that I can live with.

Yesterday was payday. Nothing out of the ordinary. Paid a bunch of bills, debt went down some, savings went up some. Again, I'm waiting with baited breath for news of the promo so I can figure out how this impacts my budget for the rest of the year.

A question has come up that I am wondering if anyone here can answer. When my grandfather passed, there were quite a few fairly high value savings bonds (series EE) left behind. All have a POD/TOD. He was listed as the sole owner on the bonds, and did not pre-emptively pay any taxes on the interest earned over the years. The bonds are all at full maturity. His heirs, my mother and her sisters, have agreed that they are aligned with having his estate pay the income taxes on the accrued interest, and the plan is to cash all of the bonds this year, so that the 1099s can be included in his & my grandmother's 2021 taxes (MFJ, Grandma has advanced dementia, so she unfortunately is not a part of these discussions). The tax implications make no difference for their/her financial situation.

Of the PODs, one of them is on Medicaid, and is concerned that if she cashes in the bonds left to her, that she will get bumped into the next income bracket, which would boot her off Medicaid. On the flip side, she is unemployed, and really could use the cash infusion. From my research, it appears that it would have been easier if the bonds were cashed while he was alive, because he would still be the owner....but that's not where we ended up. So I guess the main question is.....since there are PODs on the bonds, are we able to have "him"/his estate be responsible for reporting the income/paying the tax on the interest? Is it as simple as the POD takes their bond to any bank, and brings the required documentation (assuming ID, and his death certificate), then the bank cashes, and generates a 1099, which I then have his tax preparer include in his 2021 tax filing? If this is the case, it would seem to me that the PODs would not be the ones reporting the income, but he would. Anyone have any insight here? I have been researching on the Treasury site, but of course, it's not super clear. FWIW, the other PODs don't really care who reports the income/pays the tax - it's just this one person with a tenuous situation. As the person handling all of the paperwork, I have just asked that if indeed the 1099s will have his name on them, that all of the bonds be cashed in 2021, so that I can include them all with his final tax filing. I don't want to be filing taxes for him years after he is gone. I am trying to simplify all of the estate matters for my grandmother as well.

Posted in

Uncategorized

|

2 Comments »

June 3rd, 2021 at 03:24 pm

School has officially started, and while I'm really enjoying it so far, it's definitely a lot more work than I was anticipating. In the past 2 days, I've put in probably about 6-8 hours of work so far. The work itself is not difficult (which is a relief because these are fairly intro classes that I would hope I could handle at my age and at my life experience level lol), it just takes a lot of time. I am hoping this is just me getting into the groove, and that I don't feel overwhelmed in future weeks. For week 1, I have completed all of my work for one course, and still have a lot of reading and two more assignments for the other course. I'm now glad that I was only able to take 2 courses this summer, as I think 4 would have been completely overwhelming haha.

In the course of doing the schoolwork, I realized that my current personal computer (trying to do the majority of the work from my own computer rather than my work computer) is just not a good fit. It's a teeny tiny little Macbook, and it's just not big enough to be comfortable to work on for any extended period of time, especially when doing writing. I did pick up my mother's new laptop, and we've decided that I am going to keep it haha. It wasn't terribly expensive, and it's a good investment to be able to efficiently do what will be a LOT of work over the next two and a half years. She'll take a look at it, and decide if she likes it. If she does like it, I will just buy another one, and that will be hers. If she doesn't like it, I will just send the payment for it to her credit card, and then we will go shopping for hers together whenever she is ready.

On the same day, I received an offer to increase the amount of this summer's loan to cover education related expenses. I decided to take them up on the offer, to pay for the laptop as well as whatever other tools I discover would be helpful in this journey. I was eligible to request another $5,000, but didn't think I remotely needed that much. However, the school has to certify the additional funds, so I decided to request more than I needed in case they certify me for a lower amount haha. I requested $4,000, and if approved, will add it to the private loan row in my summary tracking. This loan will be moved into the priority debt section once it's all finalized and fleshed out, and I am hoping to have it paid off before I graduate. Since I won't need to pay any of my other student loans until 6 months after I grduate (including the ones that existed before I went back to school), I can focus on this one.

There have been a lot of conversations at work so far this week (which is impressive considering we were off Monday and Tuesday). I had a conversation with HR, and it went really well. I feel confident that I will be getting the promotion I have earned, and I was able to communicate what I expect from a salary/title perspective. No promises of course, but enough to make me withdraw from consideration from the external job I was set to interview for. The idea of changing companies right now was stressing me out, but I was willing to go for it as long as I was unsure what was happening with my current job. I still don't have confirmation, but am feeling secure enough to let it go. When asked what salary I was targeting, I replied with between $110k-$120k. This is within the salary band for the next level up, albeit at the high end of the range, but I also mentioned that I believe I have been working at the level that's two above mine (which obviously has a higher salary band). I feel like it was a very productive conversation, and I felt heard. Even if I don't get what I asked for, I feel confident that what I am offered/awarded will be enough for me to not consider a move.

Of course I have been busy doing projections....obviously since I am not sure what the salary would be, I have no way to know how much extra money I will be netting. I'm playing with the different take home amounts to see how my budget can evolve. The first priority will be funding grocery spending in my budget....til now I've been making it work but it's not actually working that well haha. The second priority will be funding payments for the private loan. Third will be saving to purchase a new piece of fitness equipment, fourth will be adding in funding for other sinking funds, fifth will be increasing revolving debt payoff, and then finally will be increasing savings (both retirement and general). Obviously, as debt goes down, I can increase savings. Excited to see how this affects my budget, but the order of events works for me, and I hope to have some info before the end of June, so that when I do an end of quarter goals review, I have some insight into where this will bring me in the second half of the year.

Posted in

Uncategorized

|

2 Comments »

June 1st, 2021 at 12:18 am

Woof. This month was spendy. I loosened my resolve and spent on a bunch of categories that I've been super strict on so far this year. Ended up putting some money back on a credit card and it's time to rein it in. I alos need to rein in my diet, I've been on a tear for the past week or so. I think I needed a break from all of my strict guidelines for everything, what with processing all of the (known and potential) changes at work. School starts tomorrow, so hopefully I'll be too busy to let my anxiety manifest in bad ways lol.

Spending:

Category: May Spend/YTD Spend - commentary

Alcohol: $63.90/$94.22 - as expected, I bought some bubbly for Mother's Day, and picked up a few other bottles for myself

Car/Gas: $30.08/$239.78 - I got gas at some point this month, and still have half a tank left. I'm driving about 30 minutes away tomorrow, and then have a doctor's appointment in late June, so not sure if that'll mean one or two fill-ups in June, but it is what it is.

Clothing: $22.15/$151.67 - can't remember what this was, but it was something definitely on top of a gift card/rewards. I'm getting a little too loose with this, but overall still not bad at all for the year.

Dining/Entertainment: $192.87/$398.62 - UGH. See above, lol. This isn't good for my finances or my diet!!!!!!

Education: $21.75/$207.38 - this is the rental fee for the book for one of my summer courses.

Gifts: $151.32/$367.87 - this month was all Mother's Day.....in fact, I think all of these gifts so far have been for my mom haha. Honestly, I buy for so few people these days. I'll buy something for my sister's birthday, and then probably nothing until Christmas unless anyone new comes into my life before then (but I'm not really looking for that just yet, and last time I checked, they don't generally show up at the door spontaneously lol).

Grocery/Household/Toiletries: $613.14/$2355.86 - whhheeeeewf. This one is big this month. I did have to replace some housewares - a new hamper, a new set of skillets, a new salt & pepper grinder. That added up. Once I remembered those, I felt slightly better about the total for the month. Then I also realized there are more than a few pet expenses mixed in there that I didn't feel like splitting the receipt out for. Definitely going to try to rein this back in for June.

Medical - $127.07/$219.13 - this was 3 co-pays for doc appts (bi-weekly therapy, and a copay from a doc appt in March that they billed me for in April, but I didn't pay til this month). Plus I got a 90 day supply of prescriptions.

Miscellaneous - $0/$232.45 - woo! A zero spend category! LOL

Office Supplies - $0/$87.92 - woo x2!!!!

Personal Care - $0/$194 - woooooo x3!!!! Haha. There should be some spending in this category in June. I'm due for a pedicure, and I need to activate a Groupon I purchased using some gift cards for a laser hair removal package - when you activate these vouchers, you have to pay sales tax directly to the vendor, as well as leave a tip at each appointment. It's minimal, but still needs to be planned for.

Pet - $210.38/$429.25 - I had to purchase yet another littler box and another litter box enclosure, because one of the cats is a giant monster. Swapping boxes wastes a lot of litter, but I wasn't about to pour dirty litter into the new box. This new system seems to be working, so fingers crossed it's just food and litter from here on out. They need to go to the vet in June, but my mother will cover those appts this year.

Subscriptions: $17.94/$204.40 - I got suckered into subscribing to another cooking magazine I really like, and of course my monthly iCloud storage.

Travel: $0/$37.91 - not expecting to add anything else to this category for at least a few months. Between finances and school and work, I don't have the resources, tangible or intangible, to go anywhere. I do have a flight credit from a trip cancelled in April 2020 that I may use in August, but I would just be going to Chicago to visit some friends. I'd have dining and Uber expenses, but that's about it.

Total: $1450.60/$5220.46 - yikes. That's $400+ higher than any other month this year. There were definitely a few larger one off expenses, but that's gotta get nipped in the bud.

Month over Month Summary:

Overall, debt is up this month, thanks to the addition of the new student loan balance (plus a small increase in credit card debt), and savings are slightly down. Nothing too crazy, and I am ok with it. These numbers do not reflect an updated mortgage balance, nor do they reflect the contributions to 401k/payments to 401k loans from last Friday's paycheck. There hasn't been a ton of progress since 5/1, in fact I guess it looks like a little bit of a backslide, but nothing insurmountable or honestly unexpected. But since 1/1, debt is down significantly, and savings are up significantly. In June, I am not expecting huge swings in debt, but will continue chipping away at it. I do expect a large lump sum being added to savings sometime in June, which will help the balance sheet a bit.

Posted in

Uncategorized

|

0 Comments »

May 28th, 2021 at 06:01 pm

Since the 31st is a holiday, today was payday. Uneventful as usual. I paid a bunch of bills, moved around a bunch of money, and off we go. I'll do my usual month end summary for May on Tuesday.

Unfortunately, I am waiting on a new debit card from my primary bank. The scammers got me - they got into my Instacart account, did a test order for about $15, which went through, and then tried a larger one for $420, which did not go through and triggered a fraud alert. Instacart then cancelled the first smaller order. The hold for the smaller order was $30, and was immediately credited back to my account. My debit card was cancelled immediately, and luckily I am not out any money, just inconvenienced. I'd much prefer the inconvenience of having to wait for a new debit card and update everywhere I had it stored, than having to potentially be out whatever money they managed to get until the bank investigated. Still would like to eventually get back to the point where anything autopaid or stored is done via credit card, but until I have the card I'd like to use for this paid down completely, I am not ready to make the swap. I'd like it to be a fresh start from a zero balance before I start moving recurring bills/spending that are covered from my paycheck to this card, so I don't mingle it with older debt I am working on paying off.

In school news, the loan for my summer courses was disbursed to the school. I'm waiting for them to process it, and then they will send me back the overpayment (the loan is for more than the classes ended up being). I am expecting a check from them for ~$3890, not sure how long it will take to receive. For now, I am going to just stash this in one of my accounts and consider it untouchable - depending on what happens in the next few months, I will likely use it towards surgery. If anything changes that timeline, or I am able to figure out another way to fund this, then I will pay it back to the loan balance. For now, I am going to be making small monthly payments on that loan even while in school. My first payment will be due in July. Waiting for the first statement to close.

I also confirmed with my HR department that my summer classes were approved for tuition reimbursement. Once I complete the courses, and (hopefully lol) pass, I will need to submit the receipt and my grades to get the $$, as it's a two step process. Approval then reimbursement. I should see this reimbursement in August/September, and that $$ will get stashed in the same place as the loan overpayment, and treated the same way.

I was also able to register for fall classes. I registered for 15 credits, yowza. Once that balance due hits my school account, I will repeat the process, and submit the courses for approval in Step 1 for reimbursement. Federal loans will be covering this semester, so I don't have to do as much active work as I did for summer with the private loan....the federal loans should all process fairly seamlessly. I do not believe I will have to pay cash for anything, as the full time tuition for my school for a full year is less than the federal loan max per year. Yay for state schools!

The professor for my other class this summer confirmed that she is using open source materials for the class, so no need to buy any textbooks. That was good news. I'm waiting for a few more snowflakes to come in to be able to register for some of the CLEP exams I will be taking. They did add a virtual option, which works out to be a little cheaper than having to pay a test center administrative fee, and a heck of a lot more convenient too. The only catch is that I need to be able to install software onto a PC to be able to take advantage of this. I cannot install software onto my work computer (PC), and my personal computer is a Mac. As I always do lol....I figured out a way around it. My mother needs to purchase a new computer, since she is retiring next year and her personal computer is from 2004. I suggested that I find her a Chromebook, with a budget of around $250. I asked her if I can make this purchase for her now, and keep it at my place for a few months, so I can take a bunch of these tests. She was fine with this. If she needs it before I am done with it, I can just bring it to her and then borrow it again as necessary. My goal is to take all of these exams in the next year or so, just waiting for snowflakes to be able to cashflow exam fees. I was able to find a free service that prepares you for the exams so I should not need to purchase study guides, saving me more money.

Lots going on with school! Summer classes start on Tuesday, and run for 8 weeks. I'm excited to get back into the swing of things.

Lots going on at work as well. Since the last time I posted....my boss (whom I ADORE), gave her notice. This sent me into a bit of a tailspin....not only will I miss working with her professionally and personally, there's a lot more pressure on me now, as most of the projects she was working on will fall to me. If I rise to the occasion, then this is a very good opportunity for me. She did submit me for a promotion before she left, and I am confident it will go through based on some of the intel she was able to share before her last day. I should hear about the promo mid to late June. If it's a go, it would go into effect July 1, with the first paycheck reflecting increase on July 15.

At the same time, I was contacted on LinkedIn by a recruiter from a distant competitor, who is wooing me with $$$$$$$$$$$$$$. I don't want to leave my company, for a lot of reasons. I love my job, I love my company, and a lot of my plans over the next few years are tied to my seniority here and my current benefits (surgery, school, ability to take STD for 2 separate surgeries, being able to use tuition reimbursement to cashflow, etc). But the $$ they're "promising" is a $40k increase. Life. Changing. Depending on what level I am promoted to, the salary could be equal. Even if it's not, it might be worth staying on even at a lower salary (which would still likely be a $15-$20k increase at minimum) for a bit longer until after surgeries are done. Everything else I can figure out. I'm trying to stall the interview process to get me closer to the end of June before I need to make any decisions, and hopefully I'll have all of the info to make an informed decision. I guess when it rains it pours.

I am off today through Tuesday, so am off to enjoy my extended weekend.

Posted in

Uncategorized

|

1 Comments »

May 14th, 2021 at 02:35 pm

I am paid on the 15th and last day of the month, but if one of those days falls on a weekend or holiday, I am paid the business day prior. Since tomorrow, the 15th, is a Saturday, today was payday.

Fairly uneventful. Paid whatever bills are scheduled as part of this check. Transferred some money around as part of my bank bonus adventures. I have to make a run to one of the bonus banks to withdraw then deposit into my primary bank this afternoon. I was going to make a pitstop at the grocery store while out, but realized that I don't actually need milk before it is delivered as part of a FreshDirect order Monday morning.

Things are really starting to move with school now.

The school certified my loan for the summer courses, so I don't have to worry about the balance due - once it is disbursed and applied, I will be able to request a check for the overdisbursement (this will be held in one of my sinking funds until I get some more info on actual costs for surgery). I have to wait for the loan to be disbursed to see payment info, but I did go ahead and add a new tab to my budgeting spreadsheet (lol) to calculate the interest that is being accrued monthly. This is a private loan, so the interest is not deferred while I am in school the way federal loans will be, so I want to make sure I prioritize it. I specified while setting up the loan that I would be paying $25 a month while in school. Looks like the loan will be accruing more interest than that monthly (high interest rate blah), so I will likely bump the payment up as soon as possible to, at the very least, keep pace with the interest.

Summer classes start in just over 2 weeks. I got an email from one of my professors telling us what the textbook was so we could get it prior to class starting....I am waiting for a reply back on whether or not this is an appropriate book to rent (it would save me 50%, and I have no interest in keeping this book). Hopefully I will hear back soon so I can order it. If I don't get a similar email from the professor of the other class with the text info, I will probably reach out to get it so I am prepared and ready to hit the ground running.

I also had some advisement conversations to prep for fall course registration. I have my fall schedule set and will be able to register once the system opens to transfer students on May 25. Everything I want to take is available with an online section, so fingers crossed. I'll be taking 15 credits....3 of those credits are software classes (Word, Excel and Powerpoint at 1 credit each).....not terribly worried about those haha. Then I am taking a math class, a stats class, and anthropology class. During my conversations, I was able to get clarity on some of the questions I had about how transfer credits were accepted, and was able to update my degree roadmap. I know now in which semester I can plan to take which courses. If all goes to plan, I will be done in Dec 2023. My fall semesters will be heavier than my spring semesters, and that's purely a function of how the tuition reimbursement falls.

Posted in

Uncategorized

|

1 Comments »

May 6th, 2021 at 01:58 pm

Just another mishmosh entry...

My 401k contribution/loan payments from my last paycheck posted today, and the combined loan balance is under the next thousand, and the account balance is over the next thousand as well. While I really want to get out of the cycle of using 401k loans as I do feel insecure about retirement and know I'm behind, I will say that it's nice to have debt that when you pay it back, increases your savings equally. Of course the goal is to not need debt lol. But ya know.....something about progress not perfection blah blah blah.

I got an update on the whole state taxes from 2019 mess.....they sent me a notice of adjustment, saying that they recalculalated on my recalculations (this is turning into a bad skit) and now I owe them $1530 (instead of the $693 refund I thought I was due). Ermmmmm, nope. It looks like instead of changing my full year city tax to the part year city tax, they instead just added the part year tax and are trying to charge me those two numbers added together as my tax due for the year. I filed an appeal because I absolutely do not owe them this money and I will not pay it. Not sure how long it'll take to get in the queue for a live review but I'll wait. This will be the most annoying $ I've ever "earned" when I finally get this refund.

I found a few more bank accounts to open for bonuses. My tally for the year is up to $2500 when all of these are completed and credited! That's pretty amazing. There are still a few banks that do ongoing bonuses that I just can't make work in the next few months that I hope I'll be able to take advantage of in the fall. So that number could even grow a little more. I know it'll have an impact on my taxes, since the bonuses are taxable, but I am hoping it's not too bad. By then, I am also hoping that I will have gotten my raise/promotion, and will have been able to increase my withholding again, so that there's some cushion to cover that.

I also made (sort of?) a decision on what direction I am going to go in regarding IRAs. As soon as I am able, I am going to open and start funding a Roth. I am above the income level where I can deduct a Traditional, and still within the level where I am eligible to contribute to a Roth....so from a tax vantage NOW, they're essentially the same impact (ie, none lol). But the Roth diversifies my tax standing in retirement, since most of my funds will be taxable otherwise (401k, SS). When I phase out of the Roth limit which could be in the next 5 years (or not haha), then I will open a Traditional IRA, and backdoor it to Roth. But since I will not have any other funds in the Traditional, I won't run into any messiness with the pro-rata rule - anything that goes in will just get converted and it'll be cleaner and simpler. If I ever do need to change jobs, I'll either leave my 401k where it is (incredibly large company, so not worried about them requiring me to roll my funds elsewhere) or roll it into new 401k. Does this all sound reasonable?

Posted in

Uncategorized

|

1 Comments »

May 4th, 2021 at 03:42 pm

This morning, as I was doing my daily morning check-in of all of my financial apps, I was excited to see that I am now fully vested in my 401k. I expected it this month, but the work anniversary that triggers it isn't technically until the 20th.

My 401k plan is on a 4 year vesting schedule. The match is 50% of the first 6%. I've always contributed more than enough to get the full match.

Mulling over my strategy for increasing retirement savings....my original plan was to just keep increasing contributions as able, but now I am toying with the idea of opening an IRA, and maxing that before going back to the 401k. Right now I am not eligible to deduct Trad, and am still under the income limits for Roth (which is appealing to diversify taxable status in retirement), but expect that to change in the next five years or so (fingers crossed anyway). I need to do some more research on what the best plan is. If I open a Roth, I would keep contributing there until no longer eligible, then start contributing to Trad and backdoor it to Roth. My only concern is that if I ever need to roll a 401k over, it would go into Trad and then give me trouble with backdooring. I think. Unless I can roll it into a new company's 401k, and then no issues. I think for backdooring to work optimally long term, you need to have zero in Trad, and use it as a holding zone before converting, otherwise the pro-rata rule comes into play. Do I have that right?

In an ideal world I would be maxing 401k, and maxing IRA, but I am not there yet. For now, being vested doesn't really change anything about my financial picture, but ensures that if I were to change jobs, I get to take the full amount of my match with me when I go.

Posted in

Uncategorized

|

0 Comments »

May 3rd, 2021 at 04:09 pm

I live for these monthly recaps lol.

April spending was a bit lower than the last 2 months, and a few hundred higher than my lowest month so far this year (January coming in at ~$715). I have a feeling the slightly higher spend from the last 2 months is an accurate reflection....but isn't that why we track it? To get an accurate picture of what is being spent/what happens??

Category: April Spend/YTD Spend - commentary

Alcohol: $0/$30.32 - this refers to alcohol purchased independently....at a liquor/wine/beer store, not as part of a grocery run (categorized in groceries), at a bar or with a dinner out (categorized in dining). Funny how life changes. I was a big wine aficiando for a long time, and this number would have been much higher at this point in the year during that time. I expect there to be an addition to this category in May for Mother's Day but my sister may end up grabbing it.

Car/Gas: $3.49/$209.70 - this month's spending must have been on parking.....I'm happy to say that I was able to make it the entire month without needing gas!

Clothing: $40.35/$129.52 - I'm going to need to place an Old Navy order soon, so I purchased a $50 gift card for $33.50 from Raise.com (I do this often....depending on the store, they often have heavily discounted gift cards and it's a good way to stack sales from the actual store itself). I also spent $6 out of pocket at another store that I like that I had some rewards credit for. Couldn't quite get the cart to line up to be net zero but $6 is pretty close. Overall, if this is my YTD out of pocket with a third of the year done, I think I'm on track for a low spend year in this category!

Dining/Entertainment: $62.79/$205.75 - a few takeout orders, and a stop at an amazing bakery for some goodies when I was starting my week off from my diet lol. The bakery is pricey but worth it!

Education: $40.23/$185.63 - this was the review books for the CLEP exams I am taking. Have to decide if I am going to include school fees that are covered by loans in this category or not. I think I should be starting to get bills from the school soon. At least I hope so....summer semester starts in less than 4 weeks.

Gifts: $67.50*/$216.55 - I pre-ordered some desserts from another fancy bakery for Mother's Day. Starred because my sister is going to send me the money for half, but hasn't yet, so her reimbursement will be reflected in May spending.

Grocery/Household/Toiletries: $477.03/$1742.72 - by far my largest category, but ya gotta eat. Since this is inclusive of a few different categories it's not an accurate picture of what I spend on groceries alone, but it would be too annoying to go back and update it now, so I'll probably break it out further next year if I feel the need to get more granular.

Medical: $60/$92.06 - my therapist's office started charging me a co-pay again. I didn't pay one for a long time, as during COVID, my insurance stopped co-pays for telehealth, which is what these appointments are considered. I have to double check to make sure they're back on again....was nice to not have to pay anything OOP for this. I have have a few other co-pays for which I've gotten a bill in the mail. I'll pay those sometime this month, so they'll be reflected in May.

Miscellaneous: $49.07/$232.45 - everything in this category this month (and actually this year) could technically be considered a new category, Fitness, but I didn't feel like adding it lol. This month was my OOP cost for a gadget for my bike, a wrench to change the pedals, and an entry fee for a DietBet.

Office Supplies: $0/$87.92 - no spending here this month. I expect something for May.....I have to drop my shredding off at Staples, and want to buy a small under desk shredder (since I can't just take it to the office every few months anymore lol)

Personal Care: $35/$194 - this was a long overdue pedicure. Worth.every.penny.

Pet: $102.53/$218.87 - I didn't really need any pet food or litter yet, but Chewy had a good percentage back on Rakuten, so I placed an order. I'm still filling in my needs of non-perishable items, based on how the girls are adjusting (very glad I didn't buy any beds.....I took 2 from my mom's house that one of the cats was obsessed with there....she hasn't even acknowledged them here lol). I don't think I'll need to buy food or litter til at least June, though.

Subscriptions: $2.99/$186.46 - monthly iCloud storage

Travel: $37.91/$37.91 - my OOP expenses for Vegas. Pretty much any money I spent while away went in this category, even if would fit in another. I didn't spend much money, since everything was pre-paid by my mom and it wasn't a leisure trip.

Total: $938.66/$3729.63

This spending summary is so helpful to me every month to go back and see what I spent money on. There are definitely a few items that I am annoyed at myself for, but all I can do is use it for learning.

Next up is the summary of debts & savings. I look at this in two ways - change from the start of the year, and change from the start of the previous month. Pretty fun that I have increased my savings by the same percentage that I have decreased my priority debts. (Nerd alert lol). All in all, everything is going in the right direction. Debt continuing to go down (although I think the pace will slow for a while. Not expecting any more large cash infusions til the summer, which are helping to accelerate paydown). Savings continuing to go up, and even if there are times when it goes back down, it's because I needed to pay for something that in the past would have gone on a credit card. I'm confident that by next January, when I am starting 2022 tracking, I'll be funding my spending categories (and will conventiently have an entire year's worth of spending data to extrapolate from!) so I can hone in on focusing on growing savings since those costs will be covered from sinking funds and savings can be just that.

If I weren't on a diet, I'd give myself a cookie! lol. For now, mental satisfaction will just have to do.

Posted in

Uncategorized

|

3 Comments »

April 27th, 2021 at 06:29 pm

Can't remember if I mentioned this a few weeks ago or not, but I requested registration for some classes for this summer's term. Since I am not yet officially enrolled, I had to wait for current students to register, then they processed non-enrolled requests on a first come first serve basis. I made my request on the first day it opened so I would be as close to the front of the line as possible.

I requested 4 classes, for a total of 16 credits (go big or go home, right?). Not sure if it's because I am a non matriculated student or just a general summer session limit, but I received a message back when they were processing my registration request that I was limited to 8 credits, or 2 classes. Probably not the worst thing in the world to happen, haha.

I then went ahead and applied for the private loan (only need private for this one semester, will be able to use federal from here on out), and am just waiting for the school to certify/generate my invoice. Once I have the bill, I can submit for approval for tuition reimbursement (I'll then have to submit for payment once I get my grades back).

I also purchased the CLEP exam review books for two of the exams I want to take (I believe I am planning to take a total of 7 exams). I decided to take the practice test in the back of the book for a baseline of where my knowledge is. I got 29% correct lol. Not sure what constitutes a passing score, but pretty confident that it's a lot higher than 29%. Guess I should read the book before scheduling lol.

It's all starting to move and I'm pretty excited! I may have to push my estimated graduation date out by a semester, based on how they applied my transfer credits, but I decided to just wait to speak with my academic advisor once I am matriculated to figure all of that out. No sense in making myself crazy yet.

Posted in

Uncategorized

|

1 Comments »

April 26th, 2021 at 04:49 pm

When I wrote last, I was waiting to see if I would get a call from the market research team conducting the in-home study or if I was not going to get called and get paid either way. Well, they did end up calling me around 1pm, and said they would arrive around 2:30. That worked out ok with the list of errands I had set up for the afternoon. They were on time, I let them in, we went over everything, and I skedaddled. They kept me updated on their progress throughout the day, and let me know they were done & gone around 10:15pm. I received an email with the link to my $595 virtual rewards card on Monday. Setting up access was easy, and I was able to use it in full. I used it for a mix of wants and needs. It's now got a zero balance. I was able to pay this month's electric bill and the majority of this month's cell phone bill (freeing up paycheck money to increase payment to the credit card I'm working on now), plus I ordered a few things from eBay, Amazon and a clothing store to round out the rest.

In other snowflake news, I joined a site called Drop last month. They've been a bit annoying to work with, but I am waiting on some pending points to post. Once they do, I'll have enough redeem $100 worth of Amazon gift cards from completing a few offers. I'll combine that with the $10 in gift cards I'll get for this month's receipts in Amazon Shopper Panel. No immediate plans for those gift cards, but Amazon never goes bad lol.

I also got another Chime referral bonus! That brings me to a total of $300 earned via Chime for very little work. One was the bonus I got for signing up, and I've gotten 3 bonuses from people using my referral link.

Since my last post, I did some test drives that are gonna end up costing me money haha. The day I had to be out of the house for the in-home stufy, I went over to a friend's place to hang out. She has a Peloton, and I wanted to try it out to see how it compared to my off brand bike. Holy crap. They're not even in the same universe. Now I want a Peloton and have to figure out how to save for it amidst all of my other goals. Sigh. I'll probably buy a used one and save up for it in cash, rather than buying new and financing. That could change depending on if I get promoted in July/what the pay increase would be. I don't think I would pull the trigger until next year at the earliest, which gives me plenty of time to figure it out. Paying off debt, getting my savings up to at least baby EF level and funding surgery are still higher priorities. The second expensive test drive was our rental car in Vegas. Our original flight had gotten changed, and I forgot to adjust the car rental reservation. The only cars available when we arrived were luxury cars, so we ended up choosing a BMW X3, which just so happens to be what I want as my next car (when current loan is paid off in Aug 2023). I was glad to have a week to drive it. Unfortunately, it's just as nice as I expected it to be, lol.

Vegas was pretty low spend as expected. I think I spent less than $100 out of pocket for the entire week. Not gambling helped haha. I'll be interested to see how it impacted my spending for the month when I do my April summary on Saturday.

Other than that, everything is just moving along as planned. Debt going down. Savings going up. Lifestyle staying fairly status quo. I have a few updates on other topics, but will do separate posts for them.

Posted in

Uncategorized

|

0 Comments »

April 16th, 2021 at 02:22 pm

Not much big news to report from me. Everything is humming along as per the plan, and while I wish some of it was moving faster, I really can't complain about the progress I've made on all fronts since embarking on this big ambitious 4 year goal plan.

Yesterday was payday. I had a large amount going into one of the bank bonus accounts, so I went over to one of their branches to withdraw that money. Conveniently, my main bank was right across the street, so I was able to deposit into my main checking in the same trip. Nothing unusual about this payday. Got home, made all of the planned payments for the day and that was about it.

The direct deposit into the bonus account yesterday was a one and done - meaning that it's the only direct deposit needed to earn that bonus. So when I got home, I updated my direct deposit info to switch over to the next bonus account. I also received an offer for a bonus that doesn't need direct deposit, just having to keep a minimum average daily balance for two months. Since I had more than this amount in savings, I went ahead and opened the account and made the transfer. Not planning to use for any transactions, so it's no different than sitting in my savings, except in 2 months it'll have earned me $250 lol. That's a nice return! This slows down the bonus activity for the year.....after the current bonus I just set up direct deposit for, I just have one more planned out for the year, and I'll start working on that in June. I am thinking I can probably only get 1-2 more for the year, I'll have exhausted the list of banks that are physically close enough to me to be able to take advantage of the bonuses. So I'll have to wait at least 6 months, more like 12-24, to be able to take advantage of those bonuses again. I'll see what comes up over the summer.

Hopefully by summer, I'll have gotten promoted (this is currently top of mind as I am reviewing job descriptions for my team. I am currently performing somewhere in between the level above mine, and the one above that. Always fun to realize.) But I am hopeful that with all of the high level work I am putting it, I will be recognized. Obviously, this brings personal and professional satisfaction, but the truth is, I really need a raise to move my plan along. It's built out based on my current salary, but I am not able to make optimizations that have been identified as a need until I can increase the amount of money coming in. For the past few months, I've been managing it thanks to snowflakes and such, but I'd really like to move to the next step where all of my expenses are covered by pay, and extra money is literally only used for extra things - such as accelerating debt & savings goals, and fun stuff! We'll get there.